The crypto market has a way of catching traders off guard, and this week, the Plasma price pulled exactly that move. The token is up more than 11%, trading around $1, and its volume has exploded nearly 90% in the past 24 hours.

But according to on-chain data and analysis by top analyst Cryptor, this bounce might not be what it seems.

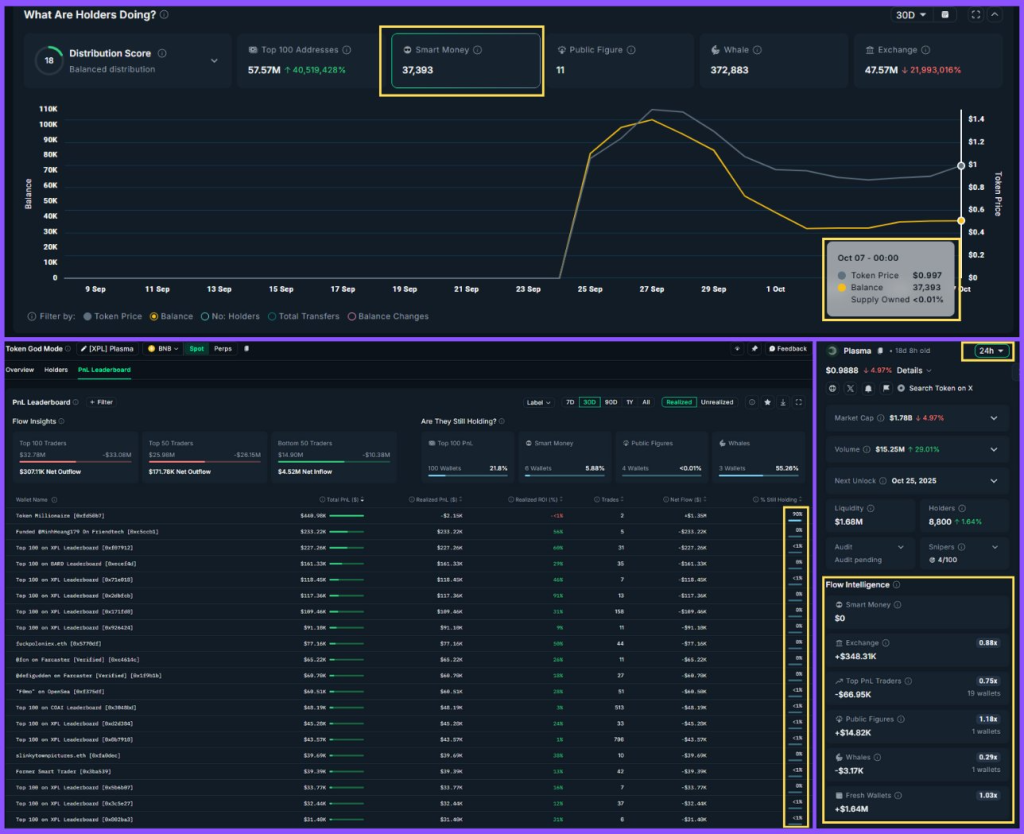

On October 1, Cryptor noticed something strange. Even though the XPL chart looked healthy, 85% of the top profitable traders had already exited their XPL positions. In other words, the so-called “smart money” was gone, and that usually spells trouble.

What happened next proved him right. XPL price dumped almost 19%, falling from $1.68 to $0.83, even while most of the crypto market was in rally mode. Then, suddenly, it bounced back, a massive 28% recovery in just a few days.

Headlines were bullish again: the CEO denied team-dumping rumors, a Chainlink integration was announced, and Aave added support for XPL. Retail investors rushed to buy the dip, convinced the bottom was in. But as Cryptor revealed, the smart money didn’t return during that move.

Read Also: How Much JasmyCoin (JASMY) Do You Need to Become a Millionaire by 2026?

What you'll learn 👉

What Plasma On-Chain Data Shows

When Cryptor dug deeper using Nansen data, the picture got clearer. During the bounce, no smart money wallets were active, zero. Instead, data showed that top-performing traders were still selling, while new retail wallets were buying around $1.6 million worth of tokens.

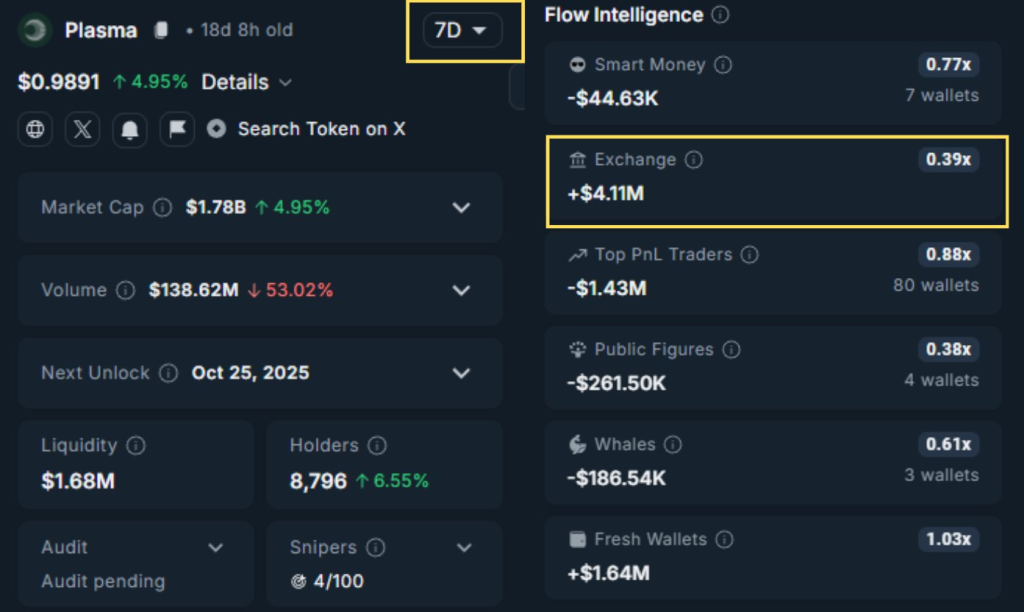

Even more concerning, over 73% of XPL’s supply now sits on exchanges, and deposits have increased by $4.1 million in the past week. That’s a classic sign of potential sell pressure building.

In short, the bounce was fueled by retail optimism, not institutional accumulation. The big players were still out.

What the Plasma Chart Is Showing

From a technical angle, the XPL price looks like it’s trying to flip bullish again. The token penetrated above the $1.00 psychological barrier and formed a triple-bottom reversal chart pattern after being stuck in the $0.83–$0.87 range.

The RSI has also recovered from its oversold readings, indicating short-term investors are getting in.

If XPL stays above $1 and breaks above $1.16, it may advance to $1.50. However, if it drops below $0.95, that momentum is lost, and another test of $0.83 is most probable.

XPL Network Fundamentals Still Strong

Despite the unstable price action, Plasma’s ecosystem continues to grow at a rapid pace. The network has processed 28.7 million transactions, which is a 5,200% year-over-year growth, and currently has $5.28 billion of stablecoin TVL, more than even Avalanche and Tron.

Its partnership with Chainlink increases lending and DeFi protocol data trustworthiness, which is inviting developers and new liquidity. Traders are, however, eyeing the 2026 planned token unlocks that can unlock 25% of the supply into circulation.

XPL Price Short-Term Outlook

At writing, the Plasma pump looks more like a technical bounce than the start of a new rally. The fundamentals are solid, but no re-entry from smart money implies the move can fade unless new buyers come in.

If the price of Plasma is able to hold the $1 line and rebuild confidence with more supportive on-chain metrics, momentum could return. Until then, traders should remember the lesson Cryptor highlighted: the chart can lie, but on-chain data never does.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.