Something feels strange when a project packed with strong tech continues to move lower. Kaspa has built a reputation for speed, efficiency, and a very dedicated developer base, yet KAS keeps struggling to regain momentum.

Readers look at the chart and wonder why the performance does not match the technology. The tension makes the new data even more interesting because it adds a different angle to the conversation about where KAS stands now.

Why KAS Price Action Looks Weak While The Technology Keeps Advancing

Kaspa usually attracts attention because it runs one of the only production proof-of-work blockDAGs. The system relies on GhostDAG, DagKnight, and the upcoming Crescendo upgrade, and the Rust engine gives it impressive throughput. Many holders compare this to the early days of networks that grew slowly at first before attracting a wave of interest.

The recent weakness does not match that profile. Big-cap tokens have fallen very fast across the market and pulled many popular options with them. KAS sits in that group, and the decline makes some readers assume that something must be going wrong inside the project. The activity on the network shows a different reality.

🚨 Bearish on Kaspa? Let’s end that real quick. 🧵

— Andrew J 𐤊 (@AndrewS19347998) November 19, 2025

“Kaspa is dead.”

“Miners dumping.”

“Nothing being built.”

Cool story. Here’s reality:

o One of the only production PoW blockDAGs

o GhostDAG → DagKnight → Crescendo (10 BPS)

o Rust engine pushing insane TPS

o vProgs = smart…

Andrew J addresses this contrast directly. He lists features that continue to expand, ranging from vProgs, which allow smart contract style actions without bridges, to new standards like KRC-20 and infrastructure tools such as KasKeeper. His point is simple. The technology is not the source of the struggle, and the price drop reflects the market cycle rather than a slowdown in development.

Industrial pilots such as GigaWatt Coin, ZET-EX, OliveChain, KAS-PIP, and K-MIF continue to test real-world use cases. Wallet growth, nodes, custody options, and developer activity also keep rising. Projects that maintain this level of movement usually recover when market attention returns. The challenge is timing, and timing remains unpredictable in cycles like this.

What The New KAS Data Shows About Market Positioning

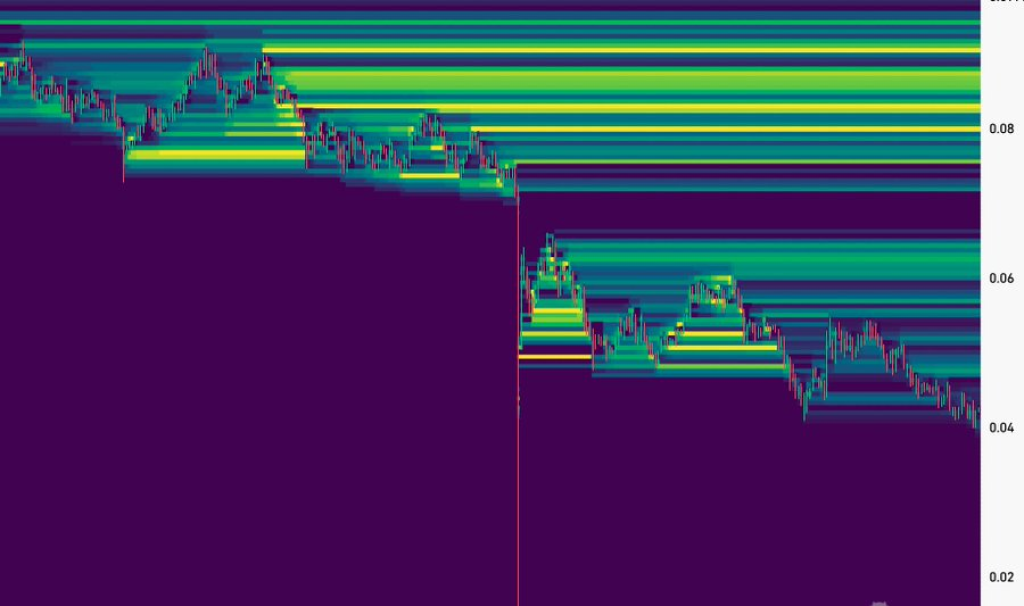

Kaspa Daily shared fresh liquidation data that adds a new piece to the story. The map shows most major liquidity stacked above the current KAS price. The area below holds very little liquidation pressure, which means the market does not look ready for a heavy downside sweep. There is light leverage underneath that supports the same idea.

Clusters toward $0.09 reveal how traders are positioned. Heavy liquidity above often acts like a magnet once momentum shifts. This gives KAS a setup that looks stronger than the chart suggests at first glance.

Tokens sometimes show this kind of structure before attempts to push higher. Kaspa Daily notes that a momentum shift could easily travel into those stacked levels. KAS still struggles, yet the structure hints that the downside may be reaching exhaustion.

Read Also: SEI Might Become the Next Big Chain: New Data Reveal What’s Coming

The ongoing KAS performance raises questions, and the new data gives some clarity. The struggle comes from the broader market rather than a breakdown in Kaspa itself. Andrew J’s view aligns with that. His explanation shows that Kaspa has not entered its hype stage yet. Many networks go through slow phases before attention catches up.

The new liquidation map adds a small spark that some readers may watch closely. The structure does not promise a recovery, though it suggests that KAS holds more potential energy than the current chart reveals. The technology continues to grow, the ecosystem keeps expanding, and the market may eventually reflect that work once momentum shifts again.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.