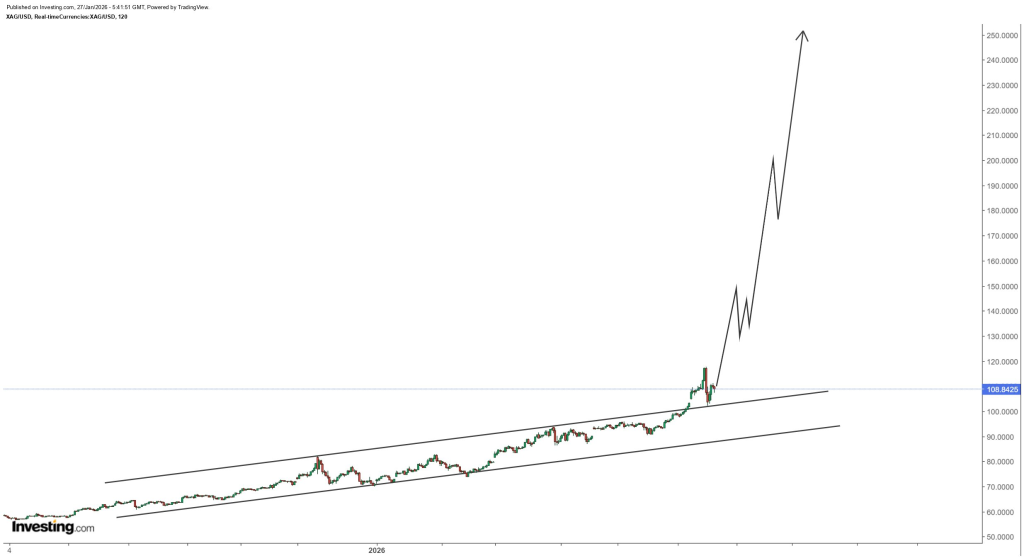

Popular investment analyst Rashad Hajiyev has made a bold silver price forecast, and argued that the metal could pump to at least $250 over the next three to four months. Alongside his claim, he shared a chart showing silver breaking out of a long rising channel and entering what he describes as the steep phase of a major bull run.

On the chart itself, the structure is pretty easy to understand. Silver has been trending higher for a long time inside a rising channel, respecting both support and resistance with impressive consistency. Recently, price pushed above the upper boundary of that channel near the $108 level, which is technically a bullish signal and often interpreted as the start of a faster acceleration phase.

Hajiyev’s projection assumes that this breakout will not only hold, but also turn into a parabolic move. His target path indicates a rapid and increasingly vertical rally, similar to what has been seen in historical blow-off phases in commodities, where price action becomes disorderly and driven more by positioning and fear than fundamentals.

From a technical perspective, the breakout itself is real and cannot be ignored. A sustained move above the channel does open the door for higher prices, especially in a market already dealing with tight physical supply, strong investment demand, and rising global interest in silver as both a monetary and industrial metal.

That said, a move from roughly $108 to $250 in just a few months would require an extreme acceleration that is rarely seen outside of crisis conditions. For silver to double in such a short window, the market would likely need a major external shock, such as a currency event, a sudden collapse in bond markets, or a severe disruption in physical supply chains.

Another issue is scale. As prices rise, liquidity naturally improves and profit-taking increases, which tends to slow vertical moves rather than fuel them endlessly. Even during recent silver’s historic rally, which was one of the most aggressive in modern history, the climb was sharp but still unfolded over a longer time frame with pullbacks along the way.

The miner projections also deserve a reality check. Even though it is true that silver miners benefit disproportionately from rising prices due to operating leverage, expectations of small caps going up five to ten times in a few months lean heavily into speculation rather than typical market behavior. Those kinds of moves usually happen later in a cycle, after price has already spent time building confidence at higher levels.

In short, Hajiyev’s chart captures a real and powerful trend, and silver does appear to be in a strong bullish phase. However, the idea of a near-term sprint to $250 feels far more like a late-cycle target than something that realistically plays out over the next three to four months without a major macro trigger.

Silver may well continue higher, and the bull case remains intact. But expecting it to double almost immediately risks confusing momentum with inevitability, which is something markets are very good at punishing.

Read also: Gold and Silver Rally Sends Fresh Signals Pointing Toward Crypto Altseason

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.