Bitcoin price hit a fresh all-time high earlier today, touching $124,277 before the excitement quickly turned into a sharp selloff.

Within hours, BTC slid 4%, shedding roughly $5,850 and falling back to around $118,427. In the process, it erased all the gains from the past two days.

So, what’s behind the sudden dip?

Here’s Why #Bitcoin Has Corrected 4% Despite Reaching an All-Time High Today. #BTC 🧵🧵🧵 pic.twitter.com/MTgK0CJYyB

— TheCryptoBasic (@thecryptobasic) August 14, 2025

What you'll learn 👉

Selling Pressure Spikes on the Charts

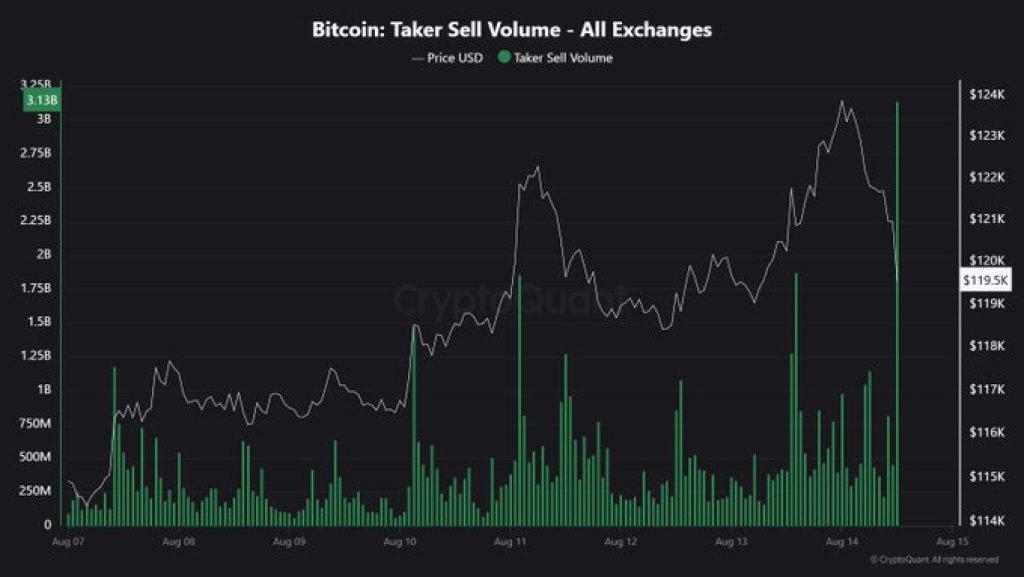

According to CryptoQuant’s JA Maartunn, Bitcoin’s taker sell volume, a metric tracking the amount of BTC instantly sold on the market, just jumped to $3.13 billion.

That’s a massive leap from typical levels seen in recent days. Such a spike often signals a wave of traders locking in profits, adding immediate selling pressure to the market.

This wasn’t just small-scale retail action either. The scale of the selling suggests big players were unloading positions as soon as BTC price hit the milestone.

Macroeconomic Data Shakes the Market

The selloff wasn’t purely technical. Fresh U.S. economic data also gave traders a reason to hit the sell button. The Producer Price Index (PPI) came in at 3.3%, higher than analysts had expected.

While the core Consumer Price Index (CPI) was still favorable, a hotter PPI points to rising inflation, and that could cool hopes for a September interest rate cut.

Polymarket data shows that odds of a rate cut next month have already dropped following the PPI release, adding to the cautious mood in both traditional and crypto markets.

Read Also: Strong Bullish Pattern Hints at Incoming Stellar (XLM) Price Rally: Here’s the Outlook

Billions Wiped in Liquidations

The correction hit the entire crypto market hard. Over the past 24 hours, more than $1 billion in leveraged positions have been liquidated.

Bitcoin accounted for $218 million of that, $149.5 million in longs and $68.6 million in shorts, while Ethereum saw even bigger damage, with $309.9 million liquidated, including a single $6.25 million ETH/USDT trade on OKX.

Despite the sudden drop, all bearishness does not follow. Traders point out that Bitcoin price has always rebounded from macro-led drops, and selling right after a new ATH may be missing the next run-up.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.