Aster (ASTER) entered the market with momentum and confidence. The project launched in mid-2025 after Astherus and APX Finance merged into a unified Aster platform, centered on a next-generation decentralized perpetual exchange. The platform combines leveraged derivatives trading with yield-generating products across multiple blockchains.

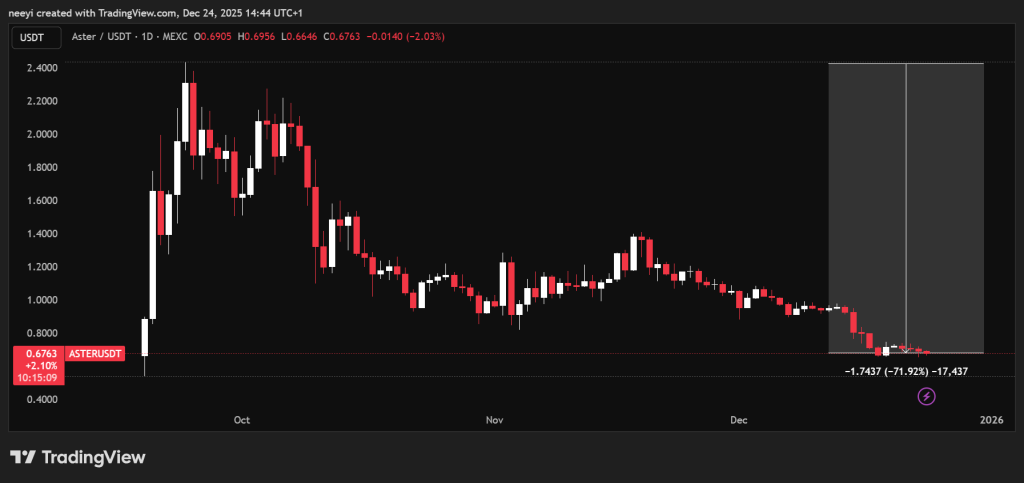

That setup quickly caught attention. ASTER price began rising steadily, and analyst MASTR later pointed out that the early structure looked clean rather than chaotic. Momentum built fast. Within a few days in September, ASTER climbed more than 250%, reaching a high near $2.4. The move appeared controlled and orderly. Then the structure gave way.

What you'll learn 👉

ASTER Momentum Looked Healthy Before The Breakdown

Before the sharp reversal, ASTER was not flashing obvious warning signs. According to MASTR, price action showed continuation rather than exhaustion. Liquidity remained active, and the post-merger narrative gave traders a clear framework to follow.

Projects often fail quietly but ASTER did not. The token was moving with intent, supported by a broader derivatives narrative and growing visibility. That context matters because what followed did not resemble a natural cooling phase.

The turning point came around 10/10. MASTR highlighted that Binance printed price lows that were statistically impossible compared to other major exchanges. More than 100 trading pairs deviated by over 10%. Several pairs showed gaps between 50% and 100%. Some exceeded that range entirely.

Those deviations appeared at the same moment across unrelated assets. No major news triggered the move. No macro event explained the timing. MASTR stressed that retail activity could not cause hundreds of pairs to misprice simultaneously. The pattern pointed to thin liquidity combined with centralized pricing dominance.

Well. Crypto is broken.

— MASTR (@MastrXYZ) December 23, 2025

Criminals run price discovery and we all pretend it is normal.

And idiots still keep their money on Binance or even buy $ASTER

Everyone knows what happened;

On 10/10 #Binance printed lows that were statistically impossible compared to every other major… pic.twitter.com/UlIGxF2nNQ

Binance Price Engine Turned Liquidations Automatic

MASTR explained that Binance dominates USDT spot pricing, which many derivatives platforms and risk engines reference directly. When Binance pricing breaks down, liquidation systems respond instantly. Algorithms act without discretion. Positions unwind automatically.

Once Binance printed extreme lows, forced liquidations followed. ASTER became trapped inside that process. Stop losses triggered. Leveraged positions collapsed. Selling pressure accelerated because the system required it, not because sentiment suddenly flipped.

ASTER price eventually fell from its $2.4 peak to around $0.6 at the time of writing. MASTR described the move as a textbook example of a liquidation cascade driven by structure rather than fundamentals.

The speed of the decline contrasted sharply with the earlier rally. Price did not drift lower over time. It snapped. That distinction is critical. According to MASTR, the market did not reassess ASTER’s value. The pricing mechanism failed first, and price followed.

What MASTR Says The ASTER Event Reveals

MASTR framed the ASTER collapse as a symptom of a deeper issue. Centralized exchanges act as price anchors while externalizing risk to users. When that anchor slips, there is no rollback and no clear accountability.

ASTER did not expose a flaw unique to itself. The event showed how quickly centralized price discovery can override decentralized narratives. One exchange effectively set market reality, and everything downstream adjusted automatically.

Read Also: Hedera (HBAR) Institutional Year Was Not Normal: Why This Could Matter in 2026

ASTER may stabilize or recover. That outcome remains open. The more important takeaway comes from MASTR’s broader warning. How many assets rely on the same pricing engines and liquidation logic.

The ASTER episode suggests that price does not always tell a story about belief or rejection. Sometimes it reveals how fragile the underlying structure really is. Understanding that difference may matter more than any single chart going forward.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.