Bitcoin’s recent pullback steadied as ETF inflows picked up again, hinting at renewed institutional conviction heading into 2026. Canada’s 3iQ unveiled a $100 million Bitcoin-denominated fund, while the Cayman Islands is positioning itself as a core base for Web3 infrastructure. The groundwork for crypto’s next cycle is being laid right now, and early-stage projects with real, working utility are lining up for future exchange routes.

DeepSnitch AI is nearing launch with more than $658K raised at $0.02629, roughly 70% above its $0.01510 start. Its five AI-driven agents track heavyweight wallet shifts, screen tokens, and deliver real-time alerts. With SnitchFeed and SnitchScan already running on a fully deployed network, the project is shaping up as a fiercely strong contender for upcoming Binance listings in 2026.

What you'll learn 👉

Bitcoin ETF inflows return after short-term shakeout

Bitcoin’s short-term holders absorbed losses during the latest pullback, but ETF inflows bounced back quickly, a clear sign that institutional demand is still firm. The broader 2026 outlook is brightening as analysts point to friendlier macro conditions, continued policy easing, and sustained appetite for ETF exposure.

Canada’s 3iQ just launched a $100 million Bitcoin-denominated fund, giving institutions access to a diversified digital-asset basket while keeping Bitcoin as the base currency.

At the same time, the Cayman Islands is drawing a growing number of Web3 foundations, offering a regulatory structure that’s both predictable and business-friendly. With a favorable tax setup and clear legal frameworks, it’s rapidly positioning itself as a key hub for next-gen blockchain infrastructure.

Strongest contenders for upcoming Binance listings 2026

- DeepSnitch AI: Launch and Binance are both on the horizon

DeepSnitch AI is an intelligence system built to help regular traders see what’s moving beneath the surface. And in this market, where Bitcoin keeps slipping, and sentiment is all over the place, that kind of clarity is rare, powerful, and priceless.

More than just collecting data, DeepSnitch AI is spotting early narrative shifts, whale activity patterns, and sentiment swings, the things that actually move prices before people notice. And tools are already shipping.

This is the sort of setup that gets people buzzing about upcoming Binance listings in 2026. Exchanges love projects that actually ship, actually grow, and have communities using their product. DeepSnitch AI checks those boxes easily.

Everything core is already live, including several agents, staking, and a dashboard, and the alert engine is running smoothly. Add in the fact that the project has raised more than $658K already, priced at $0.02629, and it starts looking like the kind of early-stage AI infrastructure token that people end up wishing they bought sooner for its wild returns.

That’s why Binance listing rumors 2026 keep circling around it. And historically, the November to April stretch is the strongest part of the crypto year. Lining up before that window closes is how people position for the big multipliers later.

DeepSnitch AI is finishing the groundwork now, the stuff that matters before listings and hype cycles kick in, and its full launch is rapidly approaching.

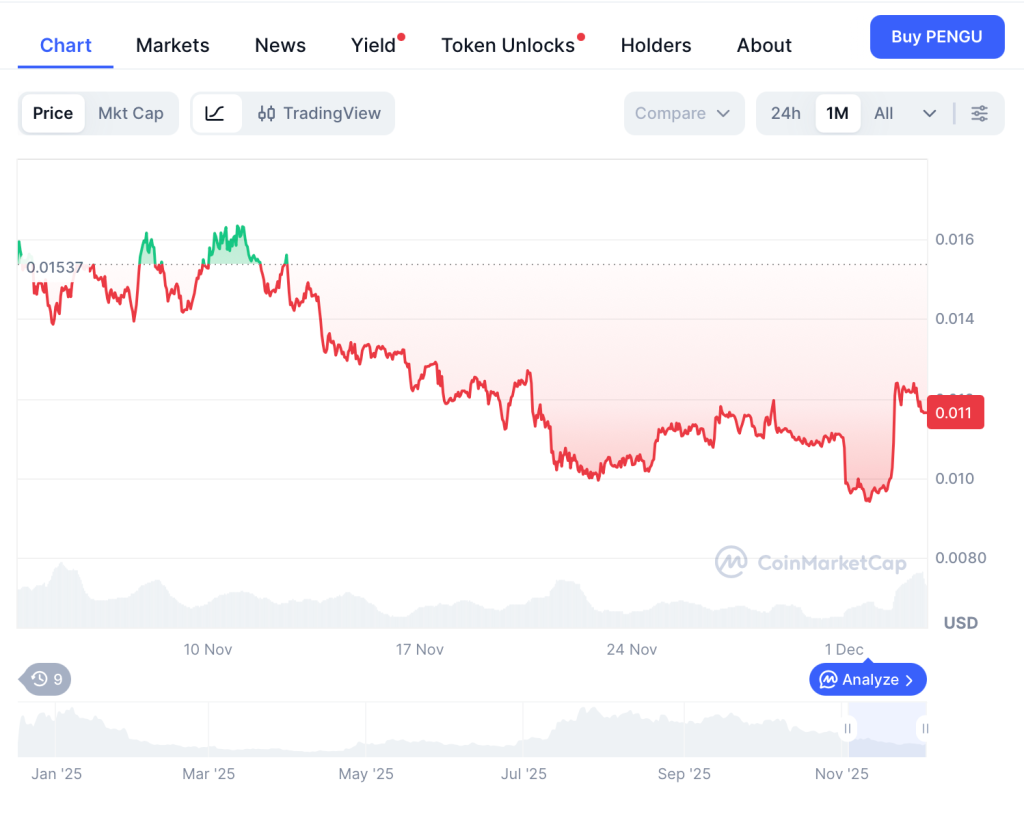

- Pudgy Penguins: Reversal attempt underway

Pudgy Penguins jumped 26% in 24 hours to around $0.012 after sliding to below $0.010. A whale bought 2.9 times their usual volume at above $270K, smart money added above $1.3 million, and Bitso announced a 2026 perpetuals aggregator with PENGU as a core asset.

Still, Pudgy Penguins is forecasted to drop 25% and reach below $0.009 by early January. Current sentiment is bearish, Fear & Greed Index shows 28 (Fear).

- Virtuals Protocol: Bearish pressure persists

Virtuals Protocol is sitting around $0.95 right now, but the chart’s still leaning downward. It’s been sliding inside a pretty wide descending channel ever since it failed to break past that $0.95 resistance. Price is now heading toward the $0.80 support zone, which might spark a small bounce. But overall, momentum just isn’t showing much strength yet.

According to CoinCodex, Virtuals Protocol is forecasted to drop 25% and reach below $0.73 by early January. This could easily be a dip before a quick rise, but for now, sentiment is tilted bearish, and the Fear & Greed Index at 28 (Fear) confirms that traders are still hesitant, not excited.

Closing thoughts

Bitcoin ETF flows are recovering, 3iQ launched a $100 million BTC fund, and the Cayman Islands is building Web3 infrastructure. The pieces are falling into place for crypto’s next leg higher, and projects with operational tools are positioning for exchange listings.

DeepSnitch AI has raised over $658K, shipped SnitchFeed and SnitchScan live, launched uncapped staking, and is launching soon. At $0.02629, this is a very likely candidate for upcoming Binance listings in 2026.

Check out the website to buy in before launch and follow X and Telegram for further updates.

FAQs

What are upcoming Binance listings for 2026?

While Binance hasn’t confirmed listings, upcoming Binance listings for 2026 are almost certain to include projects like DeepSnitch AI with operational tools, strong presale performance raising over $658K, and imminent launch are strong candidates for potential Binance listings.

Which new coins are launching on Binance?

DeepSnitch AI is building utility and community traction that typically attracts exchange interest, with operational AI tools deployed and new coins launching on Binance potential in early 2026.

What are the Binance listing rumors for 2026?

DeepSnitch AI is generating buzz as a potential listing candidate due to its AI-powered intelligence platform, operational product milestones, and strong early-stage fundraising, with launch approaching soon.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.