Pi Coin remains trapped in a tight consolidation range after failing to recover from last week’s volatility. Trading volume is down by nearly 40%, and price action shows fatigue near the key $0.60 level, with no fresh catalyst to shift momentum.

After briefly dipping to $0.41 in a flash crash, Pi Coin price bounced back but has since struggled to clear resistance near $0.63. Current sentiment remains neutral to bearish across most timeframes.

Let’s take a closer look at today’s setup.

What you'll learn 👉

📅 What We Got Right Yesterday

In yesterday’s forecast, the $0.60–$0.61 support zone was highlighted as critical for holding price stability. That area continues to act as the main buffer against further downside, as Pi Network hovered just above $0.60 for most of the session.

We also projected that a breakout above $0.63, accompanied by increased volume, was needed to reintroduce bullish momentum. That breakout has not occurred, and the price remains range-bound between $0.60 and $0.63, following the neutral scenario outlined.

📊 Pi Coin Daily Overview (June 16)

- Current Price: $0.6026

- 24h Change: -2.56%

- 4H RSI: 47.824

- Volume: Significantly lower compared to previous sessions

Pi Coin price is still consolidating just above soft support, with no clear sign of a trend shift. Weak momentum and declining volume reflect limited trader interest, and recent attempts to retest resistance have stalled below $0.63.

🔍 What the Pi Coin Chart Is Showing

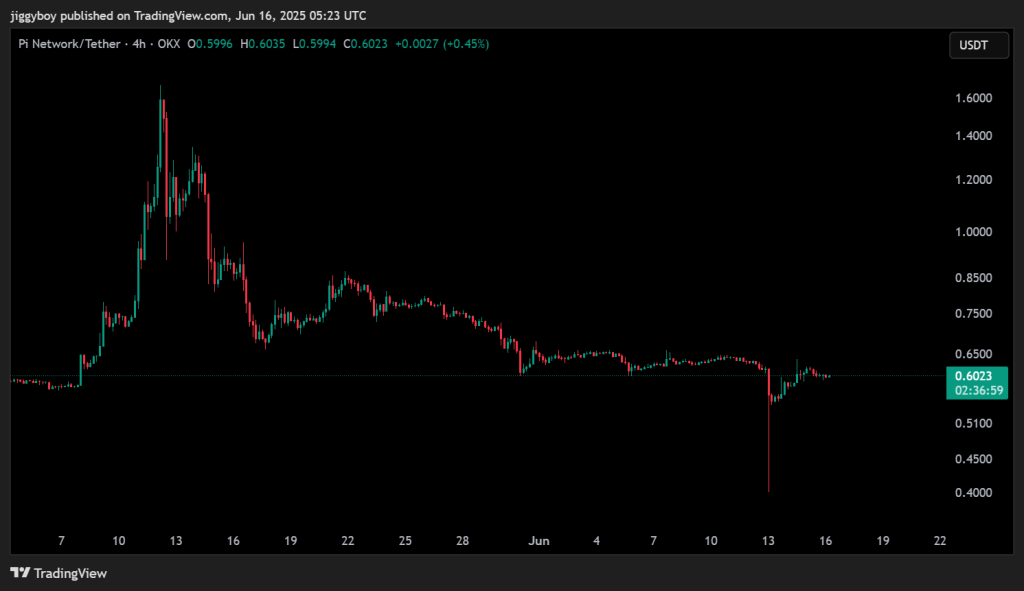

The 4H chart shows that Pi Network remains under pressure after peaking above $1.60 in May. A steep rejection led to a consistent downtrend, followed by a brief recovery that has since stalled near the $0.60 area.

While price has recovered from the $0.41 wick low, candles remain small and indecisive. The $0.60–$0.63 range continues to define short-term action, and there’s no evidence of a directional breakout. The structure remains bearish unless the Pi Coin price breaks above $0.66 with significant volume.

Moreover, support is holding for now, but if $0.60 fails, bears could quickly retest the $0.55 or even $0.50 level.

📈 Technical Indicators (Hourly Timeframe)

| Indicator | Value | Signal / Interpretation |

| RSI (14) | 47.213 | Neutral – no strong buying/selling pressure |

| ADX (14) | 20.819 | Weak trend strength – sideways bias |

| MACD (12,26) | -0.001 | Mild bearish crossover – Sell signal |

| CCI (14) | -27.0268 | Neutral – slightly below average |

| Ultimate Oscillator | 55.556 | Mild bullish momentum building |

| ROC | -0.77 | Weak negative momentum – Sell signal |

| Bull/Bear Power (13) | -0.0033 | Bearish edge – slight downward pressure |

Most hourly indicators suggest a balanced but weak market, with bears slightly in control. Only the Ultimate Oscillator leans bullish, hinting at a potential rebound attempt, but nothing is confirmed yet.

🔮 Pi Coin Price Prediction Scenarios

Bullish Scenario:

A clean break above $0.63–$0.66 on strong volume may open the door toward $0.70–$0.76. No such setup confirmed yet.

Neutral Scenario:

If $0.60–$0.61 holds, Pi Coin price is likely to remain range-bound between $0.60 and $0.63 for the day.

Bearish Scenario:

A sustained close below $0.60 could drive the price toward $0.55. A deeper slide could expose $0.42 wick lows.

🧠 Wrapping Up

Pi Coin price is consolidating in a narrow range after recent sharp moves. No strong buying volume, no fresh listing news, and no breakout from the $0.60–$0.63 corridor.

The trend remains neutral to bearish, and traders are closely watching for a move outside the current range. Without a breakout above $0.63 or a breakdown below $0.60, the sideways chop is likely to continue throughout today’s session.

Read Also: Bitcoin (BTC) Price Is Approaching a ‘Make-or-Break Zone’ – Will It Explode or Collapse?

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.