A prolonged market decline often raises the same question repeatedly. Anyone watching BTC over the last 8 weeks can feel that question building. A drop that deep pulls traders into a moment where they wonder whether this is a normal reset or the start of something much heavier. Jacob King, a top crypto commentator, shared a sharp view of the current BTC landscape.

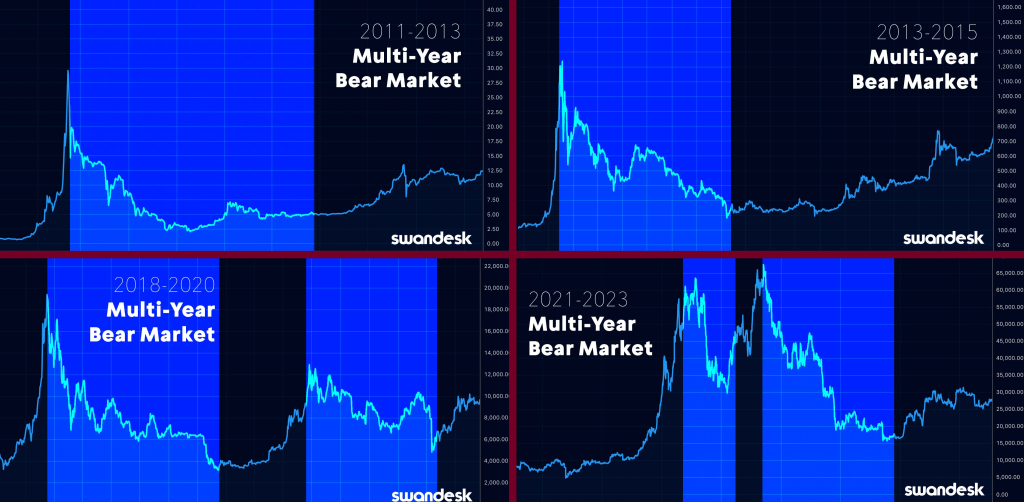

According to him, a major fall of more than 34% from the October highs caught many by surprise. Jacob King looked at that chart and argued that no previous BTC cycle carried this kind of rapid decline while still keeping momentum toward a strong bull run later.

A snapshot like that creates a story that resembles a long winter rather than a short cool breeze. A comparison to long recoveries in other big cap tokens paints a similar picture since sudden deep drops often lead to extended sideways stretches.

A claim from Jacob King suggested that the market has leaned on fresh liquidity for years during each recovery. A shift away from that pattern often changes everything. Large players have slowed their activity, according to his view. Tether no longer shows the same behavior as previous cycles, and he highlighted MicroStrategy’s mounting pressure.

El Salvador’s stalled approach added more weight to his argument. A falling hashrate added another layer that reminded some observers of early network stress phases seen in previous crypto eras.

Macro Arguments from Dan Gambardello Challenge the Grim Outlook

A different tone came from Dan Gambardello, who reviewed macro data rather than price action. A belief from him pointed toward a setup that does not resemble a traditional bear market. Liquidity movements such as the RRP dropping from $2.5T to near zero caught his eye. A long stretch of manufacturing contraction and a flattening liquidity trend created a picture that does not perfectly match a multi year downturn.

A point he made suggested that many traders react purely to price. A sudden sharp drop often triggers fear even when the broader environment holds signals of another leg up. A similar pattern once played out during early stages of previous BTC cycles when price lagged behind improving liquidity conditions.

"We're entering a bear market."

— Dan Gambardello (@dangambardello) November 26, 2025

I keep seeing this.

So I keep digging into the macro data. And that's not what appears to be happening at all…

→ QT ends December 1st

→ RRP drained from $2.5T to basically zero

→ TGA elevated (any drawdown injects liquidity)

→ Longest… pic.twitter.com/WmhiNt1UHG

A wide drop across big cap tokens has shaped the mood across the entire market. BTC takes center stage, yet the sharp pullback spread pressure across nearly every major project. A rhythm like this usually pushes attention toward tokens with unique stories or unusual strength. A rare few sometimes rise even when the broader field sinks.

A divide between Jacob King and Dan Gambardello captures the tension perfectly. One side sees a historical pattern that looks heavy. Another side sees macro conditions that are not aligned with a deep multi-year downturn. Someone exploring this discussion finds themselves in the middle of two competing lenses that both seem grounded in data.

Why the Bitcoin Struggle Narrative Feels Different This Time

A puzzle forms when both price action and macro signals pull in opposite directions. Jacob King focuses on structural cracks such as falling hashrate and weakening institutional demand. Dan Gambardello focuses on liquidity cycles that behaved similarly ahead of previous major expansions. A situation like this feels similar to standing at a crossroads where the road signs point in different directions.

A few analysts compare the moment to early turning points in other markets, such as when tech stocks whipsawed during previous macro shifts. A rapid fall does not always shape the long-term outcome. A slow recovery does not always prove a multi year collapse either. The current BTC story sits somewhere between those extremes.

Read Also: This Crypto Expert Predicts Where The Kaspa Price Is Headed Next

A careful reader of Jacob King’s message senses concern about long-lasting pressure. A careful reader of Dan Gambardello’s message senses optimism built on macro cycles rather than short-term chart movement. The friction between these viewpoints gives the BTC conversation more depth than a simple bullish or bearish call.

A market story shaped by uncertainty often ends up remembered as a transition phase. A moment like this keeps watchers engaged because it sits on the edge of two possibilities. Anyone following BTC closely may find the next few months especially interesting since both narratives cannot stay true forever.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.