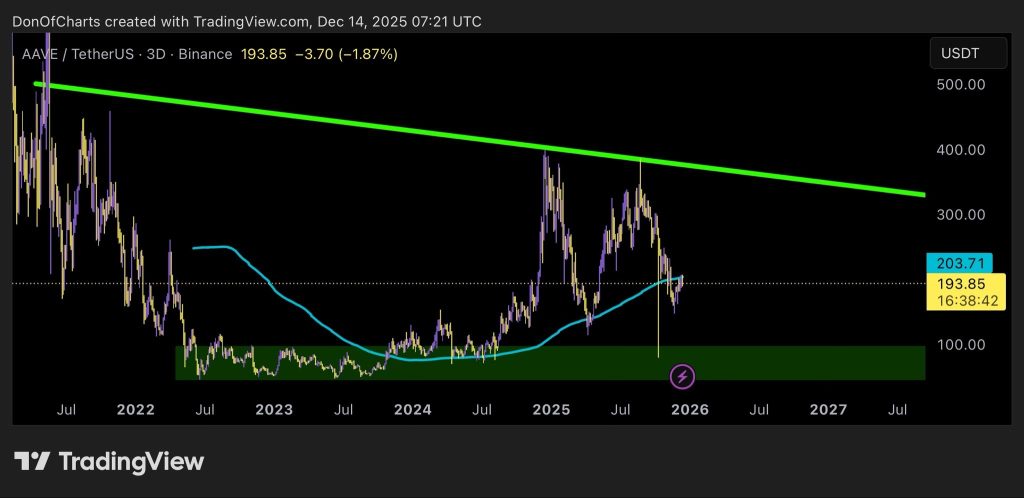

Aave is back in one of those spots where the chart really matters. After weeks of uneven price action, AAVE is now testing the 200-day moving average on the 3-day timeframe.

That level has been a big deal historically. When the price is below it, rallies usually struggle. When price gets back above it and holds, trends tend to change.

Analyst Don pointed out that AAVE is not just fighting the 200MA, but also pushing up against a multi-year descending trendline.

This diagonal resistance has been in place since the 2021 highs and has rejected the AAVE price several times during previous recovery attempts. In other words, this is not a random level. It’s one of those areas where the market decides whether a move is real or just another bounce.

Read Also: Could This Gold Price Spike Be the Catalyst for Bitcoin and Altcoins to Run Next?

AAVE’s Short-Term Price Is Messy, but Not Broken

On the lower timeframes, things are a bit less clean. As More Crypto Online noted, the bounce from last week’s lows is starting to lose momentum and doesn’t look particularly smooth. There are higher lows, but the move hasn’t been decisive. That usually tells you the market is still thinking, not committing.

The good news is that the AAVE price is holding above the $171 support area. This level lines up with key Fibonacci retracements and has already been tested. As long as the price stays above it, the recovery structure remains valid. Buyers are still in the game.

If the AAVE price can stabilize here and slowly build strength, the $230 area becomes the next logical target. That zone has acted as resistance before and would be a real test of whether bulls are serious. On the flip side, losing $171 would weaken the setup and likely open the door for a deeper pullback.

Read Also: Midnight Network Is Live on Cardano, and ADA Suddenly Looks Very Different

So Where Does This Leave AAVE?

Right now, AAVE is sitting in a classic decision zone. Long-term resistance is overhead, short-term structure is still forming, and neither side has full control yet. That’s usually why price action feels frustrating at this stage.

These kinds of setups often resolve with sharp moves once the market finally chooses a direction. A clean breakout above the 200MA and the long-term trendline would be a strong signal that the AAVE price is ready to shift into a new phase. Until that happens, consolidation and volatility are still on the table.

For now, the AAVE chart isn’t screaming breakdown, but it’s not confirming a breakout either. The next few higher-timeframe closes should tell us a lot about whether AAVE is finally ready to leave its multi-year downtrend behind or needs more time to build.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.