ASTER is holding steady above $2.00, and traders are watching for the next move. At the time of writing, the token trades near $2.04, sitting inside a clear rising channel that has guided ASTER price since launch.

Two prominent analysts on X (formerly Twitter) are sharing their outlooks, pointing to higher targets if the current trend stays in place.

What you'll learn 👉

ASTER Chart Setup and Structure

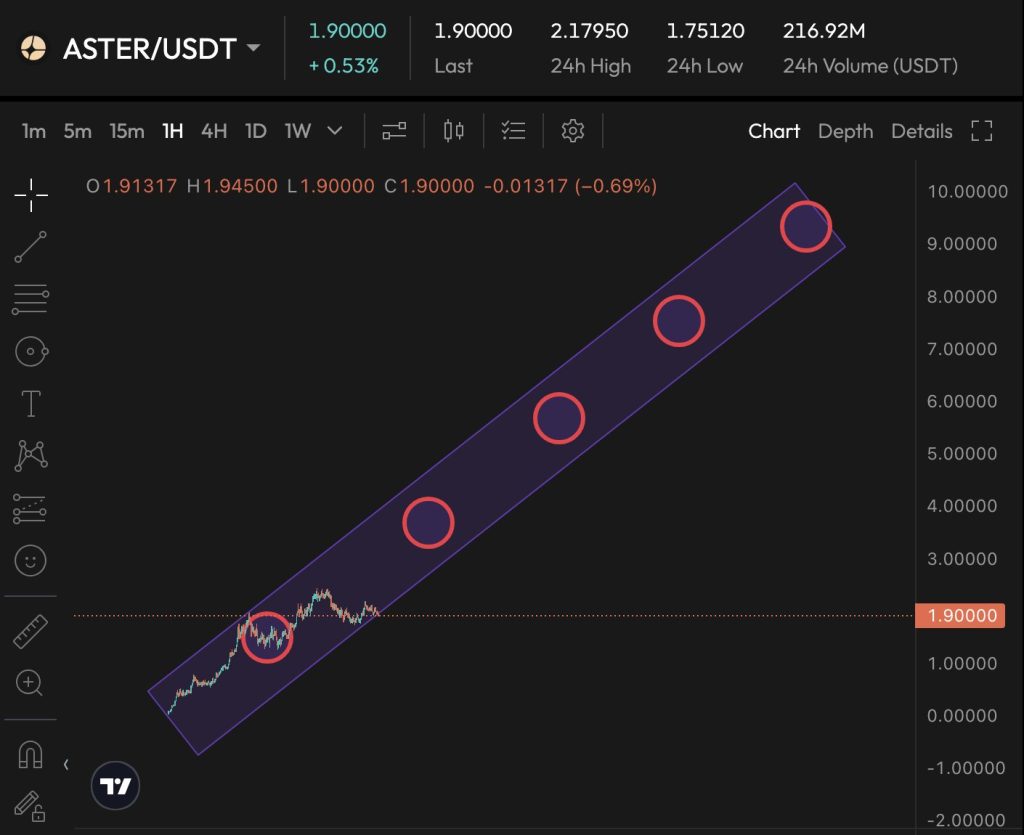

Analysts tracking ASTER say the 1-hour chart shows a steep ascending channel with four clear “steps” higher so far. ASTER price is now in the lower half of that channel, which often leaves room to climb back toward the midline if buyers keep control.

Key levels stand out. $1.90 acts as a local pivot, while $1.75 marks the lower channel rail. A dip to below $1.75 should halt the rally, but in the meantime the higher lows and higher highs pattern stands.

Upside, a break above $2.00–$2.18 would strengthen the case for an advance to $2.50, $3.00, and $4.00.

ASTER Price Support, Resistance, and Key Levels

The first area to watch for ASTER price is the $1.75-$1.90 zone, which has acted as a defense line during recent dips. Intraday shelves near $1.82-$1.85 add extra support. Traders note that holding these levels keeps the broader uptrend alive.

Above, round-number targets line up with the channel’s slope. Clearing $2.18 could quickly invite a move to $2.50, then $3.00, keeping the ladder-like pattern in play.

ASTER Long-Term Targets and Market Commentary

On X, Sr Peters urged traders to stay patient and avoid fear of missing out. He described ASTER as a long-term play, calling it “CZ’s next 10 years dance,” and added, “$4 is next, inshaAllah.”

Chasing “the next Aster” on the 7th day of $ASTER ‘s existence is one of the mistakes that can end up costing you a lot of money.

— Sr Peters (@SrPetersETH) September 27, 2025

Don’t let your emotions make you think that “you’ve missed the trade.”

Nobody. Literally nobody “has missed $ASTER.”

This is a long-term play, most… pic.twitter.com/VDbcsCaeTN

Another trader, Whale.Guru, set an ambitious path: $4 within 30 days, $10 in 60 days, and $20 in 90 days. He tied those targets to the channel’s ability to keep its upward slope.

Read Also: Aster vs. Hyperliquid: Who Wins the 2025 DEX War?

What Traders Are Watching Now

The ASTER chart reflect an orderly ascent if ASTER resists higher above $1.90 and breaks through $2.18.

As long as ASTER price remains within the channel, the path to $2.50, $3.00, and $4.00 remains in place and this area is the most significant area in the next few weeks.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.