Bitcoin is holding strong above $115,000, and many investors are starting to wonder how high it can go. One popular analyst, ฿LUE WHALΞ, says the top is not as high as some people are hoping. In a long post on X, he explained why targets like $300,000 or $400,000 are not realistic.

He said that every cycle comes with bold Bitcoin price predictions. People throw out big numbers without any clear reason. According to him, it is a mistake to wait for a specific number before taking profit. Instead of focusing on hype, traders should pay attention to real market signals. He made it clear that acting based on data is smarter than waiting for someone’s guess to come true.

BTC Price Signals Show We Are Not at the Top

฿LUE WHALΞ shared several indicators to help figure out when Bitcoin might reach its peak. One of the most important tools is the Pi Cycle Top. This tool uses two moving averages. In past cycles, whenever the faster line crossed above the slower one, it marked the top. That crossover has not happened yet, so he believes Bitcoin is not done rising.

He also mentioned the Rainbow Chart. This chart uses Bitcoin’s price history to show where it might go. According to the chart, Bitcoin is only in the middle part of the cycle. It could move up one or two more levels. That would be normal, but it still would not push the price to $400,000. He said that kind of jump would need a huge surprise event, and that does not seem likely right now.

Bitcoin Price Still Looks Undervalued

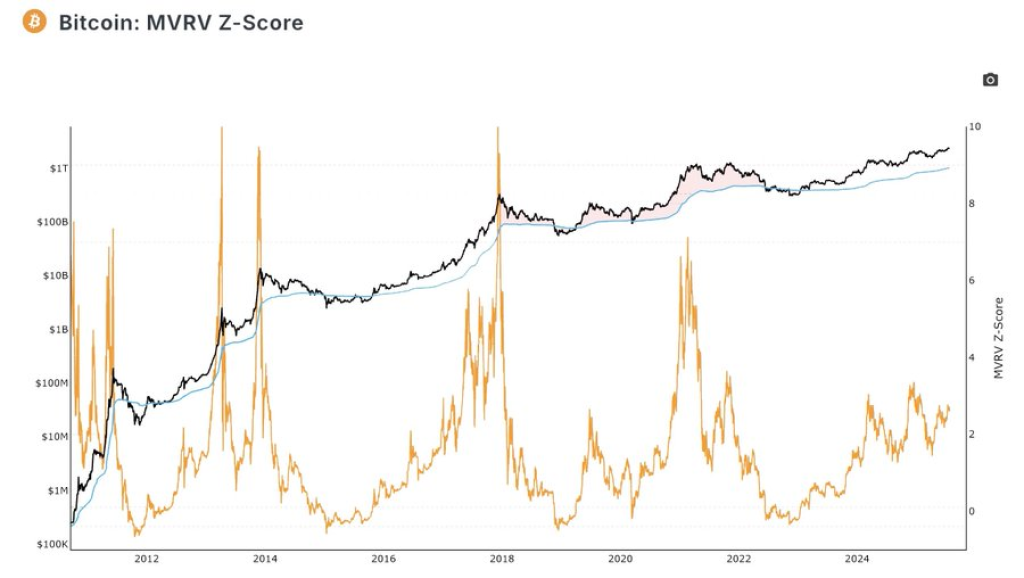

Another tool is the MVRV Z-score. This measures if Bitcoin is over or under its fair value. In past cycles, the score hit 7 when the price peaked. Right now, it has not even reached 4. ฿LUE WHALΞ said this shows we are not near the top yet. It also means there is still excitement to come.

He also pointed to Google Trends. In earlier cycles, Bitcoin hit the top when search interest was at its highest. Right now, Google searches for Bitcoin are still low. That means retail investors have not fully entered the market yet.

฿LUE WHALΞ warned traders not to wait for influencers or big-name investors to announce when to buy or sell. He said the top often comes when everyday people start buying. This is when smart money exits. The goal is not to chase the peak but to exit before the crowd.

He believes many people are following loud voices without looking at the charts or metrics. Waiting for someone like Robert Kiyosaki to say he sold Bitcoin is not a strategy. Watching real-time indicators is a better way to make smart decisions.

👋 Many have already said goodbye to #Altseason and lost faith in it — but the past month has shown us that we’ve only just taken the first real step toward it. 🚶♂️

— ฿LUE WHALΞ (@BTCBlueWhale) August 6, 2025

📈 After #Bitcoin dominance ( $BTC.D) surged steadily for the past 3 years, nearly all altcoins in their $BTC pairs… pic.twitter.com/slUbSUsae6

฿LUE WHALΞ believes we are still in the middle of the Bitcoin cycle. One clue is what is happening with altcoins. Ethereum recently gained more than 50% against Bitcoin. That is often the sign that money is starting to move from Bitcoin to altcoins. But the full altcoin season has not started yet.

Read Also: Nate Geraci on XRP and Solana ETFs: BlackRock Filings Are Coming

He explained that when Bitcoin peaks, money flows from Bitcoin to Ethereum, then to big altcoins, and finally to small coins. That final wave is when the market is near the end. Since we have not seen that yet, Bitcoin likely has more room to rise.

In the final part of his post, ฿LUE WHALΞ made one thing clear. The top is not in yet, but that does not mean you should expect $400,000. That price level is not supported by any of the data. He believes traders who follow the data will make better decisions than those who wait for hype to come true.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.