A thoughtful thread by a crypto analyst Cryptographur recounts lessons learned from impatience and a lack of conviction during previous market cycles—mistakes many can relate to.

Using the example of accumulating ADA in the last bull run, Cryptographur described buying around 3–4 cents, selling at 10 cents on the way up, FOMOing back in around 30 cents, and ultimately selling again at $2.90.

In hindsight, simply holding through 100X+ gains to ADA’s peak above $3 seems obvious. But in the moment, protecting gains and attempting to time market swings won out over conviction.

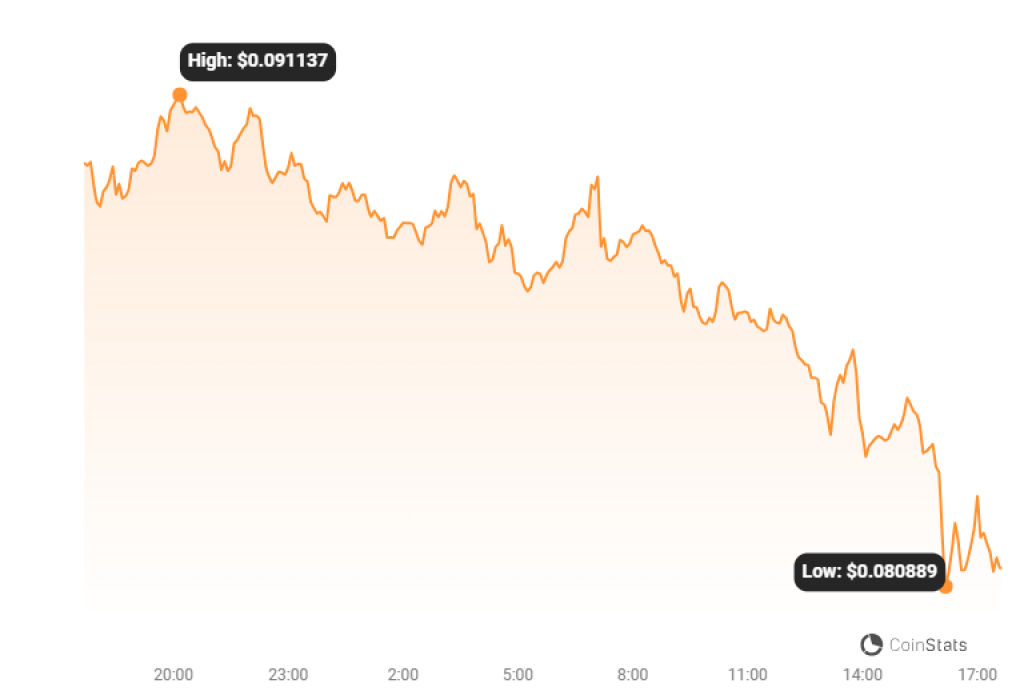

Cryptographur notes micro-cap gem Kaspa (KAS) is in a similar early stage where the long-term upside could be immense. Yet the tendency to trade reactively could undermine those returns. Kaspa is down by 9.5% in the last 24 hours according to the latest data from CoinMarketCap.

Source: CoinStats – Start using it today

His key takeaways are to stick to a set accumulating strategy rather than trying to time trades and to avoid selling until the macrocycle peaks when setting targets based on Bitcoin’s bull market tops. Patience and conviction trump short-term thinking.

Read also:

- Bitcoin, MATIC and These Altcoins Are Top Cryptos to Watch This Week

- Dogecoin Devotees Pivot to This New Memecoin, Eyeing a Fresh Financial Frontier

- How Taraxa (TARA) Could Mirror Kaspa’s Parabolic Success

This is sage advice for any burgeoning cryptocurrency investment. The massive long-term upside potential makes holding through volatility worthwhile. But human psychology so often sabotages these returns with weak hands. Developing a strategic plan and sticking to it separates disciplined investors from those who end up leaving tons of profit on the table.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.