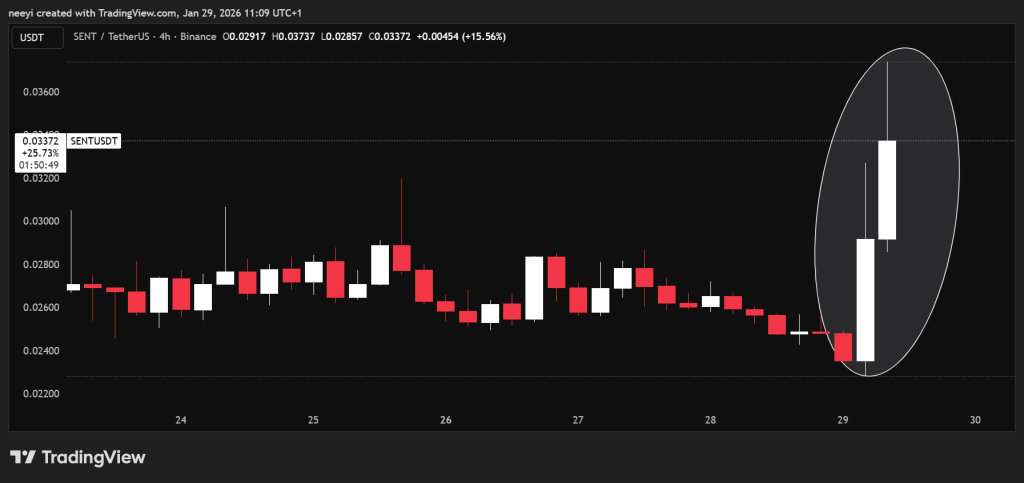

Sentient (SENT) price grabbed attention today after a sharp upside move that stood out against a shaky broader market. Sentient price climbed roughly 50% from an early low near $0.024, snapping a short run of downside pressure that had built over recent sessions. Momentum arrived suddenly, which naturally raised questions about what changed and why buyers stepped in with conviction.

Market structure matters here, since the move did not appear out of thin air. Fresh catalysts lined up within a tight window, giving Sentient a rare combination of visibility, liquidity, and narrative strength all at once.

What you'll learn 👉

Sentient Price Jump Tied To Major Upbit Listing Opening New Retail Access

Sentient price acceleration closely followed a new spot listing on Upbit, South Korea’s largest exchange by volume. Upbit added SENT trading pairs against BTC, USDT, and KRW, with trading going live on January 29 at 8:30 a.m. UTC. That timing matters, because Korean fiat on ramps often introduce a new wave of retail demand once trading opens.

Liquidity depth tends to improve quickly after an Upbit listing, especially for assets that already have awareness outside the Korean market. Sentient SENT benefited from this effect as new participants gained direct access without routing through offshore platforms.

Binance Spot Listing Keeps Sentient Visible Across Global Markets

Sentient price strength today also builds on earlier momentum from a recent spot listing on Binance. Binance added SENT pairs against USDT, USDC, and TRY, labeling the token with a Seed Tag to reflect its early stage status. Visibility on Binance typically expands reach beyond niche trading circles and supports sustained liquidity.

Earlier price appreciation followed the Binance announcement, and that baseline demand did not disappear. Instead, it set the stage for today’s move by keeping Sentient actively traded and widely tracked across major markets.

Clustered Exchange Listings Concentrate Speculative Attention On SENT

Sentient price action also reflects a broader pattern that often plays out during multi exchange rollouts. Several centralized exchanges, including BitMart, scheduled primary listings for SENT around January 22, with deposits and withdrawals enabled in close succession. Listings that cluster within a short timeframe tend to compress speculative interest into a narrow window.

That concentration effect increases volume and short term volatility, since traders respond to multiple access points opening almost simultaneously. Sentient SENT appears to be benefiting from that dynamic rather than from isolated hype.

Franklin Templeton Investment Strengthens Sentient AI Narrative

Fundamental interest in Sentient received a meaningful boost after the project disclosed a strategic investment from Franklin Templeton. The collaboration focuses on high risk AI use cases in financial services and live production environments, positioning Sentient beyond a purely experimental narrative.

Institutional branding of this scale often reshapes how a token is perceived. Sentient price response suggests that market participants are assigning value to the prospect of real world AI deployment rather than short term technical signals.

Read Also: Was Binance the Hidden Trigger Behind the Historic $19 Billion Crypto Wipeout?

Sentient price movement today appears primarily driven by fresh exchange activity and partnership headlines, not by classic technical indicators or chart patterns. Volume expanded alongside new listings, while the AI sector narrative continued to attract attention during a broader period of market uncertainty.

Sentient SENT sits at the intersection of AI themed interest and expanding market access, which helps explain why capital rotated in despite recent weakness. Liquidity improvements and institutional alignment created conditions where buyers felt comfortable stepping in aggressively.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.