According to cryptocurrency market analysis firm LookOnChain, it appears that a large institutional investor recently injected around $33.9 million into the crypto market.

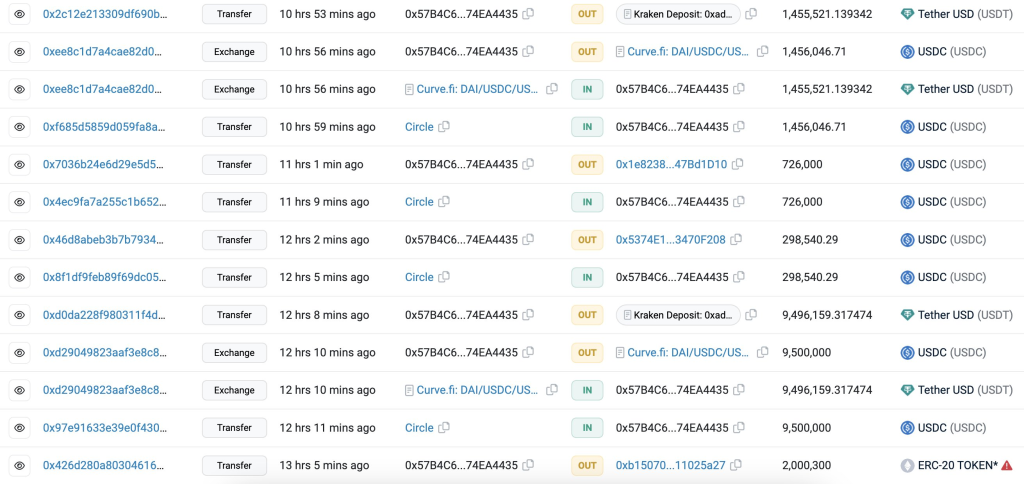

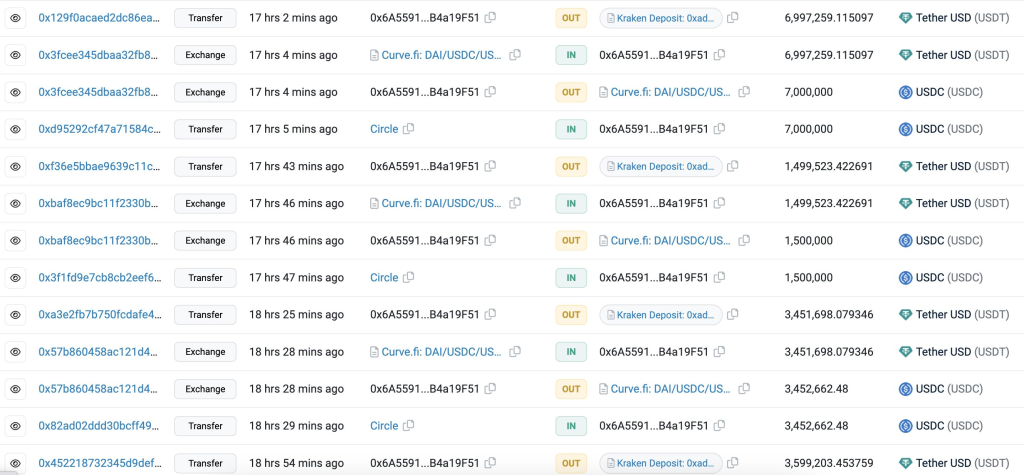

LookOnChain reported observing two wallet addresses, 0x6A55 and 0x57B4, withdrawing 33.9 million USDC (a stablecoin pegged to the US dollar) from cryptocurrency exchange Circle. The wallet addresses then swapped the USDC for USDT, another major stablecoin, before depositing the USDT to the Kraken exchange.

In total, 33.9 million USDT was deposited to Kraken over the course of this series of transactions. This large infusion of stablecoin funds suggests that a deep-pocketed institution could be gearing up for major cryptocurrency purchases.

At the time of this activity, the overall crypto market cap stood around $1.05 trillion, with Bitcoin and Ethereum – the two largest cryptocurrencies – still trading below key support levels that have now turned into resistance at $27,400 and $1,600 respectively.

The timing of this massive stablecoin transfer to Kraken is notable given the current market conditions. With Bitcoin and Ethereum struggling to regain bullish momentum, the injection of nearly $34 million into the market could signal that a major institution sees current prices as a buying opportunity.

By stockpiling stablecoins like USDT on exchanges like Kraken, institutional investors can quickly execute large cryptocurrency purchases when they feel the time is right. The movement of such a large sum of money into the crypto ecosystem suggests that at least one deep-pocketed player is preparing to take advantage of persisting market weakness.

The large infusion of funds observed by LookOnChain may indicate that a whale institution is gearing up to make a big bet on the crypto market recovery as Bitcoin and Ethereum linger below key support turned resistance levels. The coming days and weeks may see significant buys if this entity decides to deploy its stablecoin war chest.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.