ProShares launched the first money market ETF structured to qualify as a reserve asset under the GENIUS Act, creating a new tool for stablecoin issuers, as Ripple’s legal chief met with White House and banking officials to refine stablecoin yield language in the CLARITY Act.

Regulation is no longer something to dread from start to finish, not least because it’s becoming the infrastructure for the next growth cycle. And while that’s the macro scenery right now, DeepSnitch AI bonus codes are pulling in buyers who recognise that presale pricing plus live utility is a rare combination (especially when you can stack more tokens at purchase, ahead of launch).

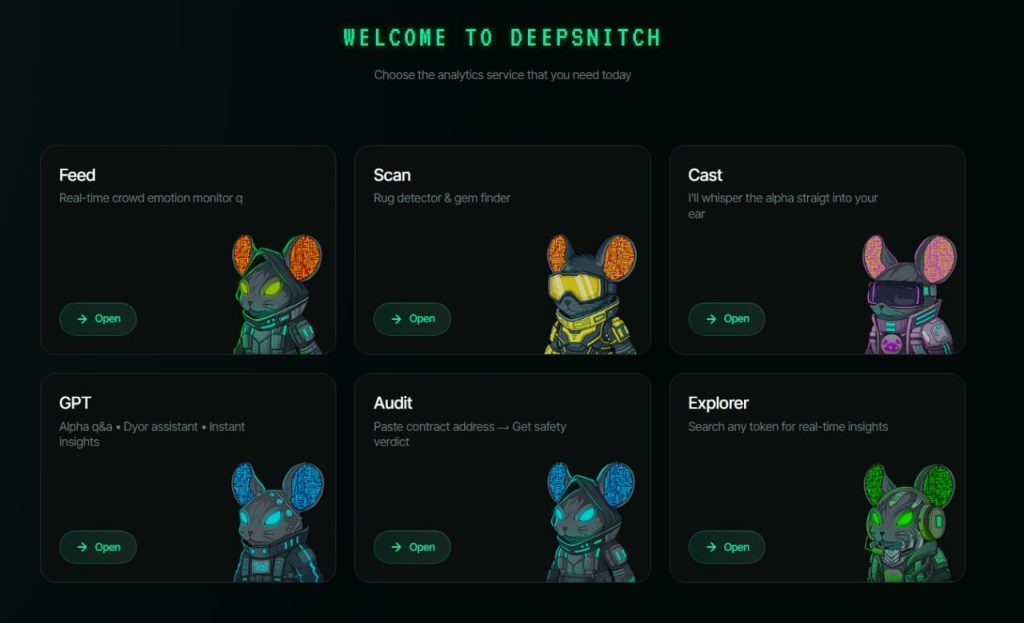

Five AI agents comprise the platform, built by expert on-chain analysts, to compress hours of research into a few clicks, and tokens are at only $0.04064, even as the presale has already drummed up $1.66M.

Launch is around the corner, and while DeepSnitch AI presale incentives reward conviction at every tier, there’s not much time to get involved ahead of what’s set to be a moonshot launch.

What you'll learn 👉

GENIUS Act reserves go institutional, as Ripple brokers clarity at the White House

ProShares’ IQMM ETF began trading this week, investing solely in short term US Treasurys with a floating NAV. It’s structured so stablecoin issuers can hold it as compliant reserves under the GENIUS Act signed into law in July 2025.

And in the same stretch, new SUI staking ETFs from Canary and Grayscale have launched even as CoinMarketCap’s Fear and Greed Index sat at 11 out of 100, so firmly in extreme fear. All this is to say that products are still moving steadily along, regardless of sentiment.

In crypto-relevant politics, the White House is actively brokering stablecoin provisions between crypto firms and banks, trying to narrow the gaps before legislation hardens. Senator Moreno expects the CLARITY Act to pass by April, and Polymarket currently assigns it an 83% chance of becoming law this year. The odds, at least for now, suggest Washington is inching toward resolution.

As clearer rules unlock broader adoption, deeper liquidity, and bigger demand, a presale-stage platform with DeepSnitch AI bonus codes available could compound its value in ways that post-launch entry may not muster.

Regulation builds the runway, as DeepSnitch AI bonus codes could power up the rewards of a 1000x token

1. DeepSnitch AI

DeepSnitch AI’s platform will, come launch (in a matter of days), run five AI agents that handle everything from real-time market scanning to automated contract audits.

To give a feel for what’s on the cards, take AuditSnitch. This is an agent that allows users to paste a token’s contract address and receive a verdict in reply: CLEAN, CAUTION, or SKETCHY. Behind that simple output, it’s inspecting ownership control, liquidity locks, tax structures, transfer restrictions, and known exploit patterns. These are the things that the vast majority of buyers never manually check, delivered in seconds.

There’s an urgent need for this kind of utility, which is exactly why so many believe in DeepSnitch AI’s 1000x potential in the near future. And that need was spotted early on by the expert on-chain analysts who built the platform and had it audited months ago, before shipping the tools internally and proving its power beyond a shadow of a doubt.

As the screenshot here shows, the interface makes the result immediately legible and easy to digest, no technical background required:

That accessibility is what makes the DeepSnitch AI bonus so compelling from an investment angle. The wider the appeal, the larger the adoption base, and adoption is what fuels sustained buying pressure.

At $0.04064, which puts the token up 169% from $0.01510 where it began, with $1.66M raised, it’s still priced well below what a live, audited AI platform with this kind of utility deserves. With a projected moonshot on the cards for early 2026, you’ll want to get involved ahead of that run to make sure you reap the highest possible rewards.

2. Chainlink

LINK’s oracle infrastructure powers the backbone of DeFi; that much hasn’t changed. But as of late February, LINK is at about $8.50, with persistent selling below key moving averages.

With a bearish lean, resistance sits around $8.89 or so, and a breach below $8.50 could open a quick slide toward $8.00. The 200-day SMA is projected to drop toward $12.89 by late March, with a steep overhang that means any recovery needs to fight gravity the entire way up.

3. Hyperliquid

A utility-driven DeFi token can deliver enormous returns, and HYPE has proven that plenty in the past, rushing upwards from under $2 to above $35 in a matter of months. On February 20, it sat near $29.20, up about 1.8% on altcoin rotation.

But CoinTelegraph notes it closed below its 20-day EMA around $30.26, with the 50-day SMA near $27.74 as the next support. Reclaiming $32.50 would unlock the $35-$38 resistance zone, and the RSI at 46 indicates range-bound action for now.

Last word

LINK and HYPE both have the value they bring to the table in this market, whether it is core DeFi infrastructure or a tested utility token model, both of which keep them steady enough. But at their current valuations, neither is positioned for the kind of outsized returns that typically reward early conviction.

And on top of that, regulatory clarity from the GENIUS Act and CLARITY Act negotiations is building a runway where the projects most ready to benefit will look a lot like DeepSnitch AI.

With the public launch just days away and momentum racked up to new heights, DeepSnitch AI has rolled out a tiered investor bonus structure that scales up to 300% for contributions above $30,000. In practical terms, that means significantly more tokens secured before open market trading begins.

That DeepSnitch AI bonus is available now, and this is the kind of moment that doesn’t circle back for a second chance, so be sure to get in as soon as possible if you want to stack tokens and see outsized gains should it make its projected 1000x run in early 2026.

You can get the DeepSnitch AI bonus details and use the DeepSnitch AI bonus codes when you buy into the presale on the official website. And to track more updates and stay in the know, be sure to follow X and Telegram.

FAQs

What is the DeepSnitch AI bonus, and how does it work?

The DeepSnitch AI bonus is a tiered incentive system across the 15-stage presale. Codes multiply your allocation, and because DeepSnitch AI staking runs uncapped dynamic APR, those bonus tokens keep generating additional rewards over time.

How does the GENIUS Act affect crypto in 2026?

The Act sets federal standards for stablecoin reserves, prompting institutional products like ProShares’ new Treasury ETF. Clearer regulation tends to speed up mainstream adoption and deepen liquidity, which are precisely the conditions where DSNT presale incentives have even more value for early buyers, especially with a plausible 1000x run in the cards.

Is Chainlink a good buy in February 2026?

LINK sits below key resistance near $8.89 with its 200-day SMA projected to fall through March. Recovery requires a broader market catalyst, so if the DeepSnitch AI bonus entry opportunity is more your style, the presale’s pre-market pricing and live tooling stand to usher in far higher upside in the near term.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.