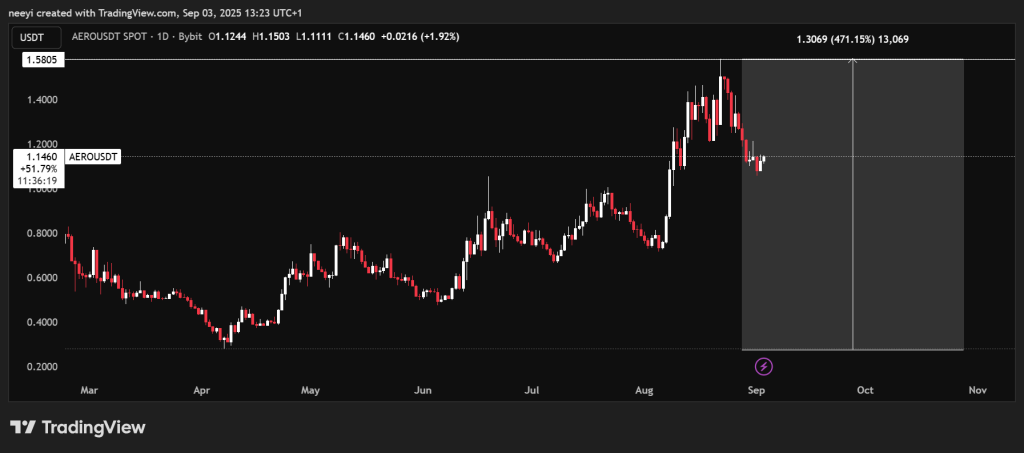

Aerodrome (AERO) is trading around $1.13 right now. It climbed by more than 400% from April to around $1.50 in August. However, it doesn’t look like the move is stopping. Some analysts are even suggesting a more bullish path for the token.

One analyst, Lee, through his YouTube channel, even thinks that Aerodrome price could go much higher. He describes three scenarios that could push AERO price to a higher level this cycle.

What you'll learn 👉

Why $10 Could Be Within Reach

Lee’s first scenario is AERO at $10. That’s about an 8.7x move from current levels, which would place Aerodrome’s market cap near $9 billion. For context, that might sound ambitious, but in crypto, we’ve seen projects grow even faster.

What makes Lee lean toward this possibility is the foundation of Aerodrome itself. Aerodrome is a decentralized exchange built on the Base network, Coinbase’s layer 2 scaling solution. Coinbase is publicly listed on the Nasdaq and part of the S&P 500, which gives the Base ecosystem a credibility boost.

Since Base doesn’t have its own native token, investors looking to back the network indirectly turn to projects like Aerodrome. For Lee, that connection alone makes AERO more compelling than just another decentralized exchange.

How $12.50 Compares to Past Success Stories

The second scenario Lee outlined pushes AERO price to $12.50, which would mean nearly an 11x rise and about an $11 billion market cap. To see if that’s realistic, he compared it to Uniswap’s UNI token. Back in 2021, UNI’s market cap peaked above $20 billion.

If Aerodrome managed to capture even half of that kind of momentum during a strong altcoin season, Lee argues $12.50 isn’t far-fetched.

After all, Aerodrome shares UNI’s decentralized exchange model but benefits from being tied to Base, a network still in its growth phase. It’s like comparing a proven veteran with a fast-rising rookie the ceiling might still be higher for the newcomer.

The Bold Case for $15 and Beyond

The most ambitious scenario from Lee the Captain is AERO hitting $15, about a 13x jump from today. That would put Aerodrome’s market cap around $13.5 billion. What could drive such a leap? Lee points to a combination of market growth and adoption.

Right now, global crypto ownership sits above 600 million people, compared to about 300 million during the peak of the 2021 bull run. That means the potential market has already doubled. If Bitcoin pushes to $150,000 or Ethereum reaches $10,000 in this cycle, Lee argues it’s reasonable to expect an even larger wave of participation. More people in crypto generally means more liquidity, more speculation, and more attention for promising tokens like AERO.

Price targets are one thing, timing is another. Historically, altcoins often peak about 18 months after a Bitcoin halving. Since the most recent halving happened in April 2024, that timeline points to around October 2025.

Lee, however, keeps it realistic the cycle could stretch into late 2025 or even early 2026. For him, it’s less about pinpointing the exact month and more about being patient. His approach is to hold, wait, and let the market play out.

So Can AERO Really Hit $15?

The scenarios range from $10 to $15, each grounded in comparisons, fundamentals, and adoption trends. Whether Aerodrome price lands on the lower end or manages to climb toward that top target, one thing is clear: AERO is positioned at an interesting crossroads of Base’s ecosystem and decentralized finance growth.

Read Also: September Setup: Is Hedera (HBAR) Next Move a Double-Digit Rally?

The question now is not just if AERO can reach $15, but what the broader market will look like if it does. Could Aerodrome become the breakout story of this altcoin season, or will another project steal the spotlight? Only time will tell, and that’s what makes watching this cycle so fascinating.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.