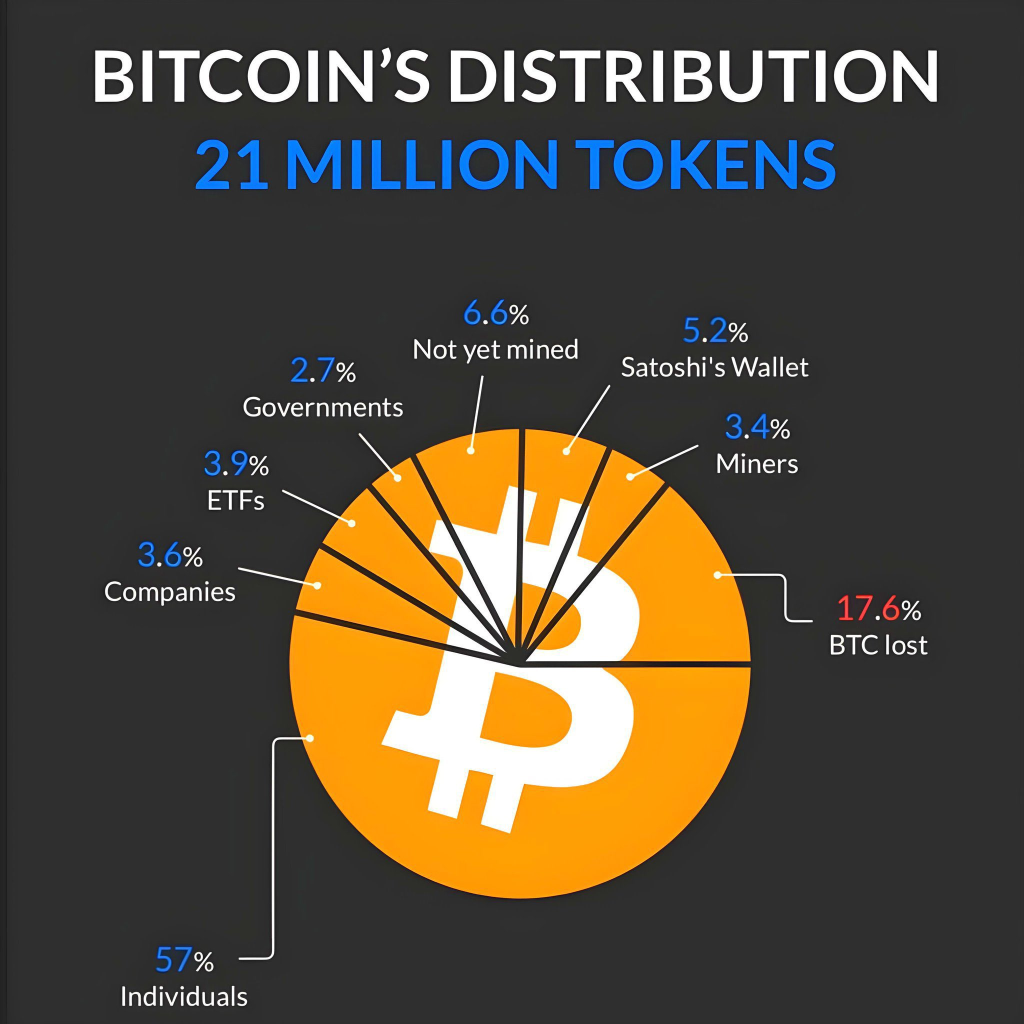

If you thought Bitcoin had 21 million coins in circulation, think again. While that’s the theoretical cap, the real number of available BTC is much lower – and the chart tells the full story.

According to data shared by Crypto Uncle on CoinMarketCap, nearly 30% of all Bitcoin is either lost, locked up, or doesn’t exist yet. That’s a massive reduction in actual supply – and it could be one of the most overlooked factors in Bitcoin’s long-term price outlook.

What you'll learn 👉

A Huge Portion Is Gone Forever

Let’s break it down. Around 17.6% of all Bitcoin is considered lost, possibly due to forgotten wallet keys, hard drive failures, or early adopters who never came back. That’s roughly 3.7 million BTC that’s simply gone from the market – forever.

Then there’s Satoshi’s wallet, which holds about 5.2% of the total supply. These coins have never moved and are widely believed to be untouchable. Add another 6.6% that hasn’t even been mined yet, and you start to realize that the actual circulating supply is nowhere near 21 million.

Who Holds the Rest?

According to the chart, 57% of Bitcoin is held by individual investors – the largest chunk by far. Meanwhile, ETFs control about 3.9%, companies own 3.6%, miners hold 3.4%, and governments account for just 2.7%.

What this distribution shows is that while retail still dominates, institutional ownership is quietly growing – especially with the rise of spot Bitcoin ETFs in 2024 and 2025. And with less than 2 million BTC left to mine, demand is starting to outpace available supply.

Read also: Bitcoin’s Official X Account Trolls XRP, Reigniting Community Feud

Scarcity Is Now On-Chain

This isn’t just theory anymore. Bitcoin’s scarcity is visible on-chain. As ETF inflows grow and more countries warm up to crypto, the race for Bitcoin is heating up – but there’s not enough to go around.

Combine that with the recent halving, which cut miner rewards in half, and the result is a shrinking new supply at a time when demand is surging. It’s a classic supply crunch – and one that’s unfolding right in front of us.

So next time you hear someone say Bitcoin has 21 million coins, just remember: the real number is far lower. And that difference could end up being one of the biggest drivers of Bitcoin’s price in the years ahead.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.