The price of Chainlink has increased by around 100% in the last 5 weeks. It spiked from around $10 and is now trading at $20. However, some analysts think this is just the beginning for LINK’s price.

SBF (@ProdDesignerSam) asserts that the price of Chainlink (LINK) is poised to exceed $150 by 2025. He emphasizes that this is not a matter of “if,” but “when,” highlighting the project’s significant endorsements from banks and multi-billion dollar institutions aiming to tokenize trillions in value.

The analyst challenges readers to consider why they would not invest in LINK given its potential.

What you'll learn 👉

LINK Utility and Unique Selling Point

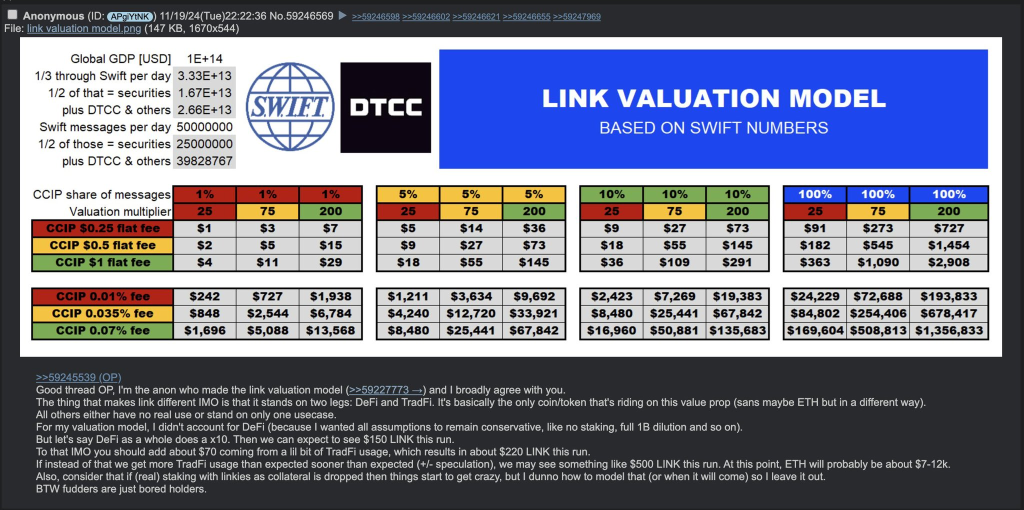

In a more detailed thread, another analyst, known as cnlink, points out what he describes as an outrageous market inefficiency. Despite Chainlink’s pivotal role in the global financial system, it holds a market cap of only $11.73 billion, ranking it at #16, while other less impactful cryptocurrencies enjoy higher valuations.

The current crypto market has a total capitalization of approximately $3.40 trillion, with Chainlink priced at $18.66 amidst extreme greed (Fear & Greed index at 82).

The analyst makes a stark comparison of market caps, illustrating that LINK’s current valuation is significantly lower than that of projects like XRP, SOL, and even meme coins like DOGE. If LINK merely matched the market caps of these other cryptocurrencies, its price could soar to between $149 and $179.

This comparison underscores the perceived undervaluation of Chainlink, which is integral to sectors such as traditional finance, insurance, real estate, carbon credits, gaming, decentralized finance (DeFi), and more.

Read Also: Litecoin Price Pumps, Analyst Says ‘It’s Time to Pay Attention’ to LTC

Chainlink’s integration into massive financial entities, including the DTCC—which handles an astounding $2.4 quadrillion in transactions annually—highlights the project’s potential. The analyst points out the absurdity of LINK being valued less than certain meme coins, suggesting this represents a peak inefficiency in the market.

SBF further argues that the widespread adoption of LINK by institutions, including SWIFT and major banks, signals a transformative moment in finance. He draws parallels to historical investment opportunities, likening the current moment to buying Amazon when it was merely a bookstore or acquiring Bitcoin when it was dismissed as “magic internet money.”

LINK Price to Exceed $1,000 in Value

The analyst outlines several reasons he believes LINK’s price could exceed $1,000, including its capability to secure quadrillions in value, the necessity for banks to utilize LINK, the imminent supply shock, and the absence of viable competitors. He suggests that the current investment scenario reflects monumental potential, akin to early investments in BTC or ETH.

Read Also: Ripple (XRP) Price Pumping But Dogecoin Remains a Better Bet: DOGE Price Analysis

His strategy for investors is straightforward: continue accumulating LINK while it remains under $20, avoid short-term price fluctuations, focus on adoption news, and patiently await the realization of its true value.

The analyst emphasizes that the opportunity to buy LINK at this price while banks announce global integrations is remarkable and could lead to generational wealth.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.