A new macro warning is starting to spread fast on X, and this one is coming from well-known analyst Alex Mason who just dropped a major news that could have serious implications for global stocks over the coming months.

The core issue is Japan.

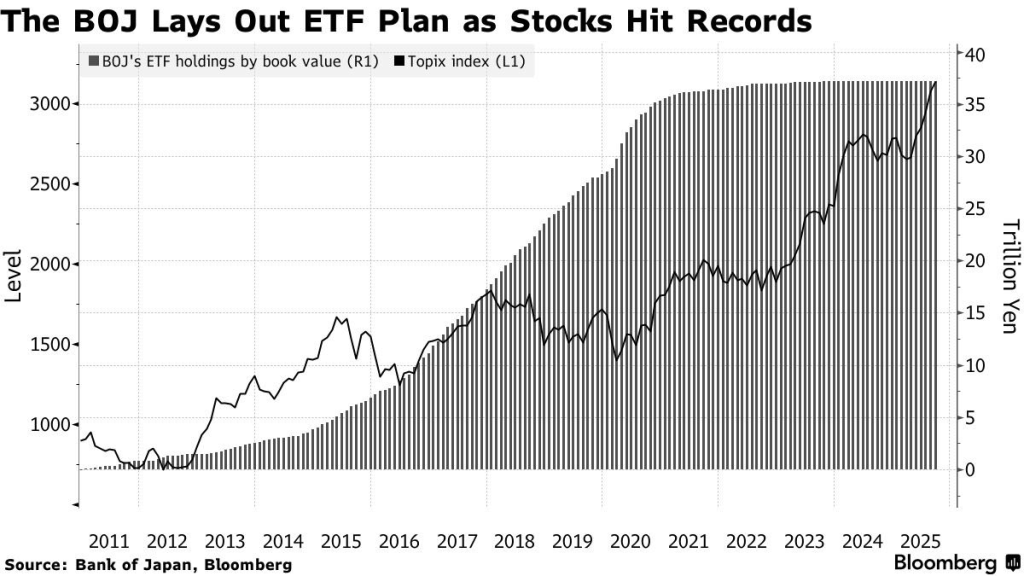

For years, the Bank of Japan has quietly acted as one of the biggest backstops in the equity market, buying stocks indirectly through ETFs. That support has been running in the background for so long that most investors barely think about it anymore.

But Mason points out that the BOJ now holds roughly ¥79.5 trillion in stocks; more than $537 billion worth. That’s not a small position. That’s central-bank-level market influence.

Now comes the part that has markets paying attention.

Japan is reportedly preparing to begin exiting these holdings, potentially starting as early as next month. If that happens, it wouldn’t be a one-time sale. It would introduce persistent supply into the stock market month after month.

And that matters because this isn’t a normal seller.

A central bank selling stocks is a completely different kind of pressure. It changes liquidity conditions, affects sentiment, and forces global investors to reprice risk. Japan is deeply connected to international markets, and Japanese institutions hold massive exposure to U.S. equities as well.

If volatility rises and capital begins rotating out of risk, the effects won’t stay contained inside Tokyo. This kind of move has the potential to ripple across global stocks, tighten financial conditions, and create a new wave of uncertainty.

Mason’s point is simple: the pressure may not explode overnight, but it could build quietly in the background while most market participants aren’t even watching.

And historically, when stocks enter a risk-off phase, crypto tends to feel it too.

If Japan truly begins unloading hundreds of billions in equities, global markets could be heading into a very different environment sooner than expected.

Read also: Silver Price Pattern Reappears on XRP Chart and $7 Suddenly Looks Real

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.