Santiment has released a fresh report breaking down Bitcoin’s latest price action, and it offers a clear picture of what might come next. After reaching a new all-time high of $123,800 on August 13, Bitcoin has slipped about -8.8% over the past six weeks. The flagship crypto hit a 13-day low of $112,200 on Monday, sparking a surge in social chatter around “buying the dip.”

What you'll learn 👉

Retail Buying Fervor May Not Mean a Bottom Yet

Santiment points out that the sudden spike in buy-the-dip mentions is not automatically bullish. In fact, their historical data shows the opposite: when retail traders rush to call a bottom, prices often fall further first. The market typically reverses only when optimism fades and traders start panic selling. So while the dip-buying crowd is growing loud, true capitulation may still lie ahead.

Before the latest drop, Binance recorded its highest short-to-long ratio in over three months. That was a classic setup for a quick leg down. But after BTC hit $112.2K, traders swiftly flipped back to mildly long positions. Santiment notes that a sustained period of shorts outweighing longs is usually needed to spark the kind of short-squeeze rally that fuels major rebounds. So far, that critical ingredient hasn’t formed.

Social media sentiment has cooled from euphoria to fear as Bitcoin slipped under $114K. However, Santiment argues that fear levels remain too mild compared to past capitulation events – like the early-April drop tied to U.S. tariffs or June’s dip during geopolitical tensions. Those bottoms only formed after much deeper panic selling.

On-Chain Signals Show Underlying Strength

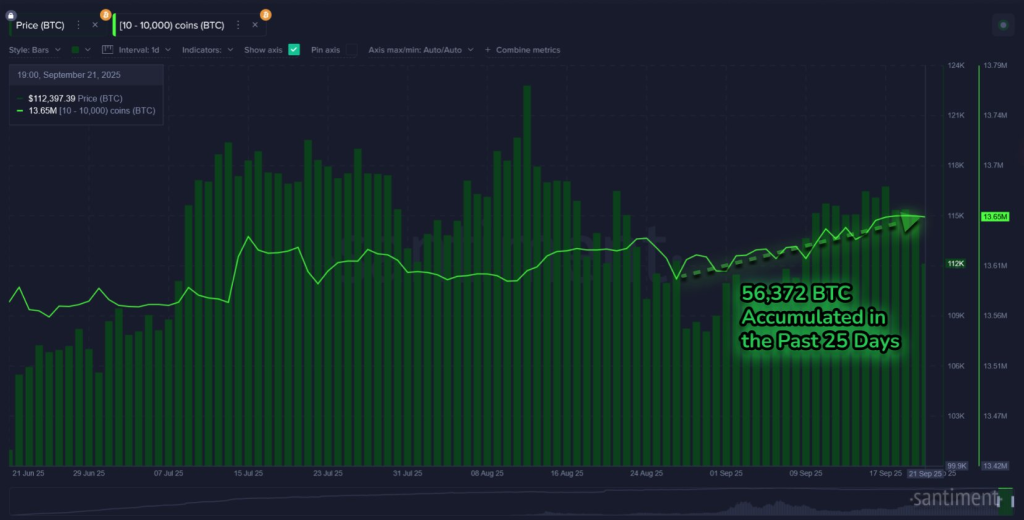

Despite the short-term caution, on-chain metrics hint at growing long-term strength.

- MVRV data shows 30-day holders are now in the red for the first time since early September, historically a bullish entry point.

- Whale accumulation is steady: since August 27, wallets holding 10 to 10,000 BTC have added over 56,000 coins.

- Exchange balances keep shrinking, with 31,265 fewer BTC available for sale over the past four weeks. Both trends point to reduced sell pressure and confidence from large investors.

Read also: Bitcoin & Ethereum Had Their Run – Now Solana’s Big Chapter Is About to Open

What It Means for Buyers

Santiment views the current -8% pullback as modest by Bitcoin’s historical standards – far from the 15–20% drops that usually trigger broad capitulation. Still, their analysis supports a careful, dollar-cost averaging strategy for those looking to buy. Spreading purchases around key levels – such as $112K, $108K, $104K, $100K, and $96K – could capture more upside whether prices drift lower or rebound sooner.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.