Silver has been on a relentless run, and it is no longer just another commodity story. With prices now trading around $90 per ounce, the metal is popular for reasons that go far beyond simple supply and demand.

Two major research perspectives are now shaping the debate around where silver could go next: one rooted in long-term monetary valuation, and the other driven by geopolitics and market behavior during global stress. Together, they paint a picture of a market that may still be far from finished.

Let’s break down what both are saying and what the charts reveal.

What you'll learn 👉

Katusa Research: Why Silver Could Be Massively Undervalued

The first bold outlook comes from Katusa Research, which argues that silver is mispriced when viewed through a monetary lens rather than a trading one.

Their key point is simple: silver has not kept pace with the expansion of the global fiat money supply.

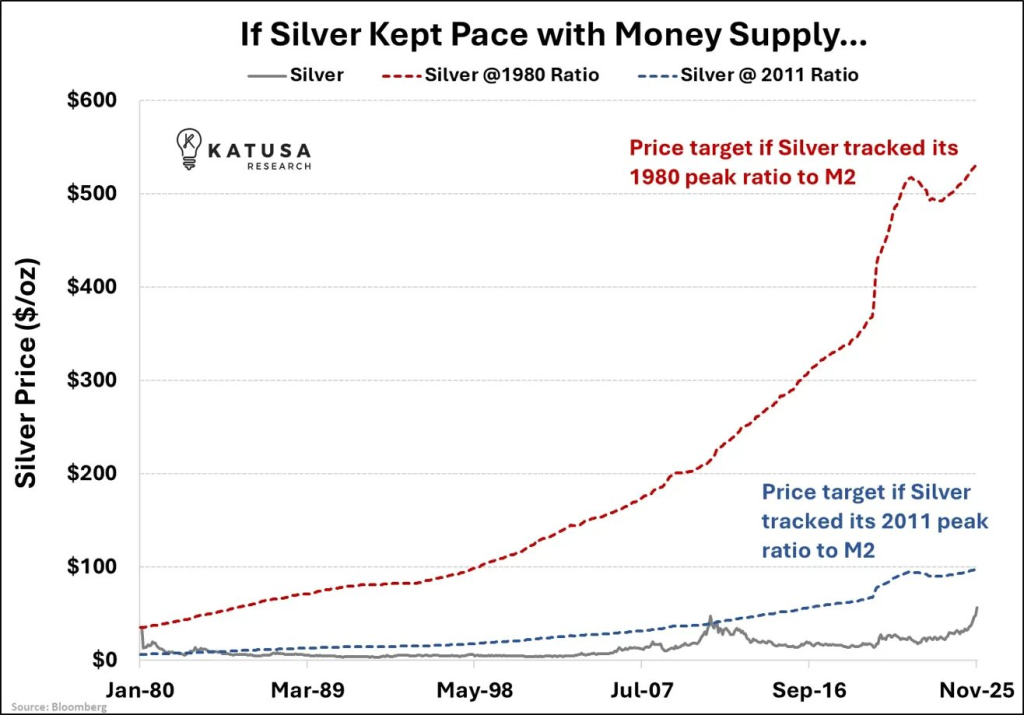

Looking at the first chart, Katusa compares silver’s price to the growth of M2 money supply over several decades. Two reference scenarios stand out:

If silver merely tracked its 2011 peak ratio relative to money supply, the fair value would sit around $97 per ounce. That is almost where the market is now, suggesting silver has only just caught up to its post-financial crisis valuation.

But the more dramatic scenario comes from the 1980 ratio. If silver returned to the same relationship with money supply that it had during its historic peak in 1980, the implied price would be around $531 per ounce.

That is not a short-term forecast, but a structural valuation argument. In other words, if silver fully repriced to reflect decades of currency debasement, current prices might still be considered low in real terms.

What makes this view interesting is that it does not rely on speculative demand. It is based purely on how much fiat currency exists today versus how little silver there actually is.

In that context, silver’s move above $90 looks less like a blow-off top and more like a delayed adjustment.

Read also: Silver Price Shock: Why Massive Bank Shorts Could Trigger a Market Crisis

Kobeissi Letter: Why Silver Is Winning the Safe Haven Race

The second prediction comes from The Kobeissi Letter, which frames silver’s rally through the lens of global instability rather than valuation metrics.

Their argument is built around performance and macro behavior.

Silver just posted its best annual gain since 1979, rising 148% during 2025, a year dominated by trade wars, bond market stress, and rising geopolitical risk. In contrast, bonds have been getting crushed and crypto has remained highly volatile, making traditional safe havens attractive again.

The second chart highlights how silver has reacted to major geopolitical events.

You can clearly see how each wave of trade tension pushed prices higher:

In January 2025, when Trump began tariff threats, silver started breaking out of its base.

In April, during “Liberation Day,” silver consolidated but held firm.

By August, following the US-China trade deal, silver surged again.

Then in October, after Trump threatened 100% tariffs on China, silver accelerated sharply.

Now, with renewed pressure linked to Greenland and European tariffs, silver has exploded toward $90.

What stands out is that silver has not been reacting randomly. Each major geopolitical shock has led to a higher base and a stronger rally. This suggests silver is being treated increasingly as a strategic asset rather than just an industrial metal.

Kobeissi’s conclusion is straightforward: in a world with more uncertainty, less stability, and fractured global trade, gold and silver naturally benefit. And silver, with its smaller market size and dual role as both monetary and industrial metal, tends to move faster.

How the Two Views Fit Together

What makes these predictions especially powerful is that they are not contradictory. They complement each other.

Katusa shows that silver is undervalued relative to the monetary system.

Kobeissi shows that silver is already behaving like a crisis hedge.

One argues that silver should be much higher in theory. The other shows that in practice, capital is already flowing into it for protection.

When valuation and capital flow narratives align, markets often move more aggressively than expected.

That does not mean silver is going straight to $500. Markets never move in a straight line. Corrections, pullbacks, and sharp volatility should be expected at these levels. But it does suggest that the long-term ceiling for silver might be far higher than most investors currently assume.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.