The cyptocurrency industry is no stranger to cycles, and the recent meme coin frenzy is a prime example of how these cycles can play out. While many investors have been drawn to the potential for quick profits, it’s crucial to recognize that investing in meme coins at this stage of the cycle may already be a bad idea.

What you'll learn 👉

Understanding the Inner Crypto Cycle

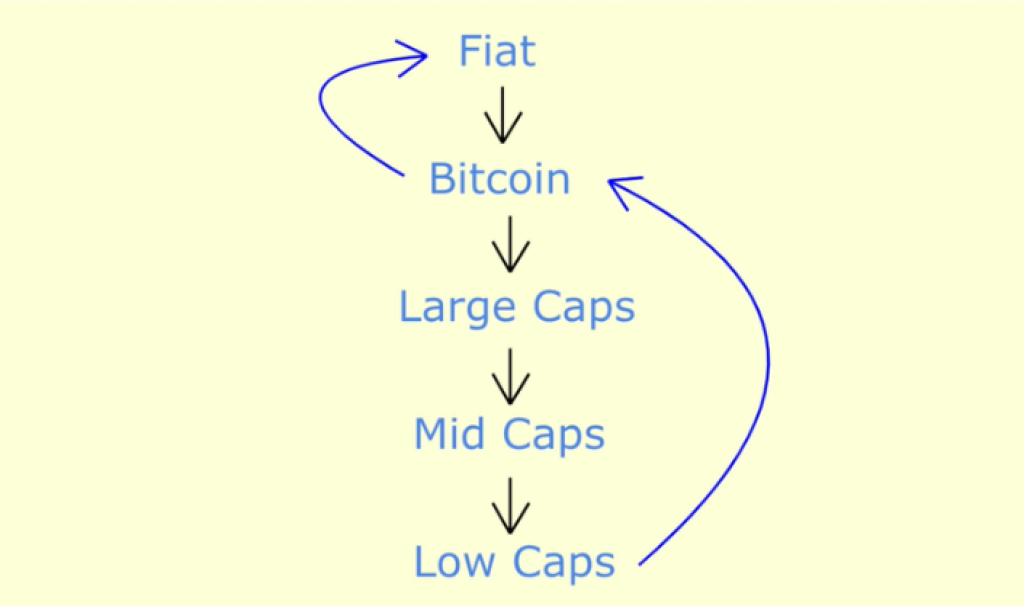

Human psychology, which shapes price movements and creates cyclical patterns, is what drives financial markets, including the cryptocurrency market, according to analyst Coin Post. These cycles are often characterized by four distinct phases, each with its own unique characteristics and investment opportunities.

Phase 1: The Emergence of Past Market Cycle Coins

The meme coin cycle begins with coins from previous market cycles, such as Dogecoin (DOGE) and Shiba Inu (SHIB), outperforming the market. This phase indicates the beginning of a new trend, although many investors may remain skeptical and stay on the sidelines.

Phase 2: Fresh Coins and Exorbitant Overvaluation

As the trend gains strength, new coins emerge, often with exorbitant valuations. While some of these coins may succeed, original ideas tend to win out in the long run. Examples of successful coins in this phase include Dogwifhat (WIF) and Pepe (PEPE).

Phase 3: The Game of Musical Chairs

In the third phase, newly created capital is reallocated as speculators transfer profits from second-phase coins to a diversified portfolio of fresh, small-cap coins. This period is characterized by rapid capital movement and increased volatility.

Phase 4: The Token Sale Period

The final phase marks the end of the mini-cycle, with increased involvement from retail investors and the emergence of token presales. Influencers raise millions, while scammers take advantage of the heightened interest in meme coins.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Identifying the Current Stage of the Meme Coin Cycle

By analyzing recent market events, we can attempt to determine where we are in the current meme coin cycle:

- The cycle began with Bitcoin (BTC) moving from $50,000 to $60,000, coinciding with major meme coins outperforming the market.

- The second phase was evident on the Solana blockchain, with hundreds of similarly-themed meme coins being launched daily.

- The WIF fundraise on Sphere, a price top, and capital reallocation may have served as signals for the third phase.

- We are currently in the fourth phase, with retail investors heavily involved and scammers taking advantage of the meme coin craze.

The Risks of Investing in Meme Coins at This Stage

As the meme coin cycle reaches its final phase, the probability of generating significant wealth by investing in coins with funny names has greatly diminished. In fact, investing in meme coins at this stage is likely already a bad idea.

While the allure of quick profits may be tempting, it’s essential for investors to recognize the risks associated with investing in meme coins at this stage of the cycle. By understanding the inner workings of crypto cycles and identifying the current phase, investors can make more informed decisions and potentially avoid significant losses.

You may also be interested in:

- Experts Interpret Solana’s (SOL) Market Trajectory: Indicator of Major Upcoming Shifts in Crypto? Here’s their Outlook

- Top Bitcoin Analyst Maps Out BTC’s Potential Correction with This Strategy

- EOS (EOS) Recovers Stolen Tokens; Filecoin (FIL) Liquid Staking Soars; Algotech (ALGT) Presale Blasts 275%

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.