Synthetix is absolutely on the move right now, breaking through key resistance levels and finally waking up after years of sideways action.

SNX price just crossed $2.20, and traders everywhere are asking the same thing: what’s driving this rally?

What you'll learn 👉

The Big Catalyst – A New Perpetuals DEX on Ethereum

The main reason behind the surge is Synthetix announcement of a brand-new perpetuals DEX launching on the Ethereum mainnet later this month. And to kick things off, there’s a $1 million trading competition starting on October 20.

This new platform will offer gasless trading, cross-chain features with Optimism and Base, and full Ethereum-grade security. Basically, traders get speed, security, and convenience in one place.

The crypto crowd is already hyped. There’s talk of capital rotating from rival platforms like Hyperliquid and Aster into Synthetix. And as trading volume ramps up, SNX stakers stand to benefit directly through higher fee rewards.

Keep an eye on the DEX launch timing and early data like TVL (total value locked) and daily trader count once things go live, those numbers will show how strong this move really is.

Read Also: Did Ethena Really Depeg? Here’s What Actually Happened on Binance

The SNX Chart Setup – Technicals Finally Break Out

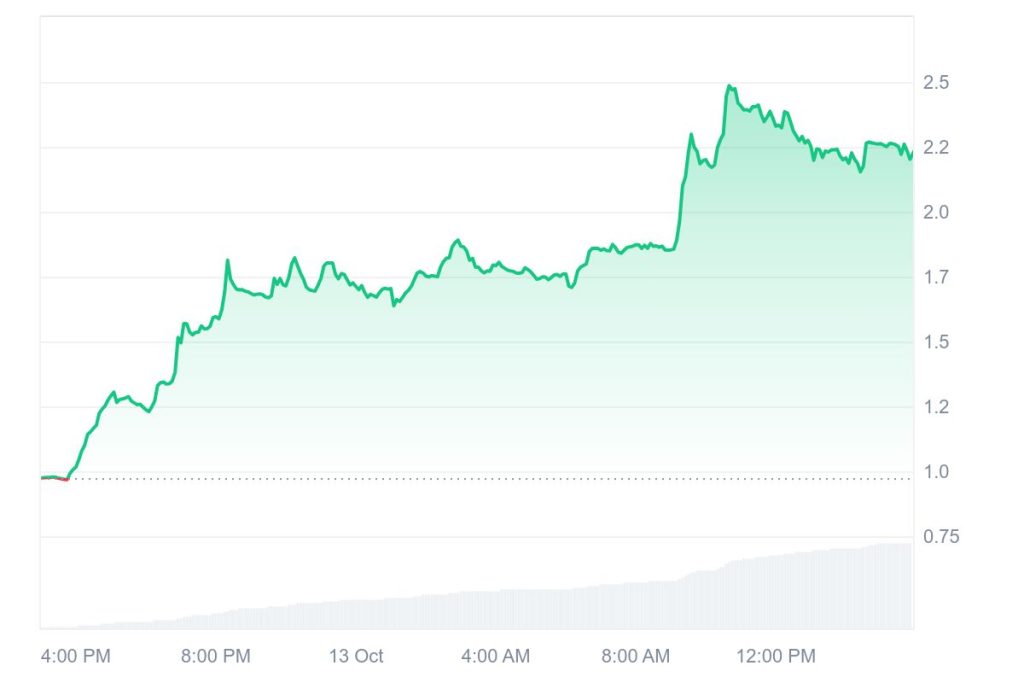

Now, the chart looks just as bullish as the fundamentals. SNX price has broken out of a four-year descending resistance line, something it hasn’t done since 2021.

It also reclaimed its 2022 pre-crash high of approximately $2.20, a key psychological level. Momentum indicators are flashing green across the board: The RSI is hovering at around 75, technically overbought but downright normal in a powerful rising trend.

The MACD has made a bullish crossover. And trading volume exploded 20x one day, at $1.1 billion, proof that this is not just retail chatter.

If SNX price can hold above $2.09, the next logical target sits near $2.60–$2.70, right around the Fibonacci 161.8% level.

The Market Context – Outperforming During Chaos

Here’s what makes it even crazier: the rest of the crypto market just went through a $19 billion liquidation wipeout on October 10. While most altcoins are still trying to recover, SNX didn’t just bounce, it took off.

Traders are calling this a clear case of sector rotation, money is flowing out of memes and into derivatives and real-yield projects. Synthetix fits that narrative perfectly. It’s one of the OG DeFi platforms from 2018, it has real utility, and it’s benefiting from the renewed focus on perpetuals and on-chain trading.

With only 343 million SNX in circulation, supply is tight, so when demand spikes, the price moves fast. The only real risk? Overleveraged traders could cause a sharp pullback if the DEX launch doesn’t live up to the hype.

Read Also: BNB Price Refuses to Slow Down: Strong Rally Puts $2,000 Back on the Table

What the Synthetix Chart Says

The 1-day SNX chart shows a strong, clean breakout pattern. Synthetix price ripped from the $1.20 range to $2.50, then cooled off slightly and is now holding steady around $2.20.

That’s exactly what healthy momentum looks like, steady volume, shallow pullbacks, and consistent higher lows.

If bulls can keep SNX price above $2.09, this could easily turn into a sustained trend rather than a short-lived pump.

What’s Next for SNX

Synthetix is back on the radar, and this one’s different. With the Ethereum DEX launch, the extreme competition, and the breakout established, all the ingredients are now in place for more upside.

As long as SNX price holds above $2.09, the path toward $2.60–$2.70 looks wide open. Just remember, after a move this strong, short-term volatility is always possible. But for now, the bulls clearly have control.

Read Also: Grayscale Filing Could Be TAO’s $50B Moment, Crypto Market Still Sleeping on It

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.