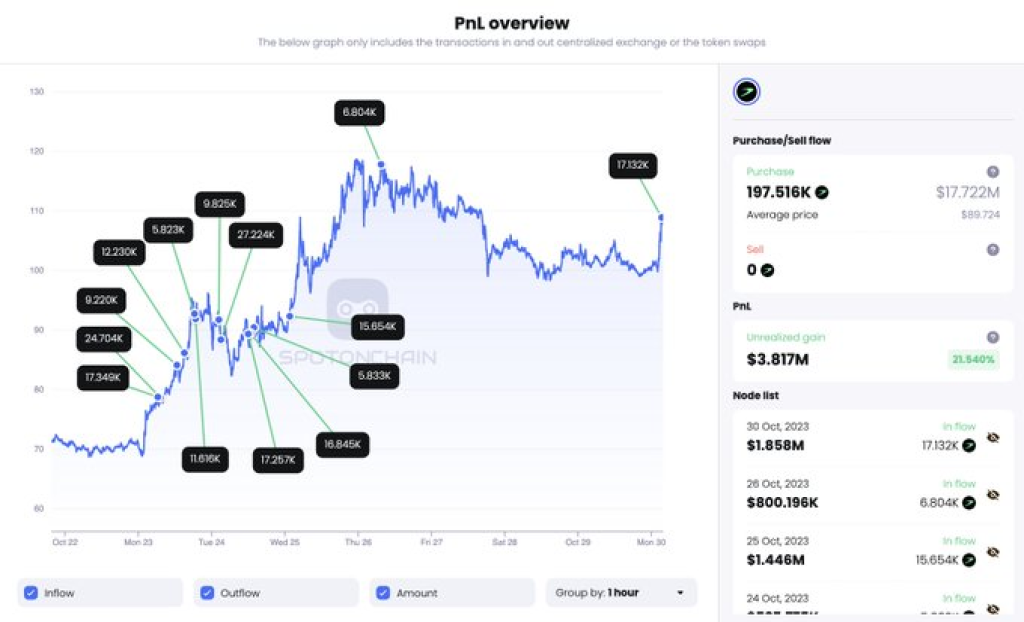

According to on-chain analytics firm Spot On Chain, large Tellor (TRB) whales have been withdrawing significant amounts from exchanges Binance and OKX over the past week, preceding a 43% TRB price pump.

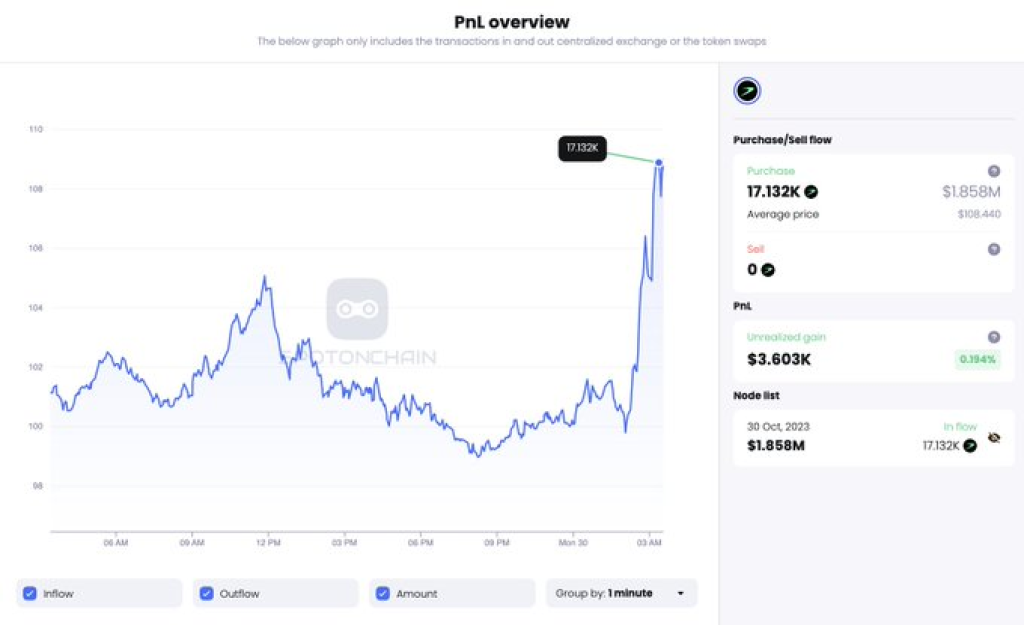

Specifically, whale address 0x7d3 withdrew 17,132 TRB worth $1.87 million from Binance as the TRB price surged. Overall, Spot On Chain detected 8 major whales withdrawing a total of 197,516 TRB worth $17.7 million from the two exchanges in the past 7 days.

These large withdrawals from centralized exchanges reduce the circulating supply of TRB available for trading on platforms like Binance.

With less liquidity on exchanges, the floats become thinner and more prone to volatility spikes as demand increases. This allows prices to be propped up at higher levels.

Alongside the large exchange outflows, TRB has seen a technical breakout over the past week, gaining 13% in just the last 24 hours. The price action has broken out above its 20-day moving average after an extended period of trading below it.

In addition to the whale exchange activity, on-chain metrics for the Tellor protocol have turned increasingly bullish recently. The 30-day MVRV ratio is positive, indicating short-term holders are profiting.

Read also:

- Shiba Inu Eyes 500% Gain As SHIB Bulls Take Control

- Dogecoin Faces Resistance at $0.07, but This DOGE Indicator Confirms a ‘Buy Signal’

- October in Focus: Injective, Solana, and InQubeta Emerge as the Biggest Winners

According to Spot On Chain, the combination of large TRB withdrawals from centralized exchanges and improving on-chain metrics points to building momentum for a prolonged price expansion.

While significant amounts of TRB have moved off exchanges lately, the on-chain data suggests these large holders are accumulating positions rather than selling. This indicates the large withdrawals are likely whales preparing for the next leg up in a prolonged bull run, rather than distributions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.