Zcash price is flying high today. It is up more than 20% and trading at $162.62, which is among the biggest gainers in the market. For a coin that has been stagnant for most of the year, this brief jump is grabbing everybody’s attention.

So, what’s behind this monster rally? Two big catalysts hit back-to-back this week: Grayscale launching its Zcash Trust and Hyperliquid adding ZEC perpetuals.

Both events have reignited interest from traders and institutions alike, and that combination is now driving one of the strongest breakouts ZEC has seen in years.

The first reason for the pump came on October 2, when Grayscale officially launched its Zcash Trust. This new product lets accredited investors gain exposure to ZEC without the headache of custody or privacy-related compliance issues.

That’s a major step forward. Privacy coins have always been tough for institutions to touch directly, but now they have a regulated path to get in, similar to what happened with Bitcoin and Ethereum when Grayscale rolled out their trusts years ago.

Just a day earlier, THORSwap integrated shielded ZEC swaps, letting users move Zcash across chains while keeping transactions private. That added a new layer of real-world utility and cross-chain liquidity.

Together, those two events gave ZEC the legitimacy and functionality it’s been missing. The market clearly liked it, and judging by the trading activity, new money is flowing in.

Analysts will now be watching October 7–8, when the first inflow data from the Grayscale Zcash Trust is expected. If those numbers are strong, this rally could have serious legs.

The second driver of this surge is all about leverage. On October 3, Hyperliquid, one of the fastest-growing decentralized perpetuals exchanges, listed ZEC/USDC perps with 5x leverage. Within 24 hours, ZEC futures volume exploded by 300%, reaching $292 million, and open interest climbed to $19.3 million.

That’s a huge spike for a coin that hasn’t seen this kind of trading action in ages. The listing attracted speculators and liquidity, which pushed prices up even faster. But there’s a twist, the long/short ratio flipped to 0.74, down from 1.5 last week. That means more traders are now shorting ZEC, betting this pump might fade soon.

So while derivatives gave the rally its spark, they also introduced more volatility. If funding rates start to cool off, we could see a quick pullback before the next move higher.

Read Also: How Much Could 1,000 Cardano (ADA) Tokens Be Worth in 2026?

What the ZEC Chart Is Showing

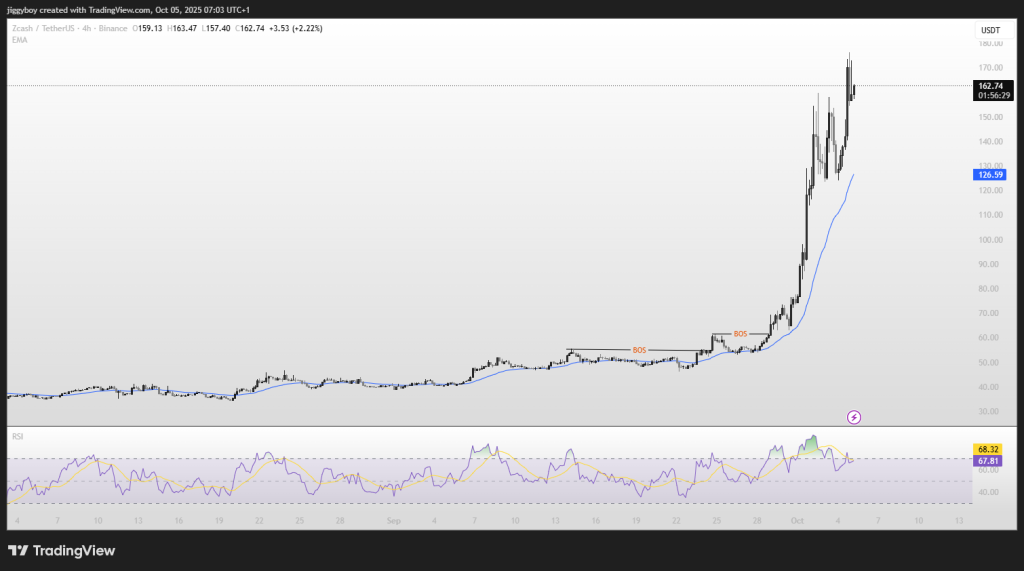

If you look at the 4-hour chart, the move is nothing short of explosive. ZEC price broke cleanly out of its long consolidation range around $70, confirmed a break of structure near $85, and then just went vertical.

The rally pushed through every resistance level on the way up, topping around $163–$165 before slowing slightly. The RSI is hovering near 68, showing the market is getting a bit overheated, not surprising after a 100% move in less than two weeks.

The EMA line is rising steeply and currently around $126, which is now a critical support. As long as the price is above that zone, the structure is bullish. A decent daily close above $160 could open the path towards $180–$200, and any correction towards $130 would most probably be profit-taking.

ZEC Price Short-Term Outlook

After months of silence, Zcash finally feels alive again. Institutional access, new DeFi integration, and massive trading volume have breathed new energy into a forgotten privacy coin.

If bulls keep control and the Grayscale Trust data confirms inflows, Zcash price could easily retest the $180–$200 zone soon. But if leveraged longs unwind and profit-taking kicks in, a cooldown toward $130 would be perfectly normal before the next leg up.

Either way, ZEC just reminded the market that it’s still here, and that privacy coins can move fast when the right catalysts align.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.