Real-World Assets (RWAs) are emerging as one of the most promising opportunities in the cryptocurrency space this cycle. With major players like BlackRock launching tokenized funds and projections indicating that tokenized assets could reach $10 trillion by 2030, it’s time for investors to take notice. In this comprehensive guide by Miles Deutscher, we’ll explore the world of RWAs, their potential for growth, and the top altcoin picks in the sector.

What you'll learn 👉

Understanding Real-World Assets

Real-World Assets represent physical assets such as gold, real estate, and other commodities as tokens on the blockchain. By tokenizing these assets, RWAs offer several benefits, including:

- Increased efficiency through lower costs and the elimination of brokers

- Improved accessibility via fragmentation and enhanced liquidity

RWAs have the potential to drive significant value on-chain by tapping into massive markets like global bonds ($133 trillion) and gold ($13.5 trillion), while also providing real-world income-generating assets for DeFi yield. Additionally, RWAs reduce brokerage and middlemen costs, making them an attractive option for investors.

The Growing Demand for RWAs

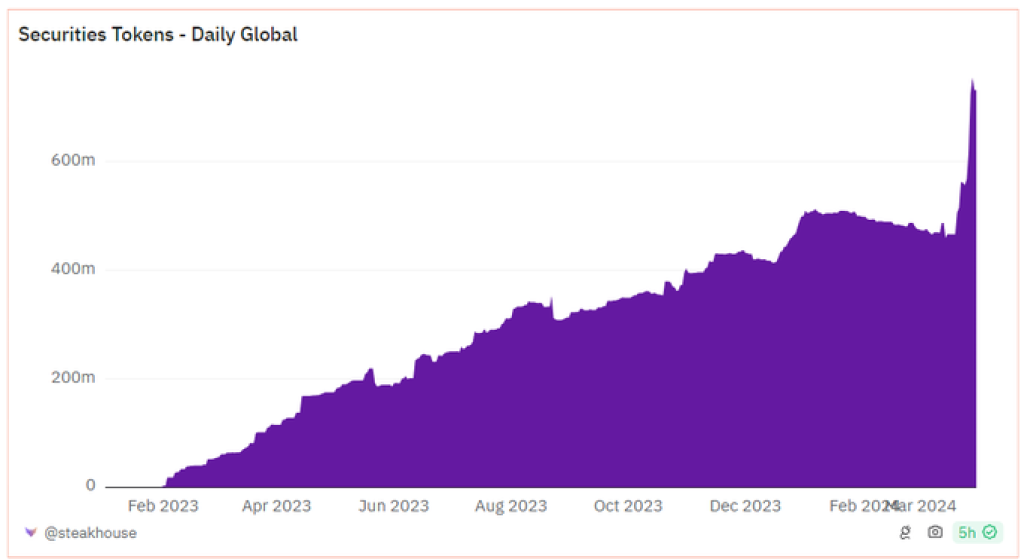

The numbers confirm the increasing demand for RWAs. Tokenized public securities have surpassed $700 million in market cap, while the tokenized gold market is approaching $1 billion, according to a report by Bank of America.

This demand spike can be largely attributed to the recent involvement of major TradFi players like BlackRock, Citi, Franklin Templeton, and JPMorgan in the RWA space.

BlackRock’s digital asset fund, which tokenizes bonds, has grown to a $274 million market cap with a 37.53% market share in just two weeks. As more institutional players enter the market, the validity and growth potential of the RWA sector in 2024 and beyond become increasingly apparent.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Top RWA Altcoin Picks

To help investors navigate the RWA landscape, Miles Deutscher, a prominent crypto analyst, has identified several key projects poised to benefit from the growing interest in RWAs. These picks are broken down into four categories:

- Layer 1 (and L2) Blockchains: RWA-focused chains like @RedbellyNetwork and @MANTRA_Chain offer direct exposure to the upside of the RWA narrative.

- Oracles: Oracles like $LINK (@chainlink) and $PYTH (@PythNetwork) play a crucial role in ensuring accurate price feeds and transmitting data across blockchains for RWA protocols.

- RWA-Specific Protocols: dApps that provide the technology to facilitate DeFi applications for RWAs or leverage underlying assets to power their platform offer the most direct exposure to RWA. Notable projects include $ONDO (@OndoFinance), $PENDLE (@pendle_fi), and $FRAX (@fraxfinance).

- Upcoming RWA Launches: Promising projects that have yet to launch, such as @Lingocoins and @truflation, are worth keeping an eye on for their innovative approaches to RWA.

As the tokenization revolution gains momentum, Real-World Assets are set to become a major driver of value in the cryptocurrency space. With institutional players like BlackRock leading the charge and the growing demand for tokenized assets, investors who stay informed and strategically position themselves in the RWA sector could potentially reap significant rewards.

By understanding the landscape and considering the top altcoin picks outlined in this guide, investors can navigate the exciting world of RWAs and capitalize on the opportunities that lie ahead.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.