In his latest video, cryptocurrency YouTuber Zach Humphries sheds light on why Kaspa (KAS) is gearing up for dominance in the cryptocurrency space over the next two years. Despite its recent surge from 4 cents to 13 cents, Zach believes Kaspa’s upward potential is far from exhausted. Here are the five key reasons driving his bullish outlook:

What you'll learn 👉

Retail Demand Surge

Retail interest in Kaspa is witnessing a notable uptick, a critical factor for Zach. He highlights the remarkable surge of 40,000 new addresses holding at least one Kaspa within the last six days. This influx of new investors is reminiscent of the retail frenzy seen with explosive cryptos in 2021, signifying a bullish trend. Presently, Kaspa boasts a total of 309,000 holders, showcasing steady growth in its holder base.

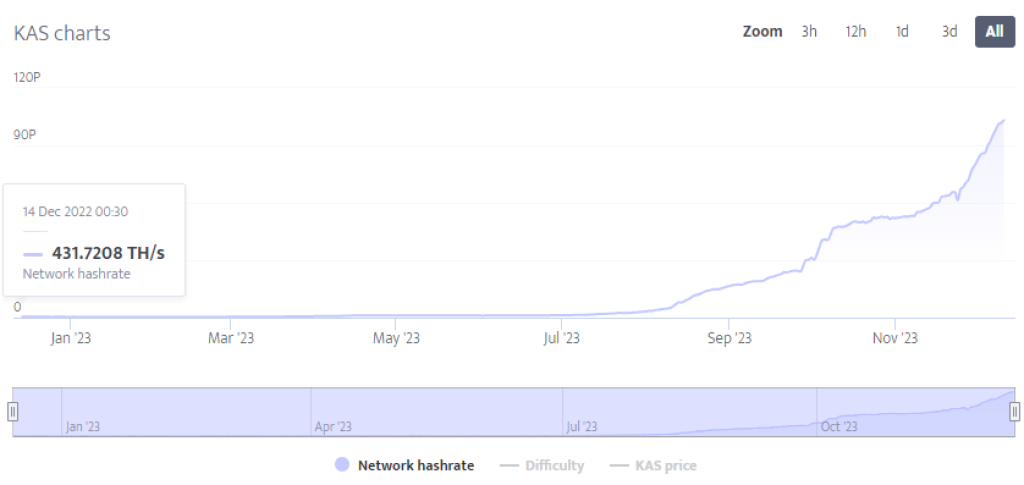

Hash Rate at All-Time High

Kaspa’s hash rate has reached a new peak, underscoring its robust proof-of-work infrastructure. Zach draws parallels with Bitcoin, emphasizing Kaspa’s position as a modernized version. The hash rate hitting an all-time high, coupled with an advantageous halving schedule and sound tokenomics, positions Kaspa as a strong contender.

Continued Partnerships and Listings

Zach points out the ongoing trend of partnerships and listings, a promising indicator for Kaspa’s future. While major exchanges like Binance and Coinbase are yet to join the fold, strategic partnerships with platforms like Carbon Browser (with over seven million users) and listings on LDX Swap contribute to Kaspa’s growing ecosystem.

Macro Positioning and Market Growth

Zach places Kaspa’s current rank at 27 on Coin Market Cap into perspective. Despite launching in the challenging period of November 2021, Kaspa has exhibited remarkable growth, currently boasting a $3 billion market cap. Zach reflects on Kaspa’s relatively quiet phase in 2021 and 2022, culminating in a significant surge from three cents in April this year.

Tokenomics and Bull Run Potential

Zach delves into Kaspa’s tokenomics, highlighting a circulating supply of 76% (21 billion out of 28 billion) and the potential for this to reach the 90% range during the bull run. He emphasizes the bullish implications of robust tokenomics and envisions Kaspa’s significant role in the anticipated bull run of 2024-2026.

Read also:

- Chainlink (LINK) Nears Make-or-Break Resistance Level

- Why Has Avalanche (AVAX) Pumped 300% in Two Months?

- Rebel Satoshi Demonstrates BIG Profit Potential: How Do Ethereum (ETH) and Avalanche (AVAX) Compare?

In conclusion, Zach expresses his excitement about Kaspa, ranking it as his third-largest holding after Bitcoin and Ethereum. He anticipates Kaspa’s ascent to a dollar and beyond during the next bull run, showcasing his confidence in the project’s long-term potential.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.