Bitcoin (BTC) price hit $99,000 over the weekend, catching most traders unawares. The drop saw the price fall as global tensions rose following U.S. airstrikes against Iranian nuclear sites. With the crypto market panicking with fear, most of the investors questioned whether this was the ‘beginning of the end’ for a bigger correction.

But according to several well-known experts, this may just be a temporary pullback.

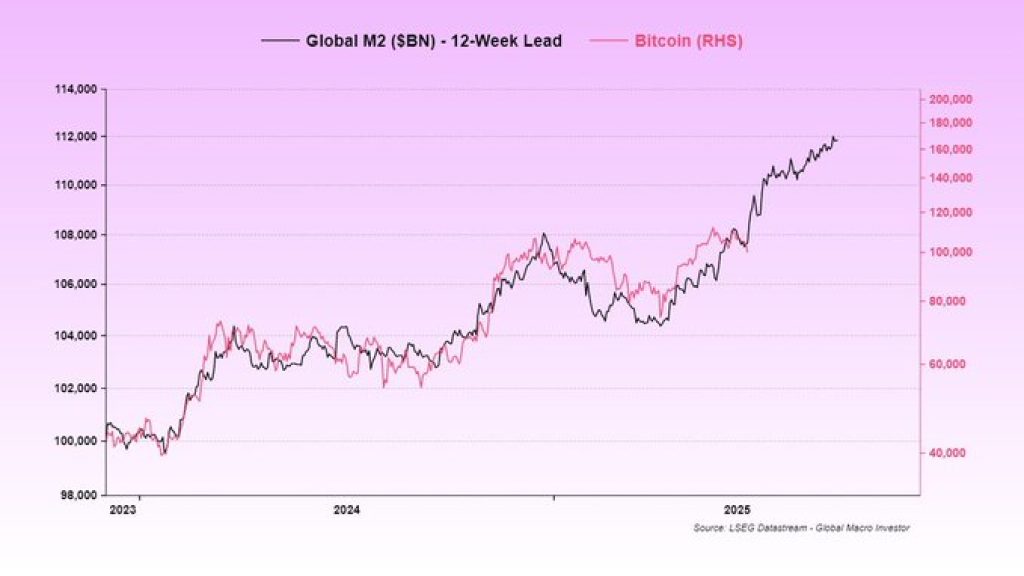

BeInCrypto reported on X that Raoul Pal, a macro investor and former Goldman Sachs executive, believes Bitcoin’s recent move fits into a larger global pattern. He pointed to the M2 money supply, which measures how much liquidity is flowing through the global economy. According to Pal, Bitcoin often lags behind changes in M2 by about 12 weeks.

That means BTC price recent drop may be part of a delayed reaction to earlier shifts in money supply, and a recovery could be next if that pattern holds.

Unfortunately, this ended up being a classic distribution schematic on $ADA.

— Sjuul | AltCryptoGems (@AltCryptoGems) June 23, 2025

As long as we don't reclaim $0.66, just expect further downtrend from now on!https://t.co/zCA88V0slQ pic.twitter.com/t602w7ChWv

Additionally, the market’s mood has clearly shifted. The Crypto Fear & Greed Index, which tracks investor sentiment, dropped sharply from 65 (greed) to 37 (fear). But some analysts see this as a bullish signal.

TechDev, a popular crypto analyst, says fear is often present near the bottom of market cycles. He thinks Bitcoin price could still dip toward $95,000 in the short term but believes it’s on track to reach $170,000 over the coming months.

Read Also: Bitcoin’s Official X Account Trolls XRP, Reigniting Community Feud

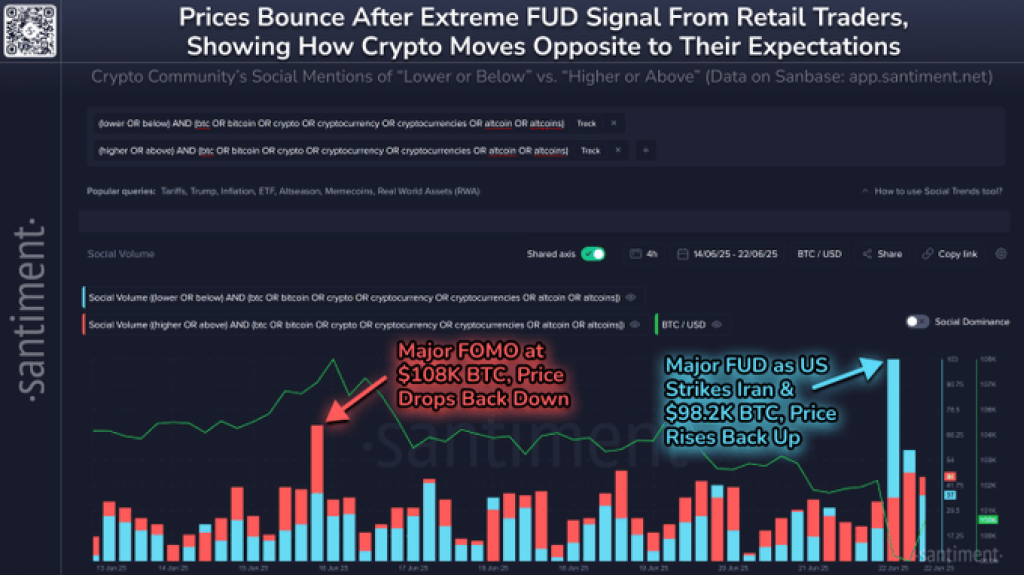

Furthermore, Santiment data shows that Bitcoin often bounces when retail investors are panicking. When social media is filled with negative chatter, that’s usually when smart money starts stepping in.

Arthur Hayes, co-founder of BitMEX, added that he still expects Bitcoin to reach $1 million over time. He believes that ongoing government spending and central bank money printing will eventually drive crypto prices much higher.

While Bitcoin price fell briefly below $100K, the bigger picture does not necessarily have to be as pessimistic as it looks. Trends in liquidity, investor sentiment, and on-chain metrics are all indicating the potential for a reversal. Others are calling the drop a buying opportunity instead of the beginning of a massive sell-off.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.