Onyxcoin (XCN) was one of the most volatile cryptocurrencies Q1 2025. As Q2 unfolds, many investors want to know what might happen next with this token. We asked AI to analyze XCN’s potential price movements through June 2025.

In January, Onyxcoin’s price shot up by 1,700% in just two weeks. This happened after XCN broke through a long-term resistance trend, reaching its highest price since 2022.

The price surge gained momentum after Justin Sun, who founded TRON, accused Chain and OnyxDAO of market manipulation. These accusations brought lots of attention to XCN. At the same time, investors were attracted by Onyx Protocol’s focus on institutions and its liquidity rewards program.

During this boom, XCN’s price jumped from about $0.00258 to $0.049. But the good times didn’t last. By the end of March, XCN has lost 80% of those gains, falling to $0.0094.

April has been more stable, with support around $0.008 holding for several days. A recent green candle suggests buyers might be returning, possibly due to positive market sentiment after news about the U.S. 90-day tariff pause. Many other cryptocurrencies have also seen price increases.

What you'll learn 👉

AI Price Predictions for Onyxcoin: Three Potential Scenarios

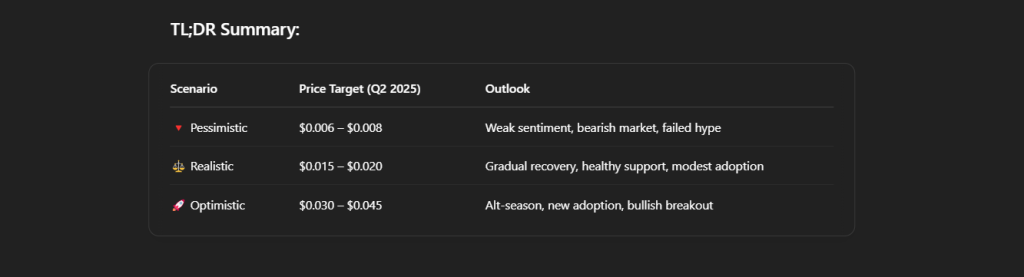

We wanted to know what XCN might be worth by the end of Q2 2025, so we asked ChatGPT to analyze it. The AI provided three different scenarios based on various factors.

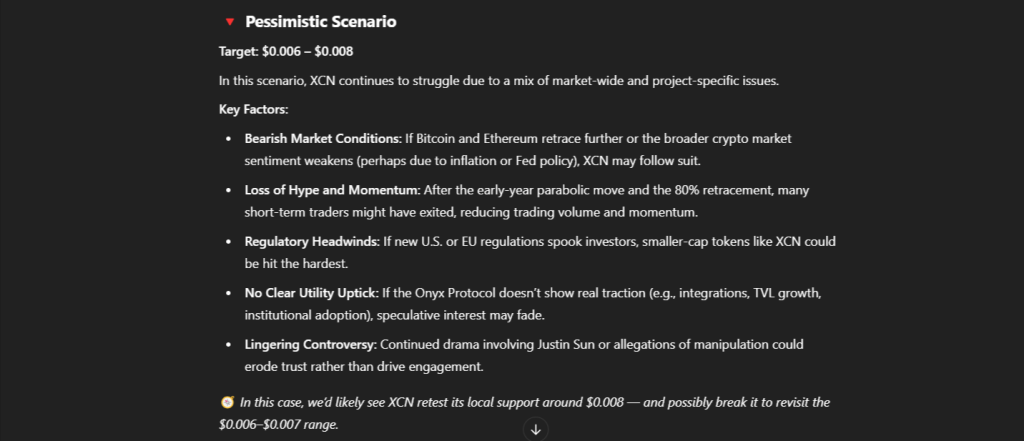

Pessimistic Scenario: Continued Struggles

In the worst-case scenario, XCN could reach between $0.006 and $0.008 by the end of Q2 2025. This assumes XCN will continue facing challenges from both market conditions and project-specific issues.

Several factors could push prices down. If Bitcoin and Ethereum drop further or if the broader crypto market weakens due to inflation concerns or Fed policies, XCN would likely fall too. Smaller tokens usually follow market leaders, especially during downturns.

The dramatic price swing earlier this year might have lasting effects. After the January surge and 80% drop, many short-term traders probably left, reducing trading volume and momentum.

New regulations from the U.S. or EU could create uncertainty for investors, hitting smaller tokens like XCN hardest. If Onyx Protocol doesn’t show real progress through integrations, increased total value locked (TVL), or institutional adoption, interest might continue to fade.

The controversy with Justin Sun and manipulation allegations could further damage trust. In this scenario, XCN would likely test its $0.008 support level and possibly drop to the $0.006–$0.007 range.

Read Also: XCN Could Replace XRP? Analyst Makes Bold Onyxcoin Price Prediction

Realistic Scenario: Finding Stability

A more balanced view sees XCN reaching between $0.015 and $0.020 by the end of Q2 2025. This assumes XCN finds stability and benefits from market recovery and ecosystem growth.

If Bitcoin stays steady or rises slightly, altcoins like XCN should recover. If the $0.008 support level holds and prices consolidate healthily, we could see another move toward recent highs.

Some progress in the Onyx Protocol ecosystem—like growth in liquidity programs, Layer 3 development, or new partnerships—could renew investor interest. If XCN breaks above $0.015 with increasing volume, traders might return.

A rise to the $0.015–$0.020 range would show growing confidence in XCN, though not another extreme spike like January’s.

Optimistic Scenario: Renewed Rally

In the best-case scenario, XCN could reach between $0.030 and $0.045 by the end of Q2 2025. This assumes multiple positive factors align, pushing XCN into another strong rally—though probably not as extreme as January’s.

A broader altcoin season or Bitcoin reaching new all-time highs would lift the entire market, especially high-risk tokens like XCN. Major developments in Onyx Protocol could drive substantial price increases, including DeFi integrations, Layer 3 mainnet launch, institutional partnerships, or significant TVL growth.

Read Also: How Much Could 150,000 Onyxcoin (XCN) Tokens Be Worth in 2026?

Listings on major exchanges like Binance or Coinbase would increase XCN’s visibility and liquidity, potentially attracting new investors. If the Justin Sun controversy fades or is seen more positively as having raised awareness, it might actually boost interest.

A focused marketing campaign highlighting Onyx’s roadmap or rewards could increase both short and long-term demand, potentially pushing XCN back toward recent highs.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.