The uranium market is setting up one of the most asymmetric commodity trades of the decade. While most investors remain focused on gold, copper, or oil, uranium is developing a structural imbalance that looks far more severe, and far more persistent.

Two recent posts captured the scale of what’s building under the surface. One came from macro analyst Lukas Ekwueme, the other from market trader Bluntz. Together, they tell a story that goes well beyond short-term price moves.

What you'll learn 👉

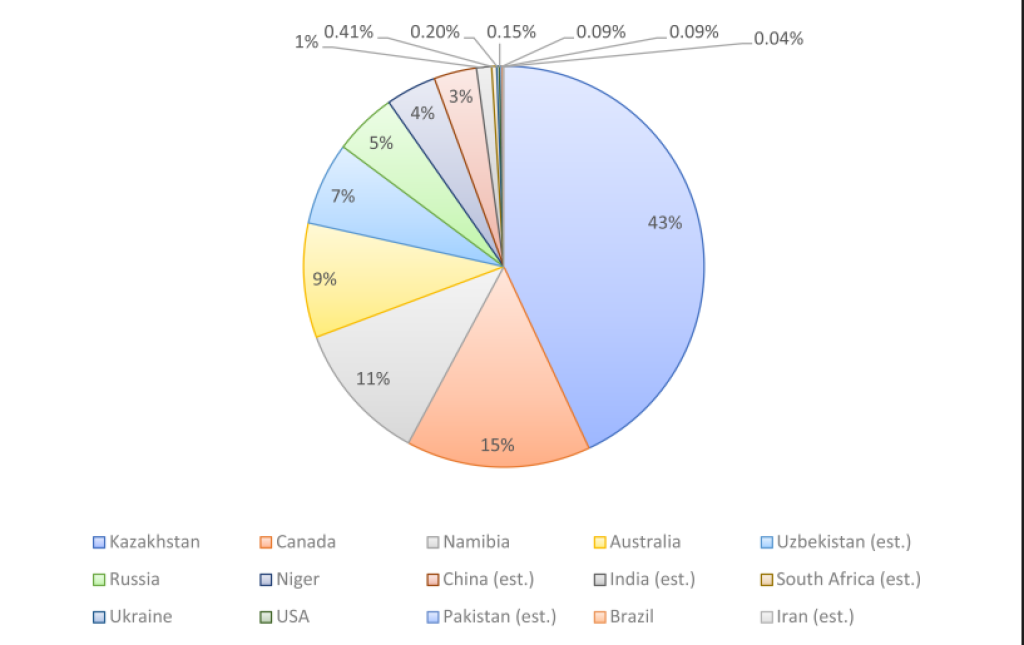

Lukas Ekwueme: A Market Controlled by Just Two Countries

Lukas Ekwueme highlighted a fact that instantly changes how you view uranium supply: nearly 60% of global production comes from just two countries; Kazakhstan and Canada.

Kazakhstan alone accounts for roughly 43% of total output, while Canada contributes about 15%. That level of concentration would already be uncomfortable for any critical resource. But the real problem is what happens next.

Existing Kazakh mines are projected to lose close to 80% of production over the next 20 years. At the same time, global uranium demand is expected to double, driven by:

• Nuclear restarts in Europe and Japan

• Small modular reactor deployments

• Rising electricity demand from AI and data centers

• Energy security priorities replacing “cheap gas” narratives

In simple terms, supply is shrinking from the very region that dominates the market, just as demand enters a structural uptrend.

This is not a typical commodity cycle where higher prices trigger fast new production. Uranium mines take a decade or more to permit, finance, and build. The market cannot respond quickly.

That’s why Ekwueme called it structurally broken, And he’s right.

Bluntz: The Deficit Is Embedded

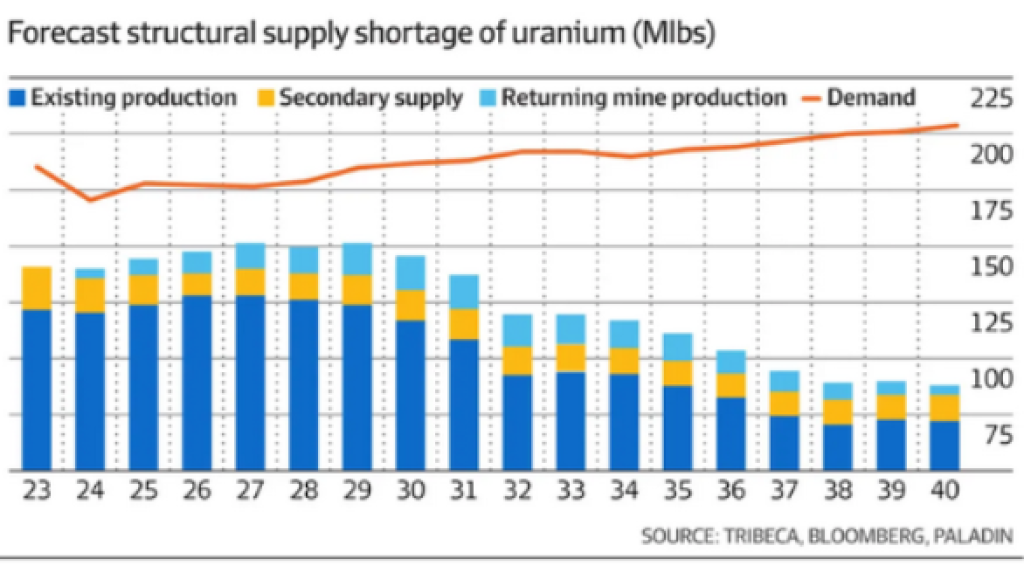

Bluntz, better known in crypto circles, shared the second chart showing forecast uranium supply versus demand through the late 2030s.

What stands out is not just a shortfall, but a persistent, widening gap:

• Existing production declines steadily

• Secondary supply fades

• Demand rises year after year

• Even returning mines fail to close the gap

This is a long-duration structural deficit.

The chart shows uranium demand moving toward ~225 million pounds annually while projected supply struggles to stay near ~110–120 million pounds. That is a systemic one.

And that’s why Bluntz framed it as a potential 10-year bull market, not a hit-and-run trade.

Once utilities are forced to compete for long-term contracts in a supply-starved market, price dynamics shift violently. History already showed this during previous uranium cycles, but this setup is far more constrained.

Read also: Is Crude Oil Price About to Repeat Its Most Explosive Pattern from History?

Why This Setup Is Different From Past Cycles

What makes today’s uranium market unique is that the supply side is no longer flexible.

In past cycles:

• Idle mines could restart faster

• Governments carried larger inventories

• Nuclear demand was politically unstable

Now:

• Most spare capacity is gone

• Inventory buffers are thin

• Nuclear energy is being repositioned as a strategic necessity

• Climate and grid stability goals demand baseload power

This combination removes the “release valve” that usually prevents prolonged commodity shortages.

At the same time, geopolitical risk adds another layer. A market dependent on Kazakhstan and Canada is vulnerable to political pressure, logistics disruption, and regulatory shifts; all of which amplify price volatility when physical shortages appear.

Read also: India Goes All-In on Silver as Metal Stocks Explode to 11-Year Highs

Is This Really a “Time Bomb”?

Yes, because uranium is not consumed like oil or gas.

Once a utility locks in fuel supply, it doesn’t speculate or delay purchases. Nuclear plants cannot shut down easily. They must secure uranium regardless of price once supply tightens.

That creates forced buying; the most powerful driver in commodity markets.

When utilities realize that future supply is insufficient, they will rush into long-term contracts, not spot markets. And that is usually when price repricing accelerates sharply.

This is why uranium tends to move in violent, compressed cycles rather than slow grind-ups.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.