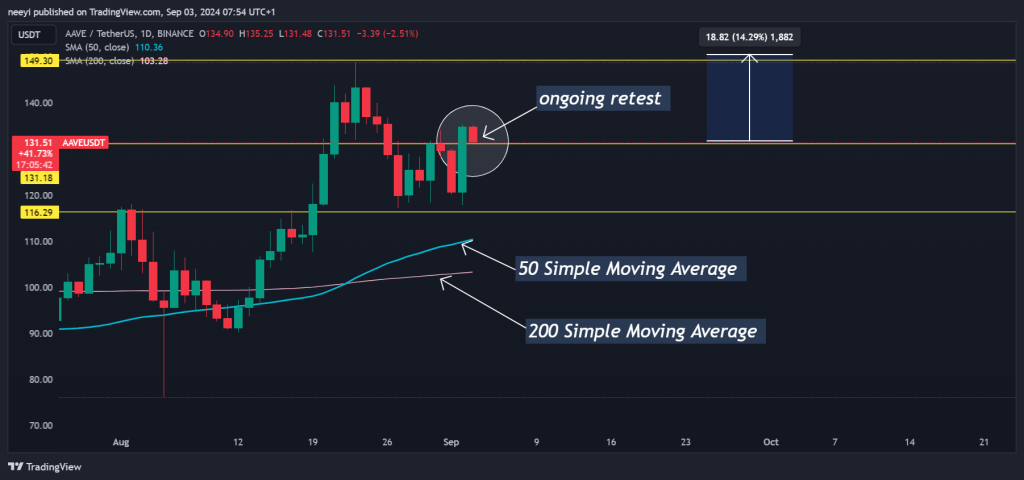

The price of Aave could be ready for a rally as it is seen retesting a key support level on the daily time frame. A successful retest could see the price spike to the last swing high at around $150.

On the monthly timeframe, there is an ongoing breakout from an accumulation zone around the same $131 area. This could be a trigger for a more long-term rally.

Going by the information on the daily time frame, a successful retest of this $131 zone should see a rally toward $150 by the end of this week.

Read Also: Why Is Mantra (OM) Price Up? Analyst Eyes ‘Big Move Soon’

What you'll learn 👉

Indicators Support Bullish Outlook

The relative strength index is looking favorable with a reading of 57. This shows that the price is in the buyer zone and has a lot of room to run before it becomes overbought in the case of bullish spikes.

The 50-day simple moving average is below the price and could potentially serve as support in case of further drops. This position also suggests that the price is bullish in the short term.

Medium-term and long-term 100-day and 200-day simple moving averages are showing a bullish signal but provide more room for the price to retrace in case it continues to drop.

AAVE Broader Price Outlook

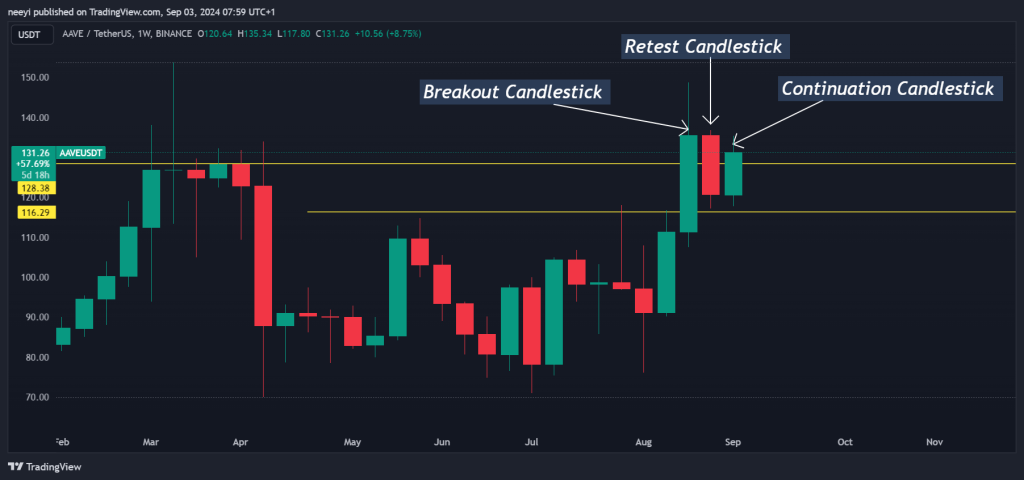

Looking at the Aave price from a broader perspective, the price broke out of a 4-month accumulation zone in mid-August, and this was followed by a spike to the $150 area. Then the price came back for a retest, which also followed about a week of accumulation.

The price broke out from the 1-week-long accumulation yesterday, and a successful restest today should see a continued rise.

Read Also: Is Dogecoin Dead? This Sign Suggests a Potential DOGE Price Rebound Is On The Horizon

The weekly time frame also tells the story better with a breakout candle, a retest candle, and the candle we have already this week is a continuation candle.

If the price goes back into the accumulation zone below $116, this price outlook will become invalid.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.