Cryptocurrency security breaches rarely happen silently due to the magnitude of losses they cause. They arrive with users crying over frozen balances, drained wallets, and a brutal realization that self-custody does not automatically mean safety.

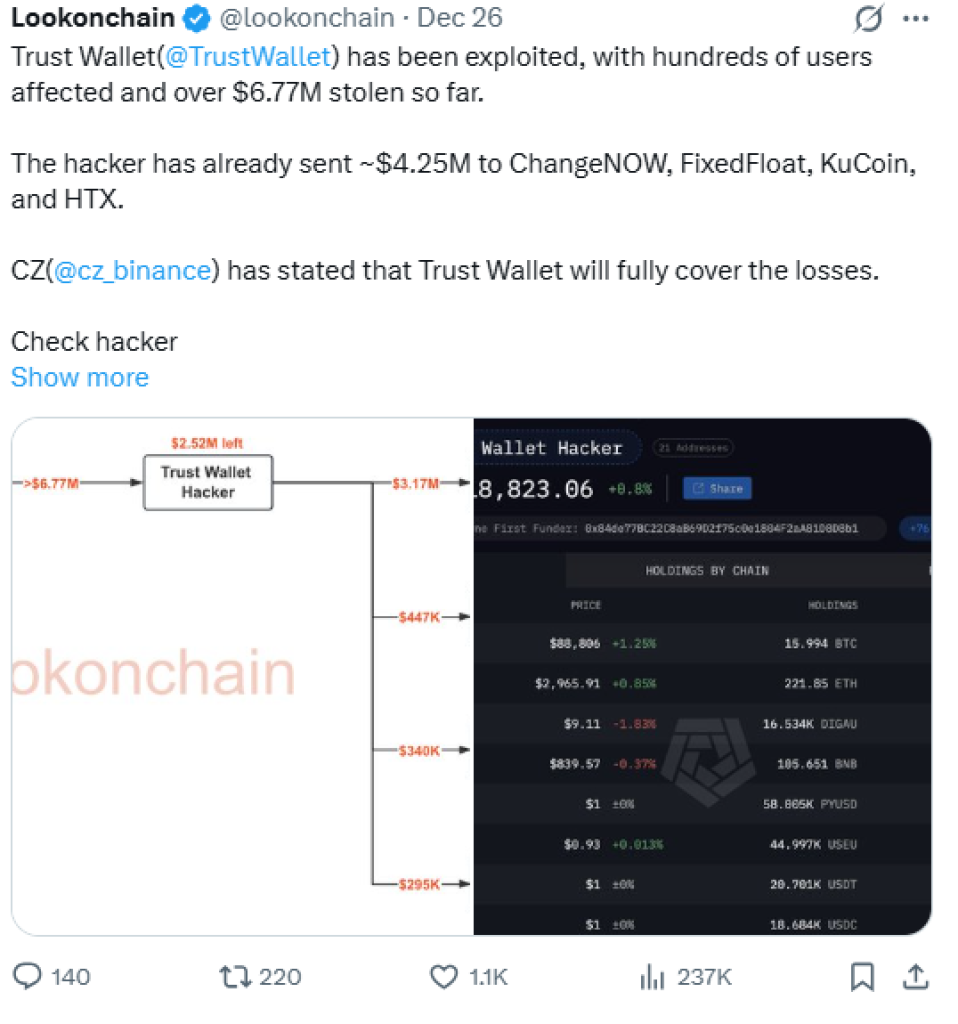

The recent Trust Wallet Chrome extension breach resulted in $7 million in user losses. The attack is a huge reminder that usability layers can become the weakest link in the crypto sector. Investors have turned to platforms designed for controlled interaction and real-world spending as confidence in browser-based wallets drops.

Digitap ($TAP), an omni-bank ecosystem, is gaining favor among investors in the current environment. Users prefer the platform because it is designed to make crypto spendable, secure, and reward-driven. Moreover, it reduces the time users must spend approving external connections, exposing their wallets, and relying on browser-based tools to transact.

The integrated banking rails that comprise Digitap’s network reduce attack surfaces while supporting daily financial transactions. These features make $TAP one of the best altcoins to buy despite being in its crypto presale phase.

What you'll learn 👉

Inside the Trust Wallet Chrome Extension Breach

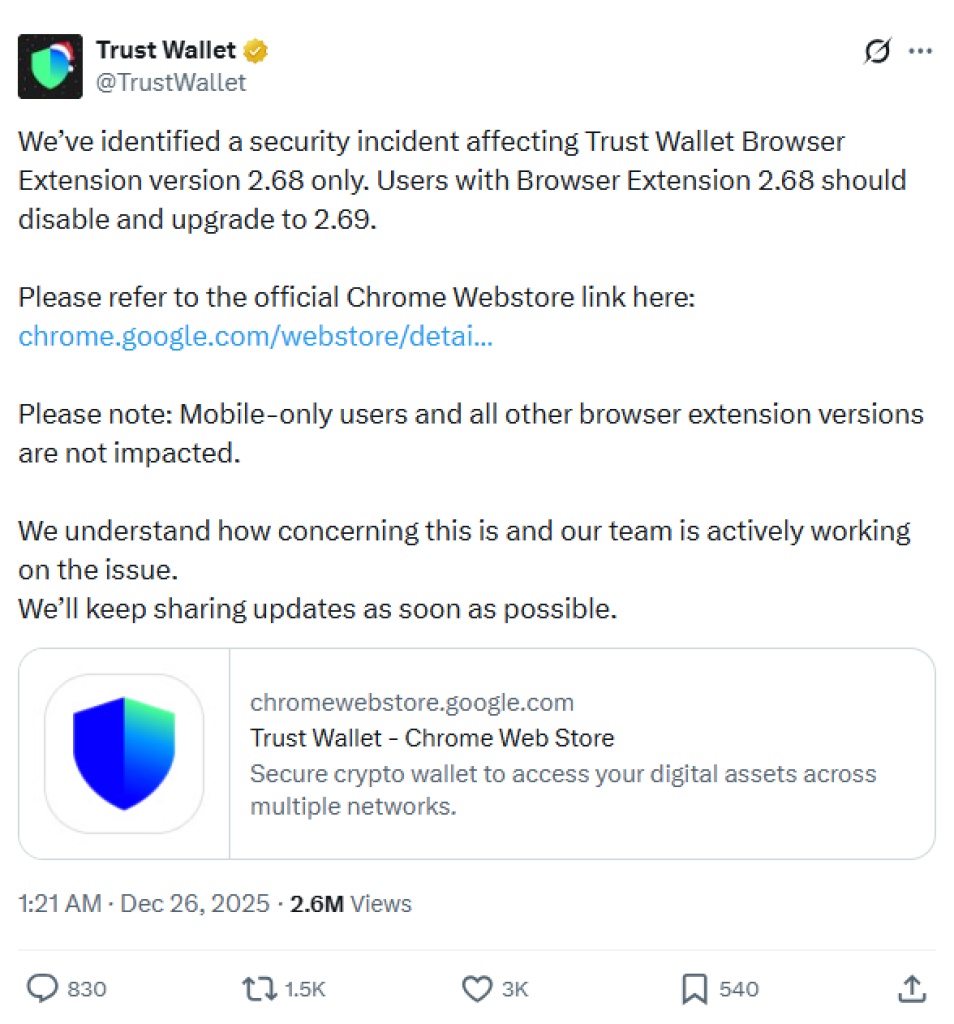

The attack was executed on Trust Wallet’s Chrome extension version 2.68. The extension shipped with a malicious code designed to continuously extract mnemonic phrases from wallets hosted within this platform.

Once users unlocked their wallets using their password or passkey, the encrypted seed phrases were decrypted and sent to an attacker-controlled server.

Security firms later highlighted that the hack did not happen due to a compromised third-party dependency. It was caused by a direct modification of Trust Wallet’s internal analytics logic.

This revelation matters because it shows that even reputable and widely used wallet providers can be hit hard by hackers if deployment controls fail.

Browser Extensions Have Become a Major Crypto Security Risk

Browser extensions are at the center of convenience and vulnerability. They are extensively connected, updated often, and deeply merged with user workflows. Although this intersection makes them powerful tools, it also makes them attractive targets to hackers.

In this Trust Wallet case, hundreds of users were hit across Bitcoin, Ethereum, and Solana. Funds were sent rapidly via centralized exchanges and cross-chain bridges, making recovery highly challenging despite public tracking.

Although Trust Wallet has promised to refund all affected wallets, the damaged user confidence is hard to repair. This hack proves that the more often users interact with wallets across many dApps, sites, and extensions, the bigger the cumulative risk.

Since Digitap enables users to access many services on its platform, it reduces the risk of overexposure to hackers. This component increases its popularity in the market, making $TAP a good crypto to buy today.

The Hidden Cost of Constant Wallet Interactions

The current crypto culture encourages continuous wallet interaction, which involves: sign here, connect there, approve another transaction. Each of these actions grows the attack surface, and over time, convenience gradually erodes security.

For users who prefer spending crypto, earning rewards, or holding assets long-term, this model is becoming inefficient. The Trust Wallet breach was not caused by reckless behavior; it targeted routine usage. This strategy is what makes it highly devastating.

On that note, many users now wonder whether always-connected wallets are the perfect tools for their daily financial transactions. This shift in sentiment explains why banking-style crypto platforms like Digitap are growing in relevance. Instead of encouraging continuous and massive wallet exposure, they aim to internalize common transactions within a controlled environment.

No investor likes risking their money investing in risky environments. Digitap took precautions and made its platform impenetrable by undergoing Solidproof and Coinsult audits. This move has increased investors’ confidence in the project, boosting $TAP’s crypto presale demand.

Digitap Reduces Wallet Exposure Through Design

Digitap approaches crypto usage from an entirely different angle. Being an omni-bank ecosystem, it is built to internalize spending, staking, rewards, and transfers within a controlled environment. Instead of needing users to continuously authorize external connections, Digitap’s banking network aims to reduce unnecessary interactions.

This operation model matters since security is normally less about perfect defenses and more about minimizing the frequency these defenses are tested. By making crypto usage simple, Digitap minimizes the opportunities hackers rely on.

Fewer prompts are a highly ignored security improvement feature since every signature request is a possible failure point. These requests could open the door for malicious updates, phishing, or compromised interfaces.

Digitap prioritizes spending and staking flows that do not need constant wallet connections to unfamiliar platforms. Integrated payment tools, cashback spending, and native staking options enable users to operate within one ecosystem instead of logging into multiple dApps consecutively.

Why Digitap’s Omni-Bank Model Makes $TAP a Crypto to Buy

Digitap’s omni-bank ecosystem integrates crypto ownership with real-world utility. It focuses on payments, cashback spending, and asset management. Digitap merges everything without browser extensions. Therefore, this model helps reduce exposure to hackers.

Interestingly, Digitap focuses on spending. Users can spend crypto in daily transactions like cash through the Visa card feature, which is embedded into its ecosystem. They do not need to approve transactions manually across many apps. Hence, this reduces the frequency of sensitive wallet interactions.

Instead of signing smart contracts, copying addresses, or interacting with unfamiliar sites, investors operate within one ecosystem. Less touchpoints mean less exploitation opportunities, the weakness exposed by the Trust Wallet breach.

Therefore, $TAP is a good crypto to buy since its omni-bank ecosystem reduces the chances of hackers compromising its network.

Investors Are Shifting Toward Digitap’s Predictable Infrastructure

Security incidents reshape investor behavior. The Trust Wallet breach came when users were growing wary of over-permissioned wallets, centralized exchanges, and opaque infrastructure. As trust in the market weakens, investors are turning to systems that feel boring, predictable, and safe.

Payments and banking-focused networks are thriving in this environment since they promise stability instead of subjecting users to continuous experimentation. Digitap is perfectly positioned to benefit from this moment since it does not have market complexity. Instead, it focuses on daily reliability by making crypto spendable.

The Trust Wallet incident will not be the last attack in the crypto space. With crypto relying on fragmented tools integrated by users, security incidents will persist. The industry’s long-term response could be to consolidate multiple functions into one ecosystem, reducing opportunities for hackers to attack.

Any platform that integrates crypto transaction complexity without compromising user control will benefit. Digitap’s banking rails represent the evolution, building a model that makes crypto operate like cash in the real world. This capability increases $TAP’s growth potential, making the token one of the best altcoins to buy in 2026.

Digitap’s Year-End Incentives Are Driving Presale Momentum

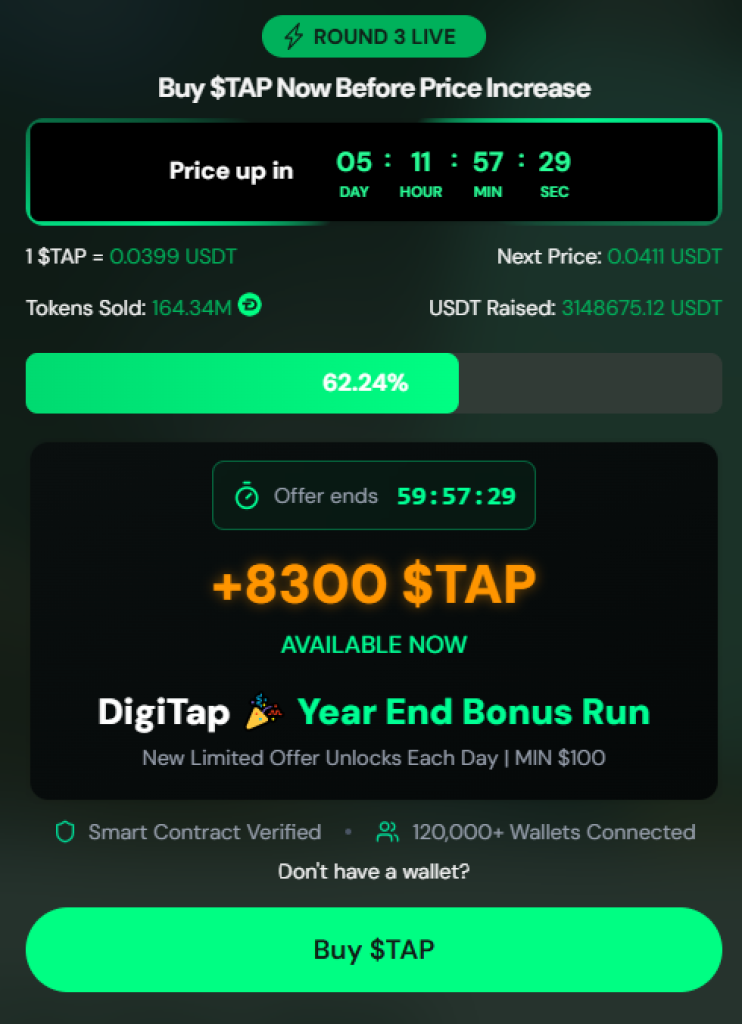

Digitap is offering buyers various rewards in a year-end holiday sale. This campaign gives investors another opportunity to access lucrative $TAP deals. A new mini-offer is introduced on the Digitap presale platform every day.

These rewards are exclusive, and some disappear within a short time. Users are required to link their $TAP wallet and explore the crypto presale platform daily to access the offers. With the Digitap omni-bank already active and offering increased security, the project could thrive in the coming cycle.

Digitap’s Crypto Presale Offers a Secure Early-Stage Entry

Digitap’s crypto presale offers a perfect and secure entry point into the industry. Currently, the $TAP token is selling at $0.0399, a 71.5% discount from its launch value of $0.14. The project has a fixed pricing model that increases with each round.

Therefore, early buyers are served with an in-built equity buffer. More than 120,000 wallets have already been connected to the presale dashboard, and over 164 million tokens have been sold. In that context, the project has raised over $3.1 million.

Trust Wallet Breach Accelerates Demand for Digitap’s Omni-Bank

The $7 million Trust Wallet hack is a huge signal showing where the current wallet models struggle under real-world usage. With such incidents, users are looking for other safer ways of interacting with crypto.

As focus turns to safe and simple methods of spending and staking digital assets, omni-bank ecosystems like Digitap are thriving. In a space where trust is weakening, minimizing exposure may become as important as transaction speeds or chasing yields.

With the New Year coming up, smart investors are moving toward platforms that make crypto safer and spendable in the real world. Digitap fills this gap perfectly, making $TAP one of the best cryptos to buy today.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale | Website | Social | Win $250K

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.