In their crypto newsletters, crypto analyst Rekt Capital highlighted how both Hedera (HBAR) and Aptos (APT) are stuck in price ranges that have been holding them back. While both altcoins show signs of potential, they still need key confirmations before any major breakout can happen.

Let’s take a closer look at what the charts are saying for each one.

What you'll learn 👉

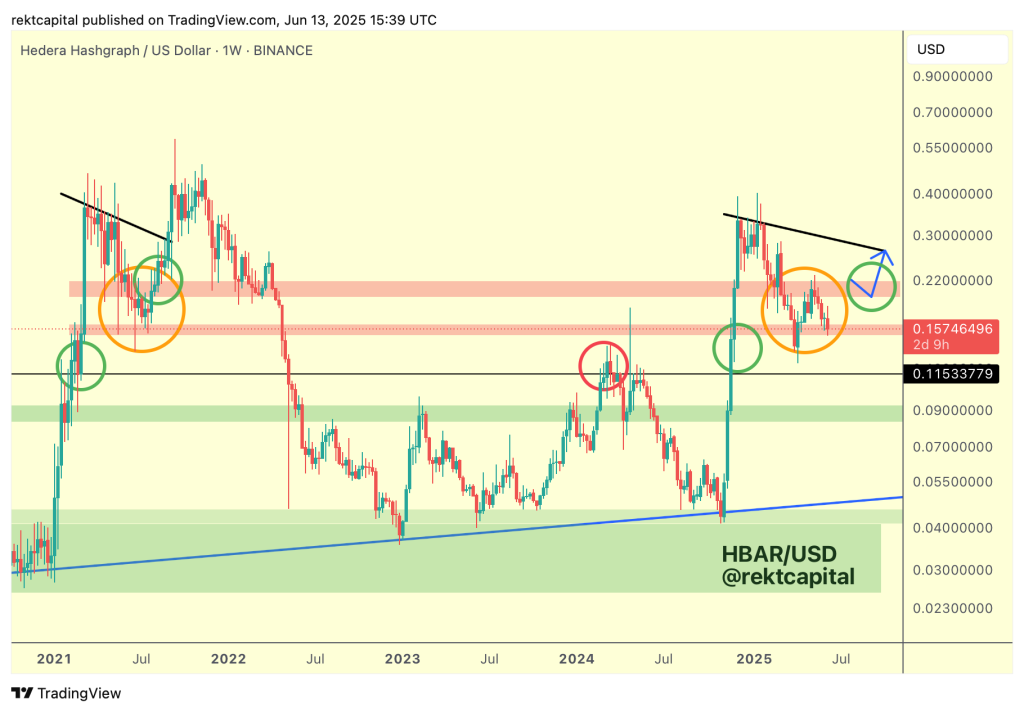

Hedera Price Movement Mirrors 2021 But With a Twist

Hedera price action has been following a similar path to what it did back in 2021, although there are a few notable differences this time around.

Currently, HBAR is trading between two red order blocks, forming a range. In 2021, HBAR built a solid base at the lower support level before breaking out through resistance on the first try. But now, things are unfolding a bit differently. Price has already dipped below the red support and was rejected at resistance on the first attempt.

Despite the slight change in structure, the overall setup is still similar to what we saw in the previous cycle. It just looks like HBAR may need more time to consolidate between these two key levels.

To trigger a breakout, Hedera needs a strong weekly close above the red resistance or a clear retest that flips it into support. Until that happens, the price is expected to retest the range low again. A successful hold of this range low would be a bullish sign. Even if HBAR briefly dips below the box, forming a higher low could still set the stage for a strong recovery.

For now, the HBAR price is at a critical decision point. Either it holds and consolidates, or it risks further downside.

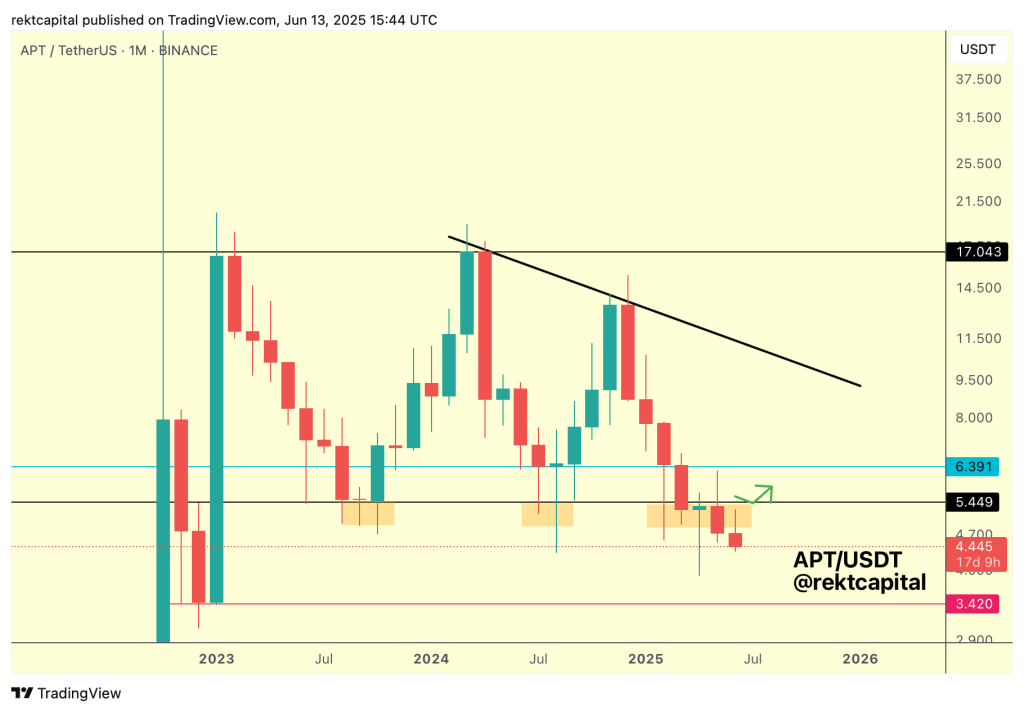

Aptos Still Battling to Reclaim Its Range

The analysis shows that APT price is still hovering just below the macro range low of $5.44. A few months back, Aptos closed a monthly candle below that key level, and since then, it has failed to reclaim it. Price has repeatedly wicked into this level for over two months, but every time, it has been pushed back, turning the level into a firm resistance.

For Aptos to get back into bullish territory, it needs more than just a brief move above $5.44. It needs a weekly close above this range low and a successful retest that confirms the level as support. So far, APT has failed to do this twice. If it tries again, the third attempt will be critical.

Despite the resistance, there are some encouraging signs. Aptos continues to make higher lows compared to its early 2025 bottom, showing resilience. The RSI on the weekly chart has also broken out of a long-term downtrend and is now forming a new uptrend. Historically, when the RSI consolidates in this way, it has often led to upward moves in both the RSI and the price.

All eyes are now on the April 2025 lows. If APT can defend this area, especially with a higher low or a double bottom, the setup could become very bullish. That structure would also create a W-shaped pattern, a classic reversal signal in technical analysis.

Conclusion: Both Altcoins Are at Make-or-Break Levels

HBAR and APT are both in range-bound territory, and traders are watching closely for signs of a breakout. For Hedera, the key is holding the current support zone and aiming for a retest of resistance. For Aptos, reclaiming the $5.44 level and confirming it as support will be crucial.

Read Also: 10,000 Kaspa Today = Financial Freedom Tomorrow? Let’s Do the Math

In both cases, a bit more consolidation may be needed, but the ingredients for a breakout are slowly coming together. The question is whether the market will provide enough strength to push these altcoins over the edge or whether they’ll remain stuck for longer.

If history repeats, both APT and HBAR could be setting up for big moves. But until then, support and resistance levels will continue to act as the battlegrounds.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.