Tokenized treasury infrastructure keeps drawing attention as traditional finance looks for better ways to move yield bearing assets onchain. ONDO often comes up first in these conversations because of its early presence in real world assets. A different angle is now emerging.

An analyst argues that SEI may quietly be building a stronger foundation for institutions that care about scale speed and long term infrastructure rather than brand recognition.

That view comes from analyst Tanaka, who has repeatedly pointed to recent network upgrades as a turning point for Sei. According to Tanaka, the combination of SEI GIGA Upgrade and SEI Market Infrastructure Grids changes how institutions should evaluate tokenized treasury platforms.

What you'll learn 👉

Institutional Requirements Shape Tokenized Treasury Infrastructure Choices

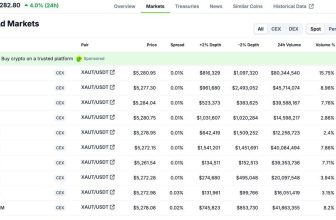

Large financial institutions approach tokenized treasuries with a very specific checklist. Tanaka explains that cost efficiency yield access and exposure to new markets matter just as much as performance. High transaction volume handling also sits near the top of the list because treasury products generate constant flows rather than occasional transfers. Regulatory clarity and risk management follow closely behind.

ONDO has made progress addressing some of these needs through structured products and compliance focused design. Tanaka believes infrastructure capabilities often determine whether a network can support sustained institutional activity without friction.

➥ Why Institutions Prefer SEI for Tokenized Treasury Infrastructure

— Tanaka (@Tanaka_L2) January 28, 2026

I’ve mentioned multiple times the SEI GIGA Upgrade and the SEI Market Infrastructure Grids, and how they shape the broader @SeiNetwork ecosystem.

But the biggest highlight of these two upgrades is this:They… pic.twitter.com/ajJLBzkdHF

SEI GIGA Upgrade Improves Settlement Speed And Market Efficiency

Transaction speed and finality remain core concerns for tokenized treasuries. Tanaka highlights that SEI delivers roughly 400ms finality following recent upgrades. Parallel execution and performance improvements allow continuous settlement without congestion during peak demand.

Fast settlement supports real time treasury operations across time zones. Institutions managing large portfolios need infrastructure that operates around the clock without delays. Tanaka notes that this performance profile positions SEI as a network capable of supporting institutional settlement expectations at scale.

SEI Market Infrastructure Grids Support Security And Compliance Needs

Security and governance matter deeply when treasury assets move onchain. Tanaka points out that SEI includes multiple concurrent proposers which reduce censorship risk while maintaining network stability. Validator distribution across regions improves resilience and global performance.

Optimized storage for complex asset metadata also plays a role. Tokenized treasuries often require detailed compliance records and legal references. Tanaka views this design as aligned with how regulated financial products operate rather than simplified retail assets.

Read Also: Hyperliquid Just Beat Binance at Its Own Game – Here’s Why HYPE Repriced Fast

Actual deployment often speaks louder than theoretical advantages. Tanaka references ONDO launching USDY on SEI as an important signal rather than a contradiction. Additional partnerships involving BlackRock linked funds through KAIO_xyz and Securitize expanding institutional platforms onto SEI reinforce this view.

High throughput capacity also supports this adoption trend. After SEI GIGA, network throughput can reach up to 200000 TPS, allowing treasury products to scale without structural bottlenecks. Tanaka argues that this combination of speed security and adoption creates an infrastructure profile institutions tend to favor when planning long term tokenization strategies.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.