Avalanche (AVAX) is back on traders’ radar after bouncing off a key support level that’s been holding strong since 2021. The token’s up 5.21% in the past 24 hours, now trading around $20.06. Trading volume has also picked up, climbing 10.62%, which usually signals growing interest and momentum building behind the scenes.

One of the most talked-about charts right now comes from top analyst Scient with 39.8k followers, who shared a weekly AVAX/USDT setup showing a massive symmetrical triangle pattern that’s been forming since the all-time high. It’s a classic squeeze between descending resistance and ascending support, and Avalanche price just had what he called a “clean test” of that support.

From here, the chart points to two possible outcomes. If AVAX breaks out above the resistance line, it could aim as high as $180–$200 based on historical moves. On the flip side, if it loses support near $13, there’s a risk of dropping toward the $9 area. No clear timeline was given, but the setup suggests a big move is likely coming, it’s just a matter of which direction comes first.

What you'll learn 👉

Avalanche Price Short-Term Momentum Builds on Daily Chart

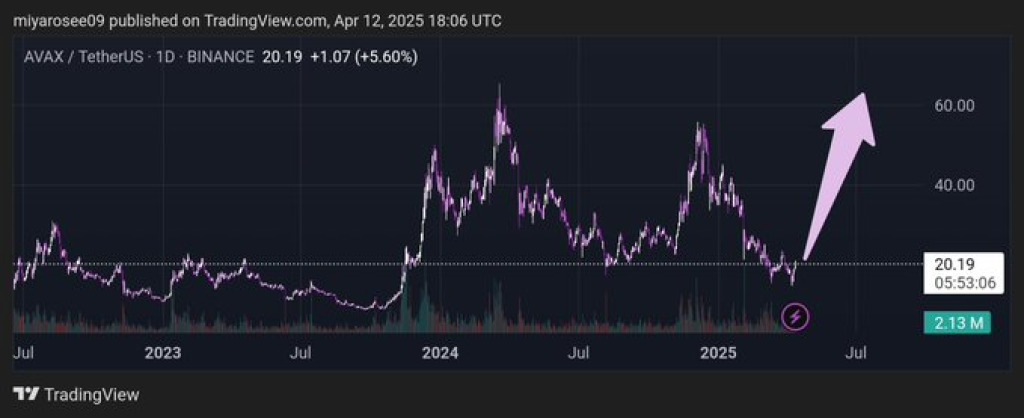

Another analysis shared by prominent analyst Miya with 22.3k followers reflects bullish momentum from a daily timeframe. The post shows AVAX price forming a rounded bottom with upward projections pointing toward $30. The user described the current zone as a “perfect chance to accumulate.” The chart also shows prior resistance at $25–27 and a long-term target near $60.

Short-term support remains between $17.50 and $18.50. If AVAX maintains momentum and closes above $22, technical indicators suggest a higher chance of a move toward the $30–$45 range.

Avalanche ETF Filing Brings Institutional Focus

Adding to the growing attention, crypto expert Simon Desue with over 500k followers noted that Nasdaq has filed to list the VanEck Avalanche ETF. This move aims to bring institutional exposure to Avalanche’s ecosystem. With its subnet technology and increased developer activity, Avalanche is becoming more visible in broader financial circles.

Read Also: Analyst Warns Cardano Holders: Don’t Miss What Trump’s New Crypto Law Really Means

🚨 Big moves for $AVAX

— Simon Desue (@SimonDesue) April 12, 2025

Nasdaq just filed to list the VanEck Avalanche ETF, bringing institutional eyes to the Avalanche ecosystem.

From subnets to ETFs, Avalanche is making HUGE moves. pic.twitter.com/TEgJgmTYSi

These developments come as AVAX price attempts to hold its current trajectory. Traders continue monitoring key resistance and support zones, awaiting confirmation of the next major move.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.