On September 29, 2025, SWIFT said it will begin using a blockchain ledger to process international payments instantly. For a system built on slow interbank messaging, it’s a notable change — and one that shows how even the most established players are adapting to faster digital finance.

Digitap ($TAP) steps into that shift with a bold pitch: one app to manage fiat and crypto, send money globally, and pay with integrated card rails. The presale tokens are already selling out fast, but can $TAP execute and channel that momentum into a 75× move?

What you'll learn 👉

How SWIFT’s Blockchain Plans Shape Digitap’s Opportunity

SWIFT’s shift is both validation and competition. Its shared ledger aims to connect existing banks directly on blockchain infrastructure, in partnership with Consensys and more than 30 financial institutions.

For startups like Digitap, this confirms that tokenized payments are no longer experimental—but it also raises the bar for them. SWIFT’s institutional reach and regulatory integration make it a formidable player. Digitap’s advantage lies in agility and inclusivity: it can reach users and regions that banks often overlook, where cross-border fees remain high and infrastructure is outdated.

Inside the Engine Powering Digitap’s Global Payment Vision

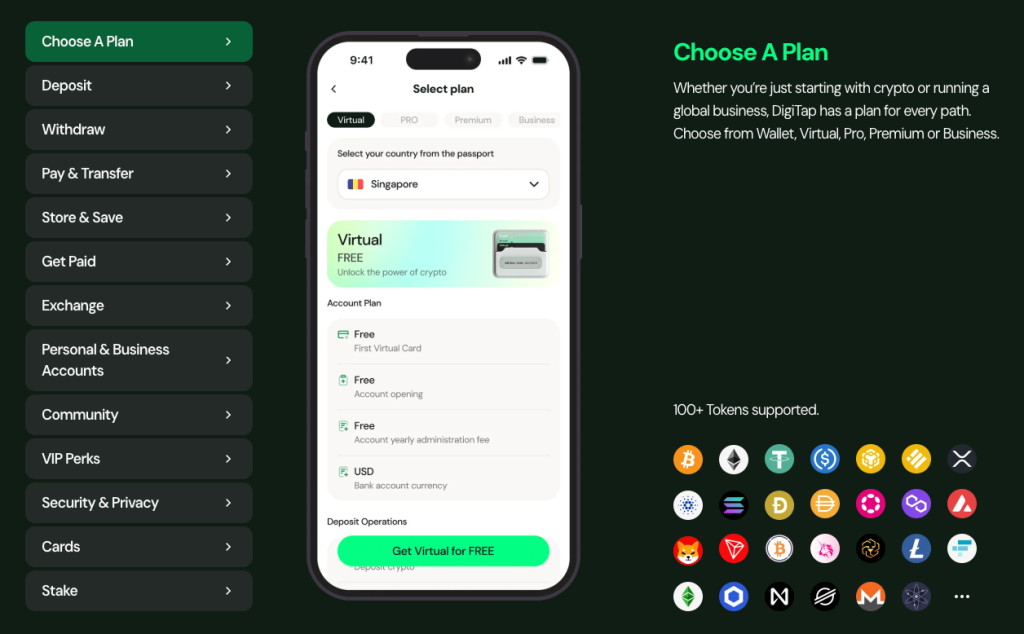

The “SWIFT 2.0” label becomes clear once you understand how Digitap operates. SWIFT connects banks; Digitap connects people directly. Its live app already functions as an omni-banking platform, merging fiat accounts, crypto wallets, and Visa-linked cards under one balance. Users can send or spend funds globally within seconds, across both blockchain and banking rails.

Where SWIFT relies on message passing between intermediaries, Digitap completes settlement directly. Its AI Smart Routing engine picks the fastest and cheapest route—whether through SWIFT, SEPA, ACH, or blockchains like Bitcoin and Ethereum. The result is near-instant settlement with sub-1% fees, compared with the 6.2% global average.

The Digitap Card strengthens the comparison further. Co-branded with Visa, it’s accepted worldwide, fully integrated with Apple Pay and Google Pay, and supports unlimited virtual cards for online purchases alongside customizable physical cards for everyday use. Setup takes minutes, and its no-KYC option offers financial privacy unmatched by legacy banking networks.

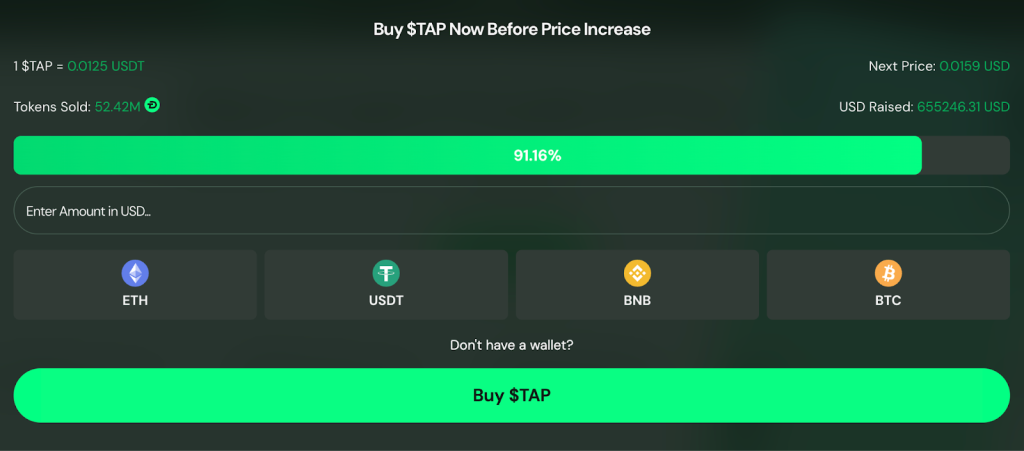

How Presale Stages Build Digitap’s Path to 75× Growth

Digitap’s presale structure adds a unique economic layer to the forecast. Each presale stage launches at a higher price than the previous one—making price growth effectively built in before the token reaches exchanges. The current stage is $0.0125, with the next phase at $0.0159. As demand expands, successive rounds will lift the base price, setting a rising floor ahead of listing.

This tiered model establishes upward pressure even before secondary-market trading begins. If all stages sell out and early staking continues to yield up to 124% APR, a post-launch high near $0.05–$0.07 appears realistic.

From there, continued adoption—driven by card usage, remittance volume, and merchant integration—could move $TAP toward $0.10–$0.30 within its first year. The long-term projection of $0.90, roughly a 75× gain, assumes a 12- to 24-month horizon supported by ongoing user growth and liquidity expansion.

It’s an ambitious but grounded scenario, based on the compounding of scheduled presale appreciation and a working product already solving a major pain point in payments.

Scenarios That Could Define Digitap’s First Two Years

Bull Case: Digitap’s rollout gains traction across key corridors in Europe, LATAM, and MENA. Its Visa integration drives real-world usage, and the app’s privacy-first model attracts global users frustrated by traditional banking. $TAP lists strongly and, as adoption expands, moves toward $0.60–$0.90, validating the 75× projection and positioning it as a leading DeFi payments brand.

Base Case: Adoption builds at a measured pace. The app’s user base grows steadily, staking remains active, and listings deliver healthy liquidity. The token holds between $0.06–$0.20 — still a 5×–20× increase from the presale floor — supported by recurring utility demand and the scheduled presale price progression.

Bear Case: Even if global expansion slows or regulatory delays occur, Digitap’s presale structure and live ecosystem provide a built-in buffer. Each presale stage increases the base price, and team locks prevent heavy sell-offs. Under softer market conditions, $TAP could consolidate around 2×–5× its entry price while continuing to pay staking rewards and maintain a functioning app — positioning it for a rebound once conditions improve.

USE THE CODE “DIGITAP15” FOR 15% OFF FIRST-TIME PURCHASES

Why Digitap Could Rank in Top Crypto Projects Before Listing

Digitap enters a market even SWIFT now acknowledges must evolve: borderless payments that are instant, low-cost, and private. Its live platform, Visa integration, and hybrid settlement system give it credibility rare in early-stage tokens.

The 75× forecast isn’t speculative hype—it’s a reflection of quantifiable factors: built-in presale appreciation, a capped supply model, and a functioning product targeting one of finance’s biggest inefficiencies.

If Digitap maintains execution and scales globally, it could emerge as the retail counterpart to SWIFT’s institutional network—a genuine “SWIFT 2.0” built for the crypto era. For investors tracking top crypto projects before listing, $TAP represents a calculated, asymmetric opportunity in a market hungry for practical innovation.

Discover how Digitap is unifying cash and crypto by checking out their project here:

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.