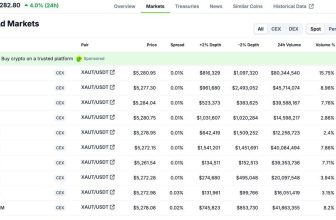

Silver pumped to $120 per ounce for the first time in history, extending one of the strongest rallies the metals market has seen in decades. The move came alongside gold’s push to $5,600 per ounce, another record high, which confirmed that strength is broad across precious metals rather than isolated to a single asset.

From a chart perspective, silver’s structure has been building for months. Throughout most of 2025, price trended higher in a controlled channel, consistently holding above its rising long-term averages. That steady grind higher shifted into a sharp expansion phase late in the year.

Once silver cleared the $90–$100 zone, momentum accelerated quickly, with very little resistance left on the chart. The recent move toward $120 shows a sequence of strong impulse candles and only brief pauses, which indicates demand is overwhelming available supply rather than price being pushed by thin liquidity alone.

Short-term indicators show that strength but also highlight risk. On the 4-hour timeframe, RSI remains elevated, signaling an overbought market. However, there is no clear topping structure yet. Pullbacks have been shallow and short-lived, and buyers continue to step in quickly.

As long as silver holds above the $105–$110 area, the broader trend remains intact. A consolidation in that range would be technically healthy after such a fast run.

Beyond the chart, fundamentals are playing a growing role in silver’s repricing. Industrial demand has reached record levels, now accounting for more than half of global silver consumption. Solar panels remain the largest driver, but demand from electric vehicles, AI data centers, and advanced electronics continues to rise. At the same time, supply constraints have become harder to ignore.

The market is facing its fifth consecutive year of supply deficits, driven by flat mine output, limited recycling, and years of underinvestment in new production. Much of the silver used in industry is consumed in tiny amounts and cannot be economically recovered, tightening the physical market further.

JUST IN: Silver reaches new all-time high of $120 pic.twitter.com/mh4WBv9Rm7

— Watcher.Guru (@WatcherGuru) January 29, 2026

Macro conditions have added fuel to the rally. Sticky inflation, heavy government borrowing, and rising geopolitical risks have increased safe-haven demand. Ongoing U.S.–China trade tensions, instability in the Middle East, and mining disruptions in regions such as Mexico and Russia have amplified concerns around supply security. Fears that silver could face future U.S. tariffs as a critical mineral have also encouraged stockpiling, contributing to rising COMEX inventories.

In the short term, silver may cool off after such a rapid move. A period of sideways trade or a modest pullback would not change the broader outlook. As long as higher lows continue to form, the market remains in control of buyers. The breakout above $100 has shifted silver into a new price regime, and the focus now turns to whether price consolidates before the next advance or continues to grind higher under persistent physical and macro pressure.

Read also: Was the Gold and Silver Crash Engineered? Here’s Why Traders Are Calling It Forced

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.