PancakeSwap price is making headlines after a 12% daily surge pushed its price to $3.19, while trading volume spiked by 191%. This move has positioned CAKE as the day’s top gainer, outpacing other BNB Chain projects, even as the broader crypto market trends upward.

The rally follows a combination of macro-chain strength, new product rollouts, deflationary actions, and growing technical momentum.

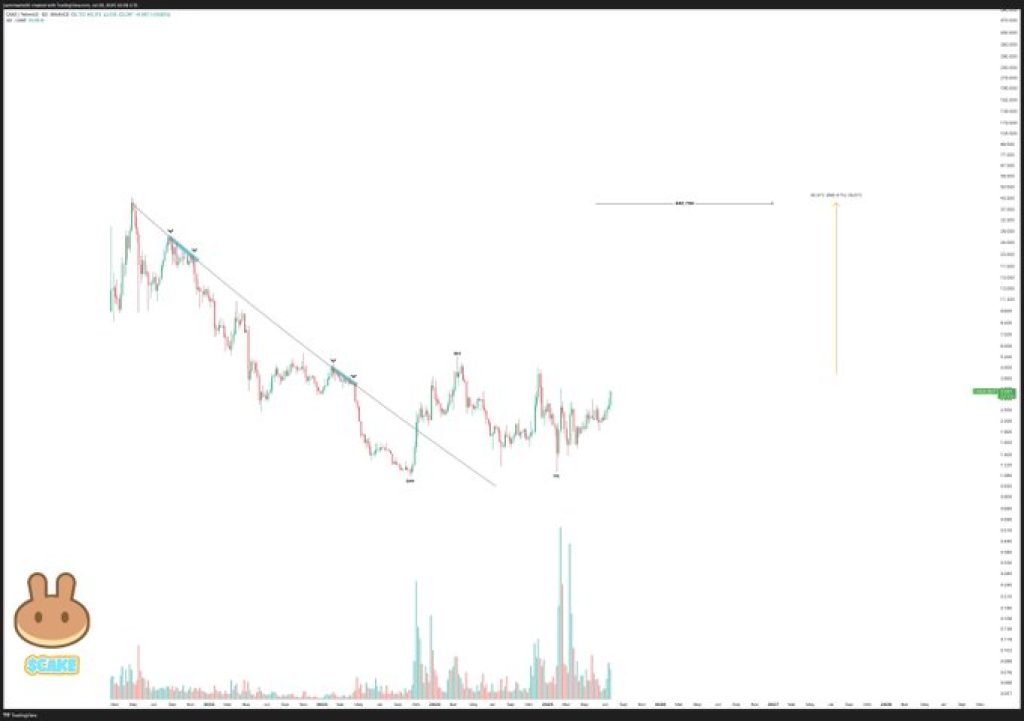

TOp analyst Javon Marks Shared on X that CAKE price is holding a confirmed breakout structure with a long-term target of $40.79. He suggests this could imply over 1,100% upside if the setup plays out.

Another market commentator, Cryptobullfish, stated that CAKE may be one of the most undervalued tokens on the BNB Chain, especially with BNB itself trading at all-time highs.

$CAKE is probably the most undervalued coin right now.

— Crypto฿ullfish (@cryptobullfish) July 27, 2025

$BNB is trading at all-time highs, while the main DEX token on BSC still has 15x potential just to reclaim its previous ATH. pic.twitter.com/pUckJ6mZS8

What you'll learn 👉

BNB Chain Rally Sparks CAKE Price Momentum

BNB breakout to a new all-time high of $850.70 has lifted projects across its ecosystem. PancakeSwap, as the leading DEX on BNB Chain, processed 96.7% of all decentralized exchange volume on the chain during Q2. This correlation has contributed to renewed CAKE demand.

The recent “Maxwell” upgrade to the BNB Smart Chain, which went live on June 30, has also played a role. By improving validator performance and block confirmation speeds, it has supported an increase in total value locked (TVL) across BNB-based protocols. With PancakeSwap at the center of this liquidity flow, CAKE continues to see benefits.

Read Also: SUI Price Enters Liquidation Death Zone – Can Bulls Break this Sell Wall Before It’s Too Late?

PancakeSwap Product Expansion and Deflation Strengthen Fundamentals

On July 24, PancakeSwap launched its Infinity DEX product on Base, Coinbase’s Layer 2 Ethereum network. Base has become one of the most active Ethereum scaling solutions, surpassing $1.6 billion in daily DEX volume.

This expansion adds new user segments and fee opportunities to the PancakeSwap ecosystem, potentially raising demand for the CAKE token.

🥞 Weekly CAKE Stats

— PancakeSwap (@PancakeSwap) July 22, 2025

Net CAKE Mint: -546k CAKE (-$1.53M)

🔥 Burn Breakdown:

➤ AMM v2: 129k CAKE ($360k) +5%

➤ AMM v3: 483k CAKE ($1.35M) +1%

➤ AMM Infinity: 5.3k CAKE ($14.7k) +96%

➤ Other Sources (Prediction, Perpetual, etc.): 81k CAKE ($228k) +26%

Proof of burn 🔍… pic.twitter.com/mbokbfQd8t

The protocol’s deflationary mechanism remains active as well. According to PancakeSwap’s dashboard, 546,000 CAKE tokens were burned in the week ending July 22, equal to around $1.53 million.

With monthly supply reductions at approximately 0.574%, token scarcity may support price as user engagement increases.

Read Also: Algorand (ALGO) Short-Term Price Outlook

CAKE Price Chart Structure Points Toward Macro Breakout

Technical analysis supports the bullish outlook. CAKE has broken out of a long-standing descending trendline and completed an inverse head and shoulders pattern. Volume has risen sharply at key support levels, confirming strong accumulation.

According to chart visuals and the analysis shared by Javon Marks, the pattern has a measured move that targets $40.79. The price is currently consolidating just above the neckline of this structure, which now acts as support.

Immediate resistance is expected around $3.70–$4.00, with minimal historical resistance between $6 and $10.

With CAKE price now trading above key technical zones and registering strong volume, traders are watching to see if the token will maintain momentum.

The breakdown above $3.00 has turned around previous resistance to become support. The next target area is between $4.00 and $6.00, depending on previous price action.

Depending on the extent of upward pressure on PancakeSwap price and market conditions going forward, the push towards double-digit price levels remains achievable. For now, technical traders and BNB Chain investors continue to monitor CAKE position as the ecosystem’s top-performing DEX token.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.