In a detailed analysis shared in May 2022, crypto market researcher Rekt Capital discussed the price movements of Bitcoin and the role played by the 200-week moving average (MA) in determining accumulation zones. This article expands and updates that analysis, diving deeper into the long-standing relationship between Bitcoin’s 200-week MA and its price history.

What you'll learn 👉

The Historical Role of 200-week MA

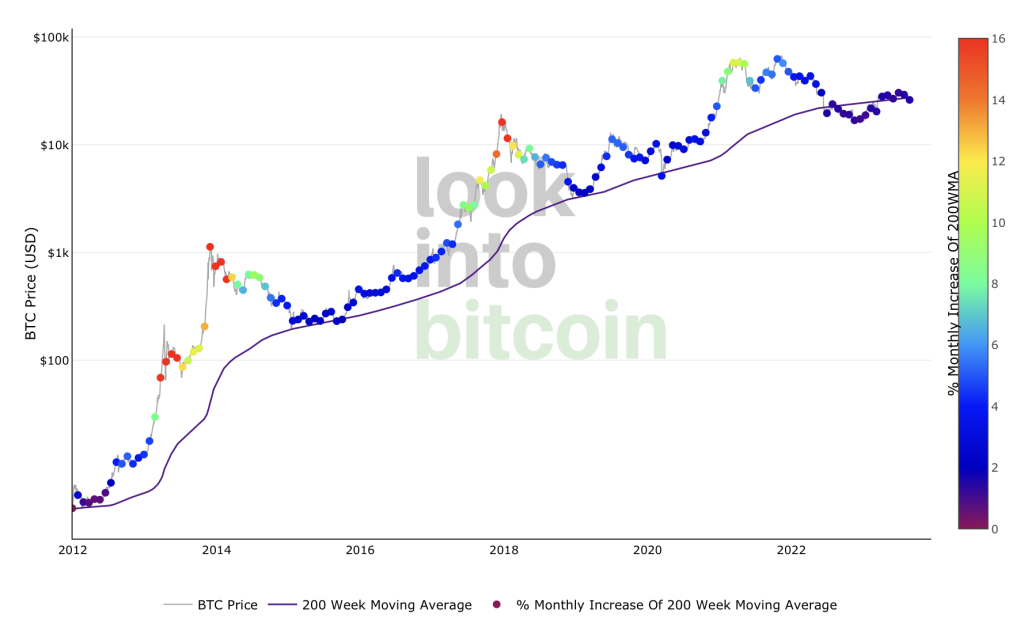

Traditionally, Bitcoin’s 200-week MA has served as a crucial pivot point for investors looking for long-term opportunities. Acting as an empirical floor for Bitcoin’s price, this MA has historically been a reliable indicator for identifying when the asset has bottomed out.

In March 2020, amid the global market meltdown, Bitcoin’s price did wick below the 200-week MA briefly. However, the price remained largely above this MA, affirming its support role.

A Shift in Dynamics: The Accumulation Area

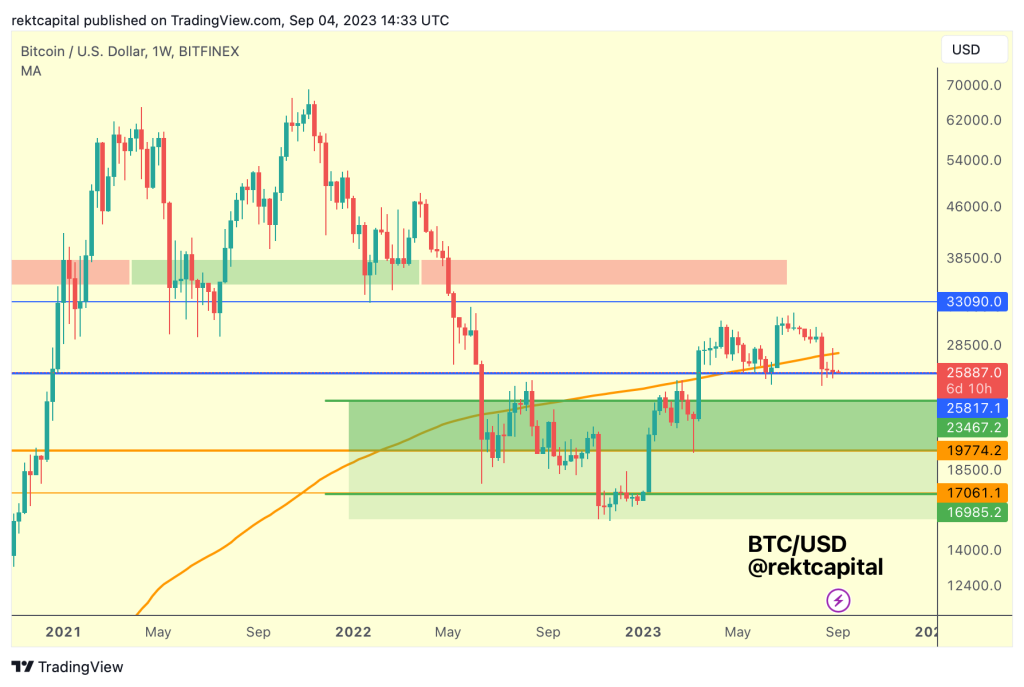

However, recent market behavior has showcased a change in this long-standing principle. For the first time, Bitcoin’s price found its bear market bottom within an Accumulation Area—essentially a price zone where long-term investors amass or “accumulate” an asset—which was below the 200-week MA.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +This Accumulation Area was not derived arbitrarily; it was established by examining Bitcoin’s historical drawdowns that occurred following so-called “Death Crosses,” events in which a short-term MA crosses below a long-term MA, often signaling a bear market.

Role Reversal: 200-week MA as a Reference Point

In earlier cycles, the 200-week MA helped form the Accumulation Range, providing an essential benchmark for traders and analysts. It acted as a reference point for a Bitcoin breakout from this zone. Yet, time marches on, and the 200-week MA, being a dynamic indicator, now represents a higher price point.

Interestingly, Bitcoin has recently flipped the 200-week MA into a new resistance level, hinting at the possibility that its price could linger below this MA in the short to medium term.

Timeless Principle: High ROI Potential Below 200-week MA

Despite these shifts, the underlying principle seems unaltered: purchasing Bitcoin below the 200-week MA has historically yielded a high Return on Investment (ROI). Even as the MA transitions from being a point of support to potentially a new point of resistance, it continues to offer an advantageous buying opportunity for long-term investors.

In summary, while the 200-week MA’s role may have evolved, its status as a significant indicator for savvy, long-term Bitcoin investment strategies remains indisputable. The moving average continues to be a point of focus, even as Bitcoin charts a course through ever-shifting market conditions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.