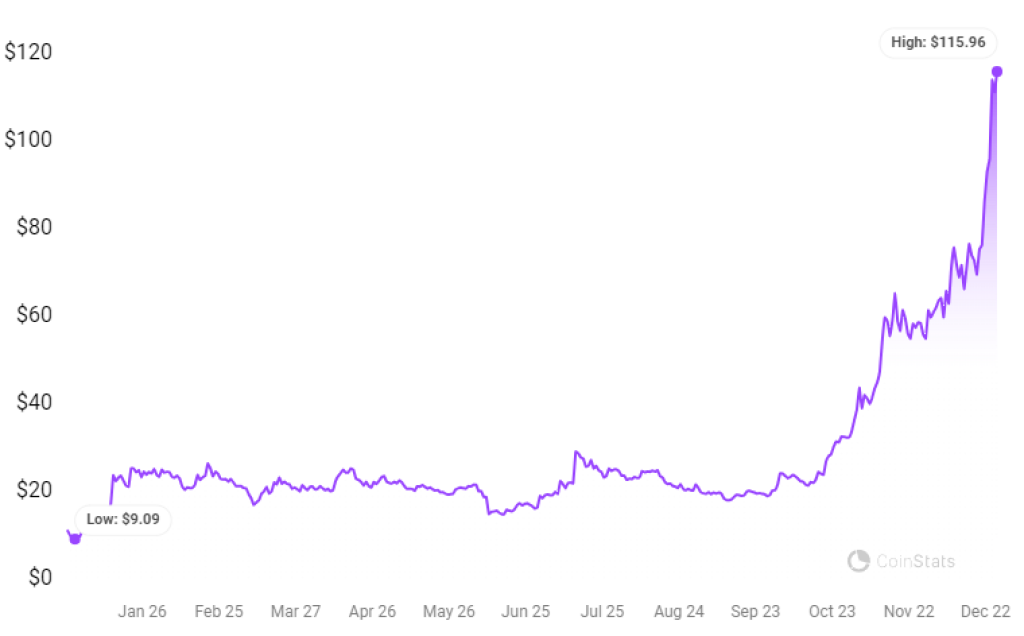

Crypto trader Bluntz Capital offered some perspective on those anticipating an imminent top in Solana’s native token SOL after its parabolic uptrend in 2023. Despite rallying over 914% year-to-date, SOL still trades roughly 113% below its all-time high from November 2021 above $260.

In Bluntz’s view, calling a top with SOL more than doubling away from historic peaks makes little sense in the context of crypto market cycles. Coins that lead each bull run tend to massively overshoot old highs before exhausting upside momentum.

Source: CoinStats – Start using it today

As one of this cycle’s darling layer 1 blockchain projects thus far, Bluntz expects Solana to continue appreciating steadily as adoption expands. Rather than overthinking short-term moves by constantly trying to identify swing highs, he advocates simply accumulating any notable dips.

History remembers the investors who maintained exposure over years, not traders who successfully timed brief pullbacks before missing larger moves, Bluntz contends.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +With fundamentals and momentum aligning for substantially higher prices, he sees no reason to prematurely call an end to SOL’s bull run. Bluntz believes periodically buying dips offers a straightforward formula for riding Solana’s upside toward the inevitable new all-time highs beyond $400.

Attempting to trade counter-trend carries far more downside risk if SOL resumes climbing before one can reenter. Hence, Bluntz encourages embracing Solana’s leadership position rather than fighting the upside. Its blockchain activity and developer traction support much greater adoption and valuations, according to bulls.

You may also be interested in:

- DeFi Investor Unveils Top Crypto Picks for the Week Ahead Including BTC, AVAX and These Altcoins

- Will Bitcoin Traders Bet on Bullish or Bearish Outcomes This Holiday Season?

- Bonk Surpasses $1 Billion Market Cap As Solana Sets New 2023 High. Can Meme Moguls Catch Up?

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.