DeFi Investor, a crypto analyst, recently posted an insightful Twitter thread explaining why Arbitrum season 2.0 might be coming sooner than expected. With several growth catalysts on the horizon, DeFi Investor argues that Arbitrum is poised for a breakout in the coming months.

Arbitrum has largely flown under the radar in recent months as attention shifted to competitors like Base and Solana. However, with $50 million in ecosystem incentives approved, the Stylus and EIP-4844 upgrades forthcoming, and a thriving community, conditions seem ripe for an Arbitrum resurgence.

Capitalizing early on this potential growth could prove lucrative. DeFi Investor suggests looking for promising ecosystem projects with solid tokenomics, revenue generation potential, and short-term catalysts. Monitoring adoption metrics of major protocols receiving incentive grants can also uncover emerging opportunities.

What you'll learn 👉

$50 Million in Incentives

The Arbitrum DAO recently approved a $50 million short-term incentive program. Although modest compared to prior bull market grants, incentives can still significantly boost ecosystem growth. For evidence, look no further than Avalanche’s $180 million incentive last cycle preceding a surge to $23 billion in TVL.

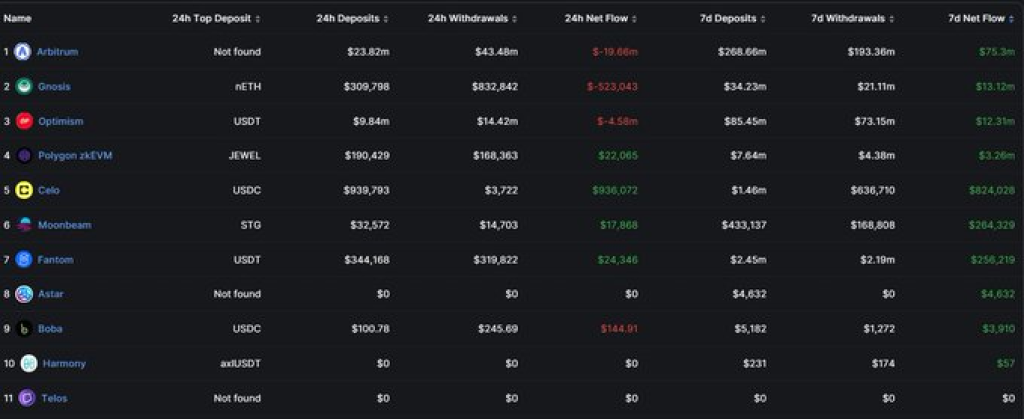

Early indications look promising – Arbitrum’s TVL recently jumped from $1.66 billion to $1.88 billion just on news of the incentives. Arbitrum also leads other chains in 7-day bridge netflow growth. Many Arbitrum projects plan to distribute grant funds this week, so expect adoption to accelerate.

Savvy DeFi proposed an additional ~21.4 million $ARB incentive for 26 overlooked Arbitrum projects. With Arbitrum DAO holding 42% of the supply and high demand for initial incentives, approval looks likely. This would bring total ecosystem incentives above 70 million $ARB.

Major Upgrades Coming

Two significant upgrades position Arbitrum for a breakout:

- Stylus – Will enable Rust and C++ smart contracts, expanding beyond Solidity and onboarding millions of developers. Launch by end of 2023.

- EIP-4844 – An Ethereum upgrade reducing L2 fees substantially. All L2s benefit, but Arbitrum’s dominance positions it best to capitalize. Launching Q1 2024.

With signs pointing to an Arbitrum resurgence, DeFi Investor suggests finding promising ecosystem projects before the herd, focusing on:

- Revenue generation

- Active community

- Strong tokenomics

- Near-term catalysts

Also monitor adoption metrics of major protocols receiving grants.

The rise of a new “killer app” on a competing L2 could shift momentum. Arbitrum benefited from early hits like GMX, so execution risk remains. But with Ethereum’s roadmap boosting L2s broadly, Arbitrum looks well-positioned.

Here are some currently low-cap Arbitrum ecosystem projects to watch: WINR, RAM, Rodeo, Grail, Moz. Surging usage of Arbitrum could propel these and other tokens higher in coming months.

Read also:

- Why is Moonriver (MOVR) Price Up? Exploring the Catalysts Behind the Rally

- Estonian Banker’s $469,000,000 Ethereum Fortune Locked Away Forever After Losing Keys – Can Anyone Crack the ETH Wallet?

- Join eTukTuk’s revolution – Only few hours left at the current price

With incentives, upgrades, and a thriving community, Arbitrum looks ready to reclaim the L2 spotlight. Savvy investors would do well to monitor adoption closely and position in promising projects early. Arbitrum’s Season 2.0 appears imminent.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.