Santiment’s latest data shows something most traders don’t expect during a bloody week in the crypto market. Bitcoin, Ethereum, and XRP all saw a clear wave of retail holders panic selling into the dip. Historically, this type of behavior has often appeared near local bottoms, not tops, which is why Santiment views the current trend as a constructive sign for a potential rebound.

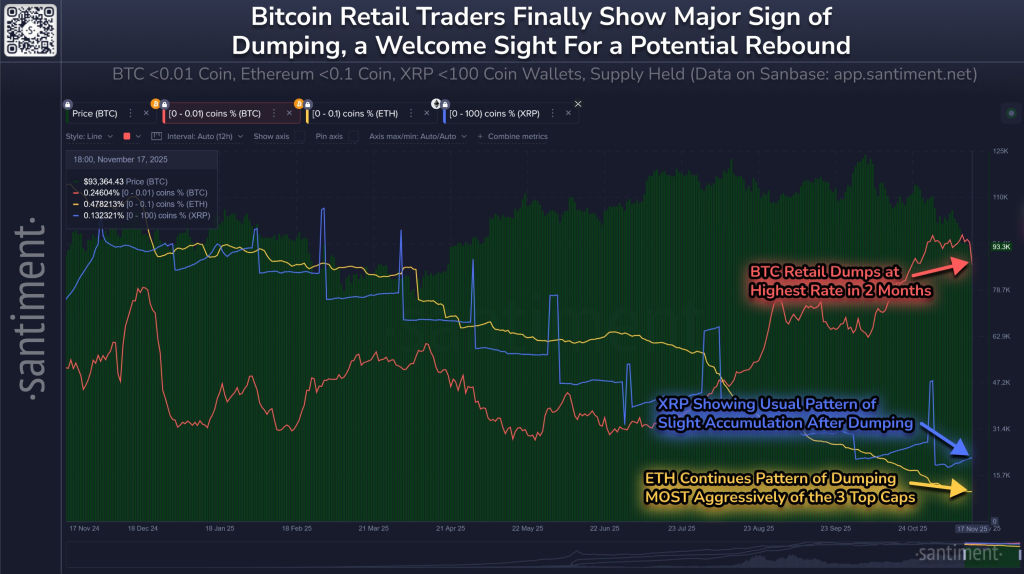

The chart highlights wallets holding very small amounts of each asset. Bitcoin wallets with less than 0.01 BTC dumped 0.36% of their supply in just five days. Ethereum wallets with less than 0.1 ETH offloaded 0.90% of their holdings across the past month. XRP wallets holding under 100 tokens sold 1.38% of their supply since early November. These are some of the largest retail outflows in recent months, with Bitcoin’s retail dump now at its highest level in two months.

When small traders sell aggressively, it often means fear is peaking. Retail typically sells at the worst possible time, while larger players accumulate quietly. Santiment’s chart captures this dynamic clearly. As the number of retail-held coins trends downward, price tends to move in the opposite direction. The visual pattern shows that Bitcoin retail wallets always peak before major corrections and drop sharply near areas where price later stabilizes and recovers.

Ethereum’s line shows an even more aggressive decline, suggesting retail capitulation is happening faster there than in the other two assets. XRP’s line, on the other hand, shows its usual cycle of dumping, followed by slow but steady accumulation.

The chart also shows that while price for all three assets has been sliding, the intensity of retail outflows is increasing. That divergence, where small wallets panic while price tries to stabilize, is often an early sign that the market is tightening before a shift. It reflects a typical phase where inexperienced traders sell into fear, while institutions and larger wallets position themselves quietly for the next move.

Santiment’s interpretation is simple. Retail panic is not a guarantee of an immediate reversal, but it is usually a healthy ingredient for one. Markets often need aggressive sellers to be flushed out before any sustainable recovery can begin. With funding rates stabilizing, liquidity normalizing, and fear dominating sentiment, the groundwork for a relief bounce is forming.

Read also: Bitcoin Bear Market Call: Analyst Sees $37k–$57k Bottom by Late 2026

There is no confirmation yet that the bottom is in, especially with Bitcoin still hovering near major macro support levels around $90,000. However, the behavior of small wallets suggests that the final stage of capitulation may be underway. If retail continues selling into weakness, the probability of a market rebound grows stronger.

For now, the takeaway is straightforward. Panic from small traders often marks opportunity, not danger. Santiment’s chart points to a market that may be closer to a turning point than many think.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.