The crypto market kicked off the week with a strong push, climbing 1.30% to reach a total market cap of $3.37 trillion. Even more impressive, 24-hour trading volume jumped over 40%, showing that market activity is heating up.

Bitcoin price led the charge with a new all-time weekly close, while Floki made headlines with a double-digit rally, thanks to technical strength and ecosystem updates.

Bitcoin hit $109,439 today, up nearly 1% on the day. According to TheCryptoBasic, spot Bitcoin ETFs saw $769.60 million in net inflows between June 30 and July 3, a clear signal that institutional money is coming back into play. Ethereum ETFs also recorded $219.19 million in inflows during the same period, adding fuel to the market’s upward momentum.

From June 30 to July 3 (ET), Bitcoin spot ETFs recorded a weekly net inflow of $769.60 million, while Ethereum spot ETFs saw a weekly net inflow of $219.19 million. pic.twitter.com/SxfsyXcrxQ

— TheCryptoBasic (@thecryptobasic) July 7, 2025

At the same time, Japanese firm Metaplanet added another 2,205 BTC to its holdings, a buy worth around $240.8 million. That brings their total to 15,555 BTC, now valued at $1.69 billion.

JUST IN: 🇯🇵 Metaplanet buys another 2,205 Bitcoin worth $240.8 million.

— The Crypto Express (@TheCryptoExpres) July 7, 2025

They now hold 15,555 $BTC worth $1.69 billion. pic.twitter.com/zZIB0L7Trm

Crypto Patel also shared that Bitcoin price has officially locked in its highest weekly close ever at $109,233, marking a fresh milestone for the market leader.

Looking at the weekly chart, Bitcoin has been on a clear uptrend since late 2023, consistently printing higher highs. The latest candle shows a bullish engulfing pattern, forming well above the $100,000 psychological level that once acted as tough resistance.

Now, support is building between $96,000 and $98,000, while traders are keeping their eyes on $120,000 as the next possible target.

What you'll learn 👉

Floki Price Breaks Out as Valhalla Launch and Chart Setup Align

Floki rose 16.7% over the past day to $0.00008763. The surge aligns with the July 5 launch of its Valhalla mainnet and a new esports partnership. Analysts point to a technical breakout from an ascending channel and a breakout above resistance near $0.0000855.

Emilio Crypto Bojan tweeted that FLOKI price had “kissed the top of its ascending channel” with volume expanding rapidly. He highlighted $0.000078 as a key zone, where a retest or clean breakout could shape the next move.

The 1-hour FLOKI chart shows consistent higher lows since June 25. Price remains above both the 14 EMA and 21 SMA, which continue to act as dynamic support. Volume is climbing, supporting the argument for further upside should the channel hold.

Total Market Cap Structure Shows Recovery in Play

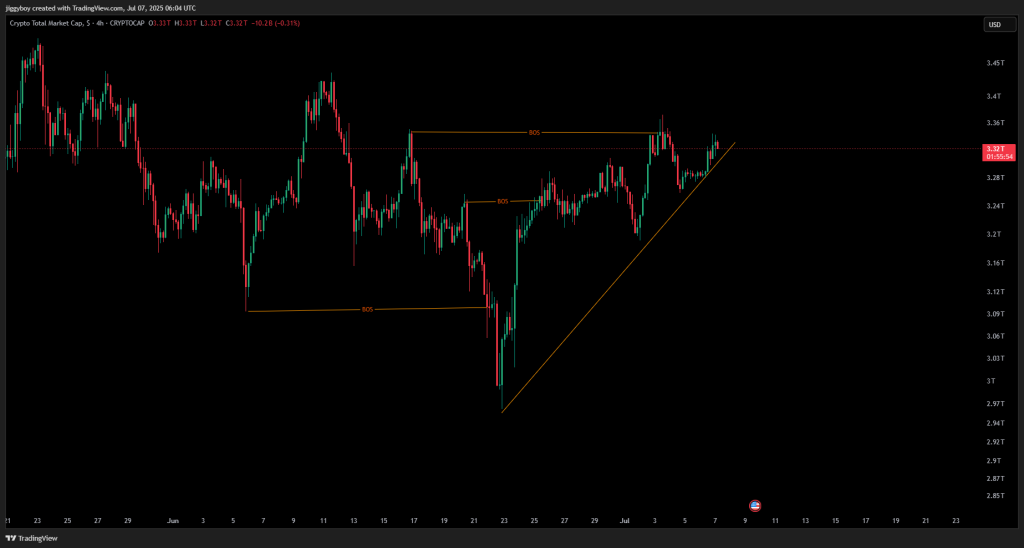

The total crypto market cap currently sits near $3.37 trillion. The 4-hour chart shows a V-shaped recovery from the $2.87 trillion bottom formed on June 23. Price action has been steadily forming higher lows within an ascending trendline.

There are three Breaks of Structure (BOS) visible since early June, indicating a shift back to bullish momentum. Resistance remains near $3.36 trillion to $3.38 trillion, with a breakout above that level possibly triggering further gains.

In addition, support is holding $3.24 trillion, and price is comfortably above previous resistance levels. Momentum seems firm, even though candles are starting to shrink, which shows short-term stabilization before a potential continuation.

Market Outlook Driven by Momentum and Volume

ETF flows, institutional buying, and technical breakout indications are coming together to fuel current sentiment. Bitcoin trend remains to command wider market movement, and altcoins like FLOKI are benefiting from capital rotation and ecosystem enhancements.

Size and shape of trends in major assets still adhere to an upbeat view as the market begins a new trading week.

Read Also: SUI Price Going to $100 Is Not a Dream, It’s What This Chart Points To

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.