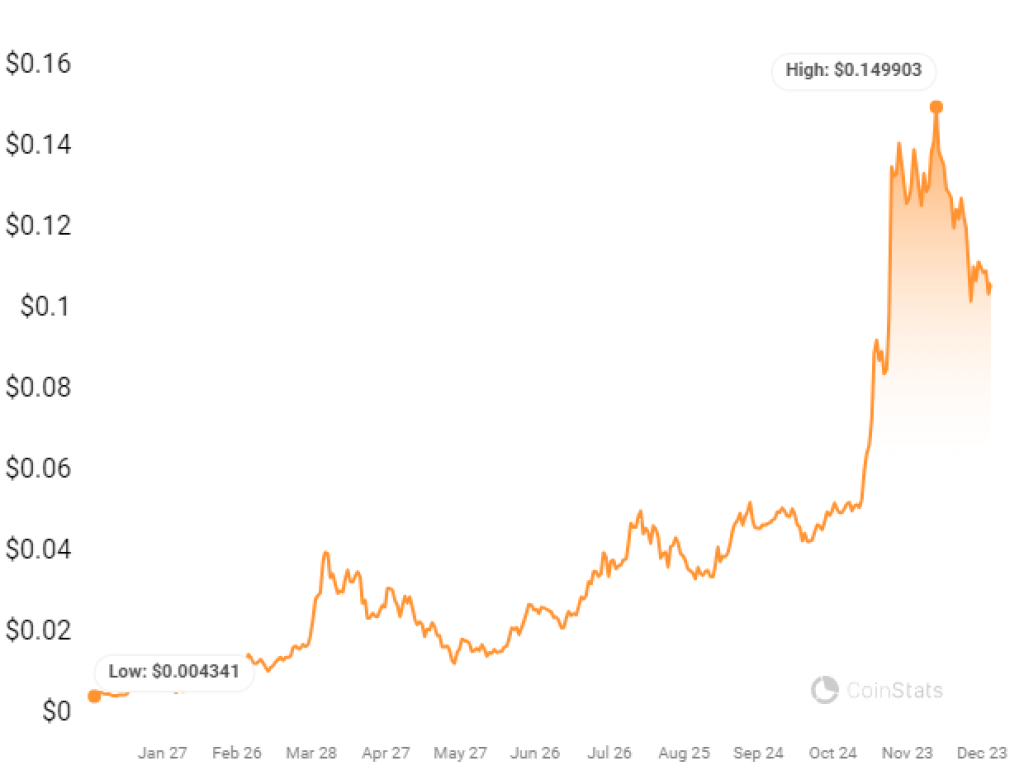

Crypto analyst Cryptographur offered an interesting perspective on formulating an investment exit strategy for emerging blockchain project Kaspa and its KAS token. He analyzed Cardano’s price history last cycle as a case study.

Cryptographur notes that after a speculative frenzy leading into Cardano’s Coinbase listing in 2021, ADA subsequently struggled considerably even as the broader crypto market continued rising into late 2021. In other words, the majority of Cardano’s massive gains came from aggressively accumulating the token before mainstream exchange availability.

Source: CoinStats – Start using it today

However, he cautions against rigidly selling all holdings immediately after Kaspa inevitably lists on major platforms. Major exchange inclusion certainly marks a milestone and helps expand visibility. Yet the peak opportunities to capture outsized returns still center around identifying macrocycle tops in bitcoin and broader risk asset markets.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Hence Cryptographur advocates for a nuanced, multi-factor approach when planning to realize Kaspa gains. Monitoring momentum deterioration in leading indices, overbullish sentiment on social media, and extreme greed on fear and greed indicators could signal optimal timing. Additionally, stretched valuations relative to developer activity or network usage offer fundamental recorders.

In summary, while major exchange listings serve as public validation, those more complex underlying factors determine the ideal moments to lock in profits. Rather than focusing solely on availability or hype, Cryptographur will incorporate comprehensive signals around market cycle progression when devising his personal Kaspa exit tactics.

You may also be interested in:

- DeFi Investor Unveils Top Crypto Picks for the Week Ahead Including BTC, AVAX and These Altcoins

- Will Bitcoin Traders Bet on Bullish or Bearish Outcomes This Holiday Season?

- Bonk Surpasses $1 Billion Market Cap As Solana Sets New 2023 High. Can Meme Moguls Catch Up?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.