Arbitrum’s ecosystem is exploding in growth, yet the ARB token itself has been sliding for months. That disconnect is exactly what analyst Michaël van de Poppe pointed out in his latest commentary, calling ARB “one of the most exciting protocols in the ecosystem” while questioning why the token keeps dropping despite some of the strongest fundamentals in the market.

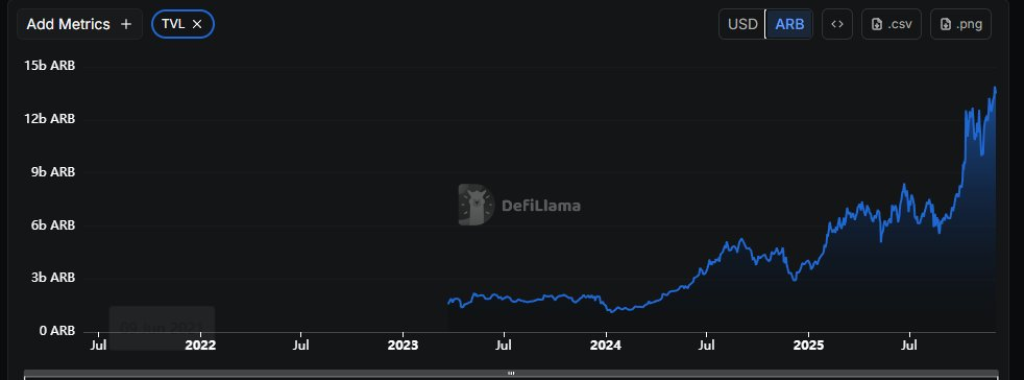

The chart he shared reinforces the point. Arbitrum’s TVL, measured in ARB terms, has gone parabolic. Since mid-2024, the line has pushed into a near-vertical climb, breaking through one all-time high after another. Even during broader market weakness, Arbitrum’s TVL barely paused. By late 2025, TVL had surged past 12 billion ARB and is now pushing toward 15 billion — levels that clearly signal massive growth in ecosystem activity, liquidity, and capital demand.

Yet ARB’s price is down roughly 70% over the past three months.

This is where van de Poppe’s argument gets interesting. On the surface, this kind of divergence doesn’t make sense: a network rapidly expanding in users, capital, and applications should see its token strengthen, not collapse. But short-term sentiment doesn’t always reflect fundamentals. Speculators tend to react to macro conditions, ETF flows, and narrative shifts much faster than to data like TVL or DEX volume, which often lag behind price movements.

Fundamentally, however, Arbitrum’s on-chain metrics look stronger than ever. TVL printing new highs daily shows that liquidity is it’s accelerating. DEX volume has also been climbing, confirming that users aren’t just parking funds but actively transacting within the ecosystem. And new applications continue launching on Arbitrum each week, widening the protocol’s footprint and making the chain one of the most active hubs for tokenization and DeFi expansion.

Active addresses are lower than they were during the peak of 2023, but that’s expected when markets cool down. What stands out is that, unlike many other chains that saw both activity and TVL collapse, Arbitrum is maintaining engagement and onboarding fresh capital simultaneously. In other words, the chain is still growing while much of the market is contracting.

That combination (falling price and rising fundamentals) is why analysts argue ARB might be deeply mispriced. Van de Poppe even suggested that ARB could return to a “fair value” multiple by 2026 if the market starts pricing in actual ecosystem strength rather than short-term fear.

For long-term investors, this kind of setup typically signals opportunity rather than weakness. Arbitrum’s narrative around tokenizing real-world assets, scaling Ethereum, and supporting the largest L2 developer ecosystem hasn’t changed. What has changed is market sentiment, and sentiment can shift back much faster than fundamentals.

If Arbitrum continues its trajectory of all-time-high TVL, increasing DEX activity, and rapid application growth, ARB may eventually catch up to the story the data is already telling.

Read also: Hedera Reaches 9M Users as RWA Tokenization Surges – What Happens to HBAR Price Next?

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.