Aptos stands at a crucial price level right now, catching the eye of many traders. The token sits right where important price lines meet—both straight across and slanted—which means its next move could set the direction for the coming weeks.

Crypto expert Sjuul from AltCryptoGems revealed on X that the APT price is testing a crucial zone, with the outcome of this test likely to dictate whether it will continue its recent uptrend or face further declines.

What you'll learn 👉

Aptos Chart Analysis: Price Levels and Potential Scenarios

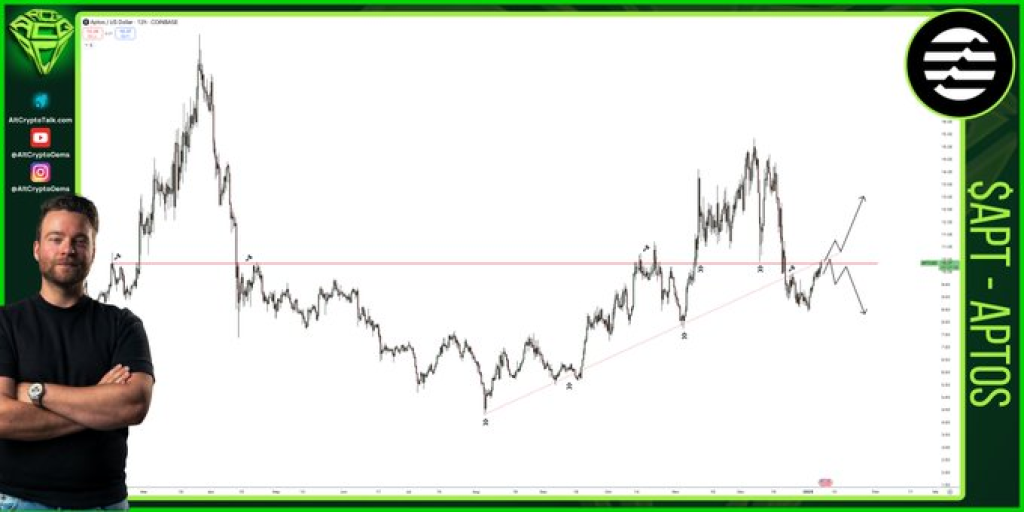

The APT token is at a confluence of support and resistance zones, as illustrated in the chart analysis. The horizontal support/resistance level, represented by a red line, has historically been an important price point, acting as both support and resistance.

Additionally, the diagonal trendline, sloping upwards, adds to the significance of the current level. If APT price breaks above the resistance zone, it could lead to a continuation of its upward movement. However, if the price of Aptos rejects this level, further downside could follow.

Analyst Sjuul’s highlights the critical nature of this level: “Flip it and we resume some nice uptrend; reject it and we keep going down.” Traders are keenly watching the price action at this point, as a breakout above the key resistance could signal strong bullish momentum, while a rejection could lead to a reversal and retesting of lower levels.

Aptos Token’s Value and TVL Analysis

Prominent analyst Azin addressed how valuable APT is on X. He noted that the price of APT is also being supported by a notable Total Value Locked (TVL) metric. According to recent data, Aptos ranks second only to Ethereum (ETH) in terms of TVL/Market Cap ratio, standing at 27.8%.

For context, other tokens like $HYPE and $SUI have lower ratios, at 24.92% and 19.4%, respectively. TVL is a key indicator of a blockchain’s overall activity and adoption, and for Aptos, this measure of liquidity further strengthens its case as a valuable token.

It is also important to note that TVL includes staking, which plays a key role in the blockchain ecosystem. This further adds to Aptos’ appeal, positioning it as a token with strong backing and utility.

Read Also: Cardano Price Prediction: Can ADA Price Rally 10x in 2025?

What’s Next for APT?

As traders and investors keep a close eye on the price action, the sentiment around APT is shifting. The market is consolidating near this pivotal price level, reflecting indecision as traders weigh the potential outcomes.

Moreover, a breakout could confirm a continuation of the current uptrend, while a rejection might lead to a pullback. With the current price testing a critical support and resistance zone, the upcoming movements are expected to play a large role in shaping Aptos’ short-term outlook.

The ongoing analysis and market observations suggest that Aptos’s price is at a key juncture, and the direction it takes from here will likely influence its performance in the coming days and weeks.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.