Aave might be getting close to a short-term turning point. After a sharp sell-off, AAVE has started to slow down near key support levels, and a fresh technical signal is now catching traders’ attention.

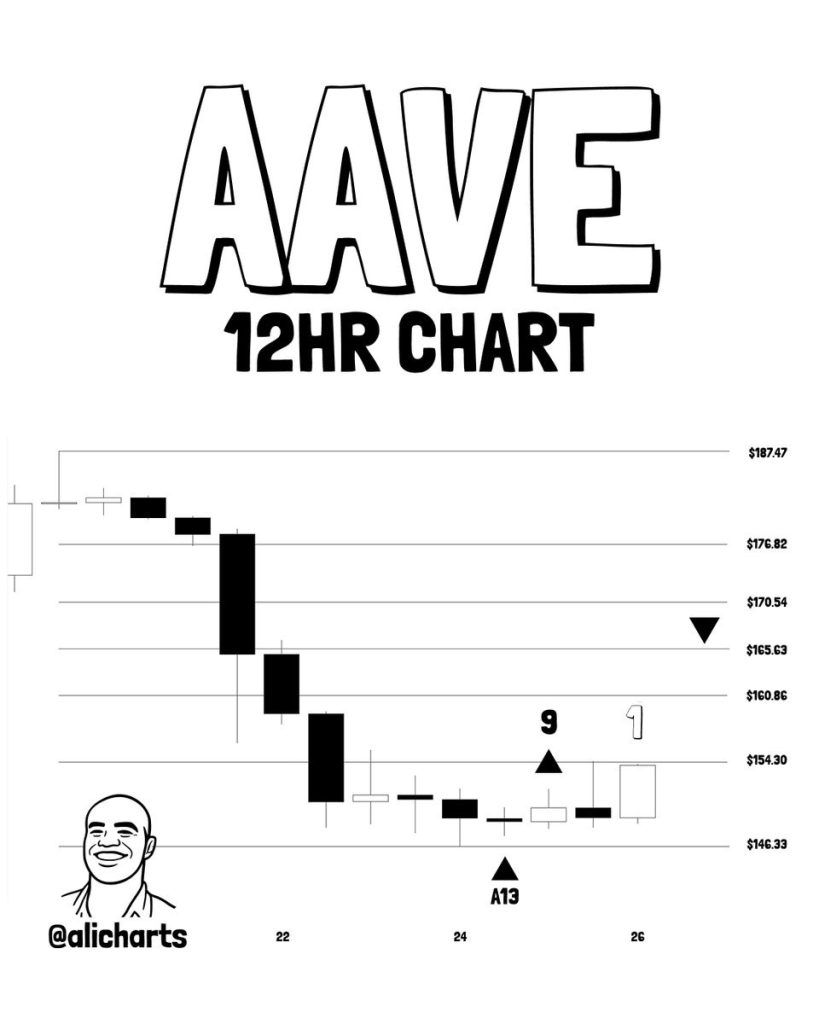

According to Ali Charts, the TD Sequential indicator has flashed a buy signal on the 12-hour chart. That doesn’t mean price is about to rip higher right away, but it often shows up when selling pressure begins to fade and a bounce becomes possible.

What you'll learn 👉

What This Buy Signal Is Telling Traders

The TD Sequential is meant to spot areas where trends start to run out of steam. In AAVE’s case, the signal appeared after several strong bearish candles pushed price lower. When that happens, it often indicates sellers are losing momentum, at least in the short term.

Taking a look at the chart, we can see that the AAVE price has been oscillating in the $146–$150 range. Rather than moving further southward, there has been a pause in the action.

Typically, this kind of behavior translates to a lack of decision-making as opposed to panic, making this signal unique. However, signals alone are never sufficient. Confirmation from Price is required within this context.

Read Also: Aave (AAVE) Has $50B in Deposits, but Borrowing Is Down 70% – What’s Going On?

Why $154 Matters So Much for AAVE Right Now

Ali pointed to $154 as the key level in this setup. That the price of AAVE is just above the recent range where there was a period of consolidation and is at a spot where sellers had intervened before. It would be a clear indication that buyers are taking over if AAVE is able to move above $154 and sustain it.

If that happens, the next area to watch is around $165. That level acted as support before the drop and could now turn into resistance on a rebound. Reaching it would mark a solid recovery move from the recent lows. Until $154 is reclaimed, though, AAVE is still in recovery mode, not a confirmed uptrend.

The Bigger Picture Still Needs Improvement

While the buy signal is encouraging, the broader trend is still fragile. The AAVE price remains well below its recent highs, and the previous downtrend hasn’t been fully reversed. That means any upside move could stall quickly if buyers don’t show up in force.

A short pullback or sideways movement wouldn’t be a bad thing here. Holding above the $146–$148 zone while slowly building higher lows would actually strengthen the setup.

Volume will be important too. A breakout above $154 with solid volume would make the move toward $165 far more convincing.

What to Watch Next for AAVE

Right now, AAVE feels like it’s at a decision point. The TD buy signal hints that selling pressure is easing, but the price still has work to do. If buyers manage to push above $154, the recovery could gain momentum toward $165.

If that level doesn’t break, the AAVE price may continue chopping sideways as the market waits for a clearer signal. Either way, this is a zone where risk and opportunity are starting to balance out again for AAVE.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.