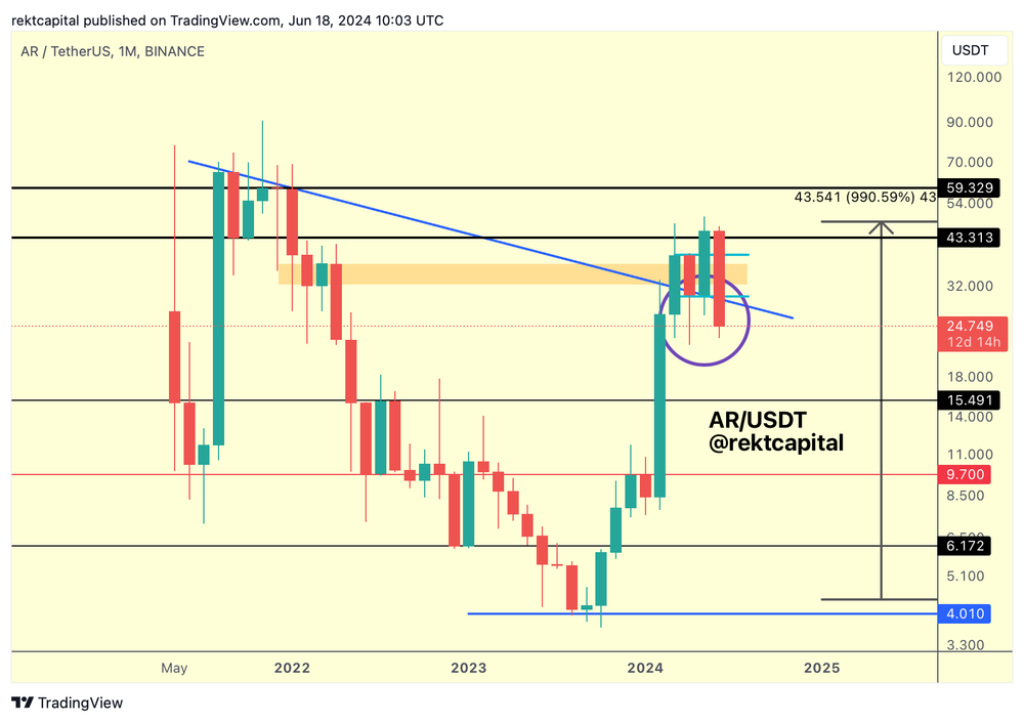

In a technical analysis by Rekt Capital, Arweave (AR) is shown to have faked a breakout from its light blue bull flag and failed to retest the $43 (black) level as support to confirm the breakout. Subsequently, AR has retraced back into the blue macro-downtrend, even overextending below it considerably.

However, Rekt Capital emphasizes that until the monthly close is in, nothing is confirmed. The analyst notes that the recent downside volatility has been quite extreme, and such extreme fear often precedes opportunity. This is why it is crucial for AR to hold the blue macro-downtrend.

Historically, AR has experienced volatile retests of this macro-downtrend, producing downside wicks below the downtrend. With AR currently trading below the macro-downtrend, Rekt Capital suggests that this could be another volatile retest. For this to be true, AR would need to close above the macro-downtrend later this month.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

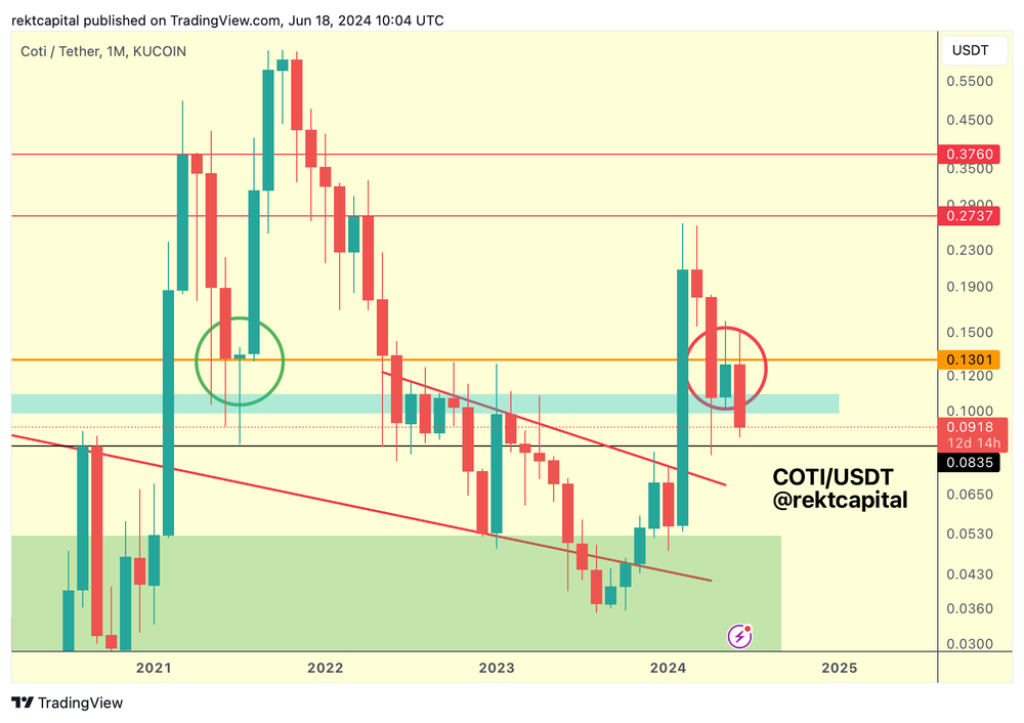

Show more +Coti (COTI/USDT) Turns Major Support into Resistance

In mid-2021, COTI found support at the orange level and downside-deviated considerably into the light blue order block, even reaching as low as the black level at $0.08. However, in 2024, COTI has turned that major orange support into resistance this month, rejecting into the light blue order block and teasing a potential drop into the black level as well.

Rekt Capital highlights that the light blue box represents a support from mid-2021 and a resistance in 2022 through 2023. COTI now has a chance to reclaim this area as support once again.

Despite the entire Altcoin market retracing heavily, the analyst suggests that not much is needed from Altcoins like COTI to end the month with a volatile downside wick to secure major support.

For COTI to secure the light blue box as support, it needs a Monthly Close above this level. However, Rekt Capital warns that in the meantime, downside volatility to the black level could be possible if Bitcoin (BTC) retraces a bit more.

Read Also: Should You Take a Loan to Buy More Kaspa (KAS)? Top Analyst Weighs In

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.