Bitcoin might still be hovering near its all-time highs, but behind the scenes, the market is sending a very different message. While prices remain above $100,000, demand is collapsing – and it’s not a minor dip. According to new data from CryptoQuant, demand momentum has now dropped to its most negative level in Bitcoin’s history, and short-term holder supply is shrinking fast. If you’ve been wondering why Bitcoin feels a bit unstable lately, this might be why.

Let’s take a deeper look at what’s happening under the hood.

What you'll learn 👉

Bitcoin Demand Momentum Just Collapsed – And It’s Historic

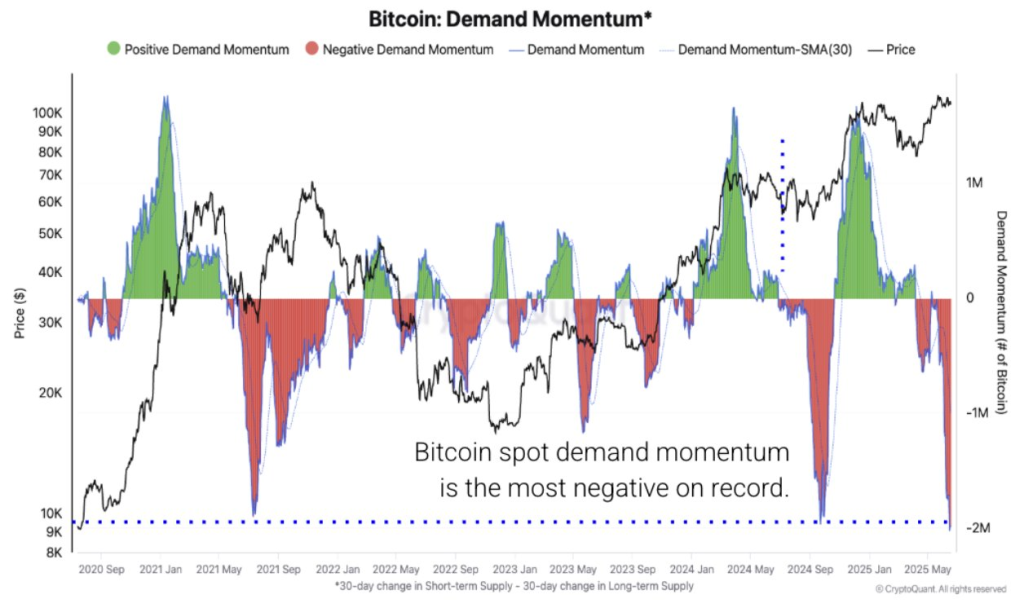

The first chart shared by CryptoQuant shows Bitcoin’s “Demand Momentum” – a metric that compares the 30-day change in short-term supply with the 30-day change in long-term supply. In simple terms, it shows how much new demand is flowing in versus how much long-term holding is taking place. When demand momentum is positive, it means buyers (especially newer ones) are entering the market. When it’s negative, it suggests short-term holders are leaving faster than long-term holders can absorb.

Right now, that number has fallen to –2 million BTC – the lowest reading on record. The chart highlights this with an intense red zone, far deeper than anything seen during past corrections. Not during the COVID crash in March 2020. Not during the May 2021 China mining ban. Not even in the chaotic FTX collapse. This current level of negative momentum stands alone.

And here’s the strange part – while demand is falling off a cliff, the price of Bitcoin has barely moved. It’s still sitting near highs, supported by ETF inflows and long-term holder conviction. But the disconnect between price and demand is growing, and historically, these kinds of gaps don’t last forever. When new demand dries up, the market eventually feels it.

Short-Term Holder Supply Is Dropping Fast

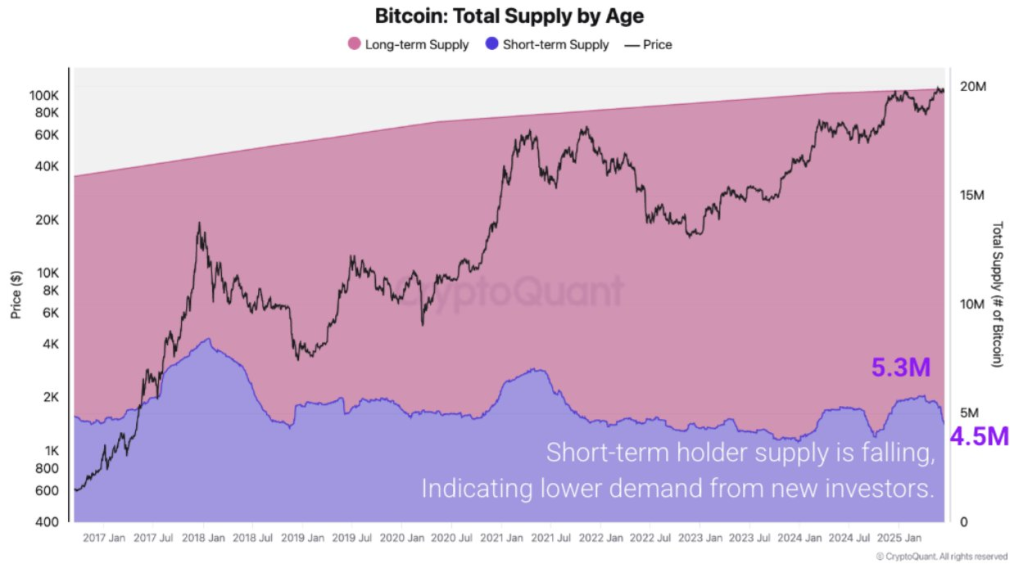

The second chart zooms in on supply by age – specifically how much Bitcoin is held by short-term versus long-term holders. The purple area represents short-term holders, and it’s shrinking rapidly. In late May, they held about 5.3 million BTC. Now, just a few weeks later, that number has dropped to 4.5 million BTC.

That’s a net loss of 800,000 BTC in short-term hands, which strongly suggests that new investors are leaving the market. These are the types of buyers who typically drive up volatility, fuel rallies, and add liquidity to the market. Their exit signals one thing: new money is drying up.

What’s left is a dominant presence of long-term holders – addresses that haven’t moved their Bitcoin in months. While these participants are generally seen as a strong foundation, they don’t add fresh demand. They’re not buying, they’re holding. And if there’s no one new entering the market to push prices higher, the rally starts to lose steam.

This is also a problem when it comes to resilience. If something spooks the market – a macro shock, a regulatory headline, or ETF redemptions – and long-term holders begin to sell, there may not be enough buyers left to absorb the shock.

Read also: Was The FOMC Meeting a Complete Disaster for Bitcoin and Crypto?

Why It Matters Now

The combination of record-low demand momentum and rapidly falling short-term supply paints a very clear picture: the current Bitcoin rally is not being driven by broad investor participation. It’s being held up by a relatively small group of committed holders and institutional flows. But if either of those groups takes a step back, Bitcoin could be in for a harsh correction.

This doesn’t mean Bitcoin is broken. It’s still a powerful asset with a maturing financial ecosystem. But markets rely on momentum, liquidity, and inflow. Right now, those elements are fading fast. Until new money returns – whether from retail, new ETF investors, or global interest – Bitcoin’s price action may remain fragile and disconnected from its underlying demand.

In past cycles, similar conditions preceded sharp pullbacks before new buyers returned. Whether that happens again now remains to be seen, but the warning signs are loud and clear.

Bitcoin may still look strong on the surface – but underneath, it’s running on fumes.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.