Santiment’s recent observations highlight promising developments for Aave (AAVE) as it maintains a resilient position in the altcoin landscape.

Source: Santiment – Start using it today

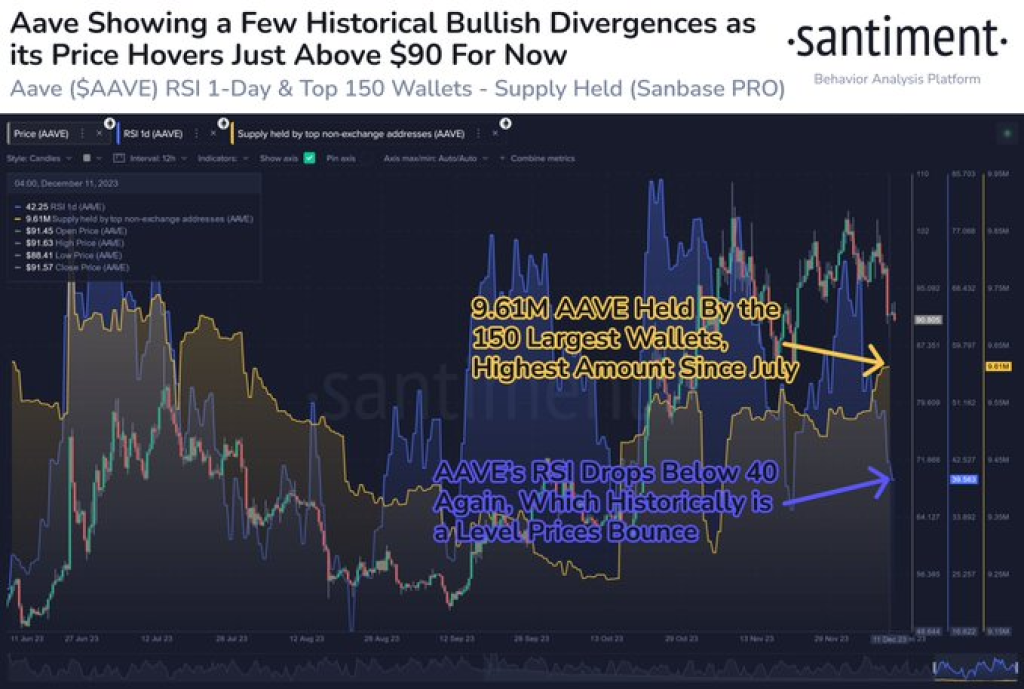

Despite being the 50th-ranked market cap asset, Aave has seen a notable surge in the number of coins held by the top 150 wallets, a trend unseen in the last five months. Concurrently, the Relative Strength Index (RSI) has entered a bounce zone, indicating potential upward momentum.

According to technical analysis firm altFINS, decentralized finance leader Aave shows signs of an impending trend continuation.

altFINS points towards the formation of a bull flag pattern on the charts—a short-term rectangular trading range between two parallel diagonal lines, moving counter to the prevailing uptrend. This often indicates a brief consolidation before the previous rally resumes.

Source: altFINS – Start using it today

With Aave now breaking out above the upper boundary of the flag structure, the measured move target implies additional upside towards $115 based on the height of the preceding advance. Bull flag breakouts reliably signal trend continuation, especially when accompanied by rising volume.

Earlier, Aave bounced after reclaiming its 200-day moving average, a widely-followed indicator of long-term trends. This coincided with a breakout from months of rangebound chop, signaling a bullish trend reversal.

Momentum gauges like the MACD line remain below signal, and RSI is under 45, suggesting room for further gains rather than overextended conditions. Key support sits around $95 and $80 on any retraces.

Read also:

- Binance Coin Forming a Head-And-Shoulders Pattern, Analyst Says a Close Above The Neckline Could Propel BNB To This Level

- Prominent Crypto Trader Shares Bullish Outlook on Bitcoin (BTC), Ethereum, and This ETH Alternative

- Top 3 Cryptos Set to Dominate 2024: Solana, Rebel Satoshi, and XRP

So in summary, Aave appears technically positioned to exit its bottoming formation and continue recovering from the losses as conviction returns among long-term crypto investors. With bearish momentum fading despite market turmoil, the next leg higher looks imminent.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.